Long-time Bitcoin (BTC) HODLers are refraining from selling their holdings, on-chain data from Glassnode shows.

According to Glassnode’s "BTC Percent Supply Last Active 2+ Years" indicator, Bitcoin that was last moved well over two years ago reached a three-month low to 45.364%.

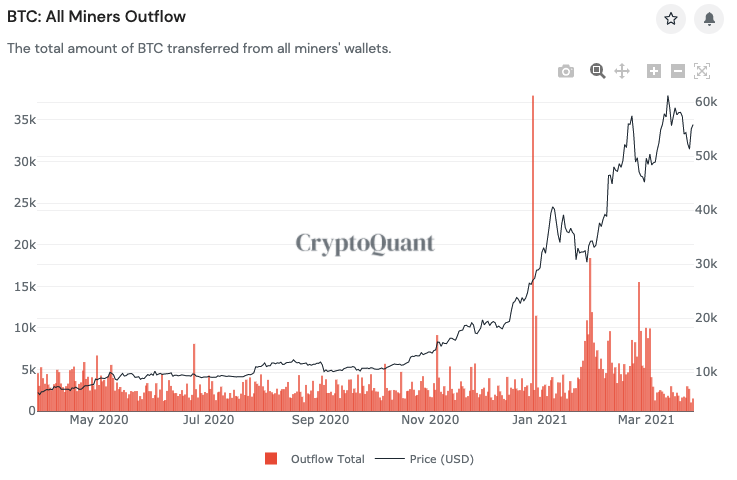

On March 17, Ki also noted three other factors based on on-chain trends that could contribute to a stagnating uptrend for Bitcoin. He wrote at the time:

"I think $BTC would take some time to get another leg up in terms of demand/supply. 1/ Too many $BTC holdings in USD compare to stablecoin holdings on spot exchanges. 2/ BTC market cap is too big to get another leg up by leveraging stablecoin market cap solely. No significant USD spot inflows - Neutral coinbase premium, and negative GBTC, QBTC premium."

Despite the above-mentioned risks, Bitcoin has performed relatively well, avoiding a drop below $50,000.

Is the BTC bottom in?

Well-known pseudonymous traders, including "Rekt Capital," have said that in the next couple days, there could be sufficient confirmation that a Bitcoin bottom could form.

It is difficult to predict when the exact bottom would form, but if BTC remains above $55,000 for a few days and prints a "higher low" formation, the trader said a new rally could occur. He wrote:

"You will never truly know when the actual #BTC bottom of the retrace is But you can look for ways for how a potential bottom could be confirmed If $BTC forms a Higher Low in the next couple of days, that should be sufficient confirmation that the bottom is in."

Therefore, as long as the price of Bitcoin holds above $55,000 in the near term, the higher low formation would be intact as the market enters April, a historically bullish month that hasn't closed in the red since 2015.

cointelegraph.com

cointelegraph.com