Tether is in headlines again as the founder of the centralized stablecoin Broke Pierce tweeted on 17 June that he was proud to lead a group of Bitcoin ambassadors to El Salvador. The crypto community prides itself as having no central leader, as such the comment wasn’t seen in good faith.

LN Strike takes the dollars in your bank accounts, converts them to BTCs over Lightning, moves them across, before converting them to Tether USDT. It’s then credited to the user account on the destination side. Tether doesn’t have a good reputation however.

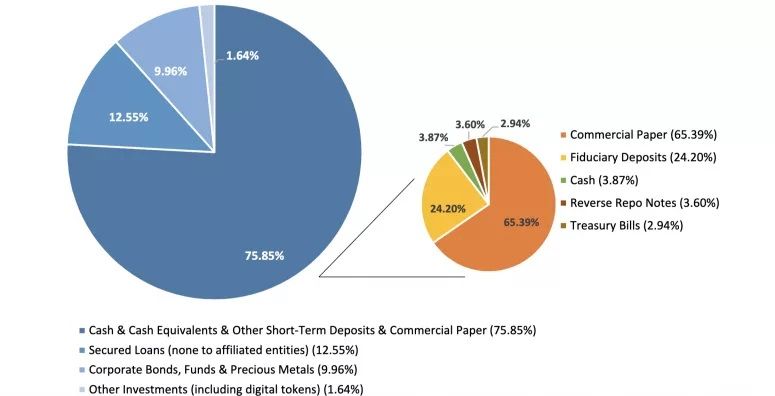

In utopia, one Tether USDT in circulation should be backed by 1 USD in the company’s reserves. But that’s not the case, far from it. The centralized stablecoin’s composition was revealed in a previous report, as part of it’s ongoing investigation with the New York Attorney General office on May 13, 2021.

Tether is primarily composed of commercial paper. What’s commercial paper? According to Investopedia, “it’s a commonly used type of unsecured, short-term debt instrument issued by corporations, typically used for the financing of payroll, accounts payable and inventories, and meeting other short-term liabilities”

Now now, not all commercial paper is created equal and it’s a debt which at times, can’t be paid. What does it mean? Tether is a weaker form of dollar and it’s problematic, because it boosts the price of all cryptocurrencies, primarily Bitcoin. It appears that El Salvadorans might be replacing dollar with a weaker version of it, presenting a systemic risk. But the plan is obscure and more details are awaited.

cryptoticker.io

cryptoticker.io