Multiple Bitcoin blocks mined at the same time have sparked debate around a possible double-spend attack on Bitcoin.

A double spend refers to when more Bitcoin is spent than the amount held in an address. Avoiding double spending is the crux of any money network. Thus, media publications jumped at the opportunity to call the time of death.

Besides the wider panic, however, there is nothing to worry about, according to Bitcoin experts. Some have even questioned if said transaction was indeed a true double spend.

Double Spend for 10 Minutes

On Jan. 20, at Bitcoin block height 666833, mining pools F2Pool and SlushPool both mined a BTC block simultaneously. The Bitcoin blockchain adds blocks one-by-one. Thus, only of them was eventually added to the major chain.

For ten minutes, nevertheless, transactions in both blocks showed confirmation.

A transaction from one set of addresses showed in both blocks with outputs of 0.00062063 and 0.00014499 BTC (total 0.00076562 BTC). The sending addresses had a total of 0.00071095 BTC only.

Hence, the input address received more Bitcoin than the sender held in their wallet.

Debate on Terminology

The BitMEX research team first reported the instance on Twitter, earning the attention of many. A double spend on Bitcoin meant the end of the leading blockchain as the ledger is no longer secure.

@cointelegraph posted an article with a quote from a "BSV" user that is a 100% falsehood, completely unquestioned.

Appalling "journalistic" standards

— Andreas M. Antonopoulos (@aantonop) January 21, 2021

BitMEX research gave an incorrect report at the beginning.

To understand what happened, one has to know about replace by fee (RBF) transactions. As the name suggests, it appears when a sender tries to replace an earlier transaction with another one with a higher fee.

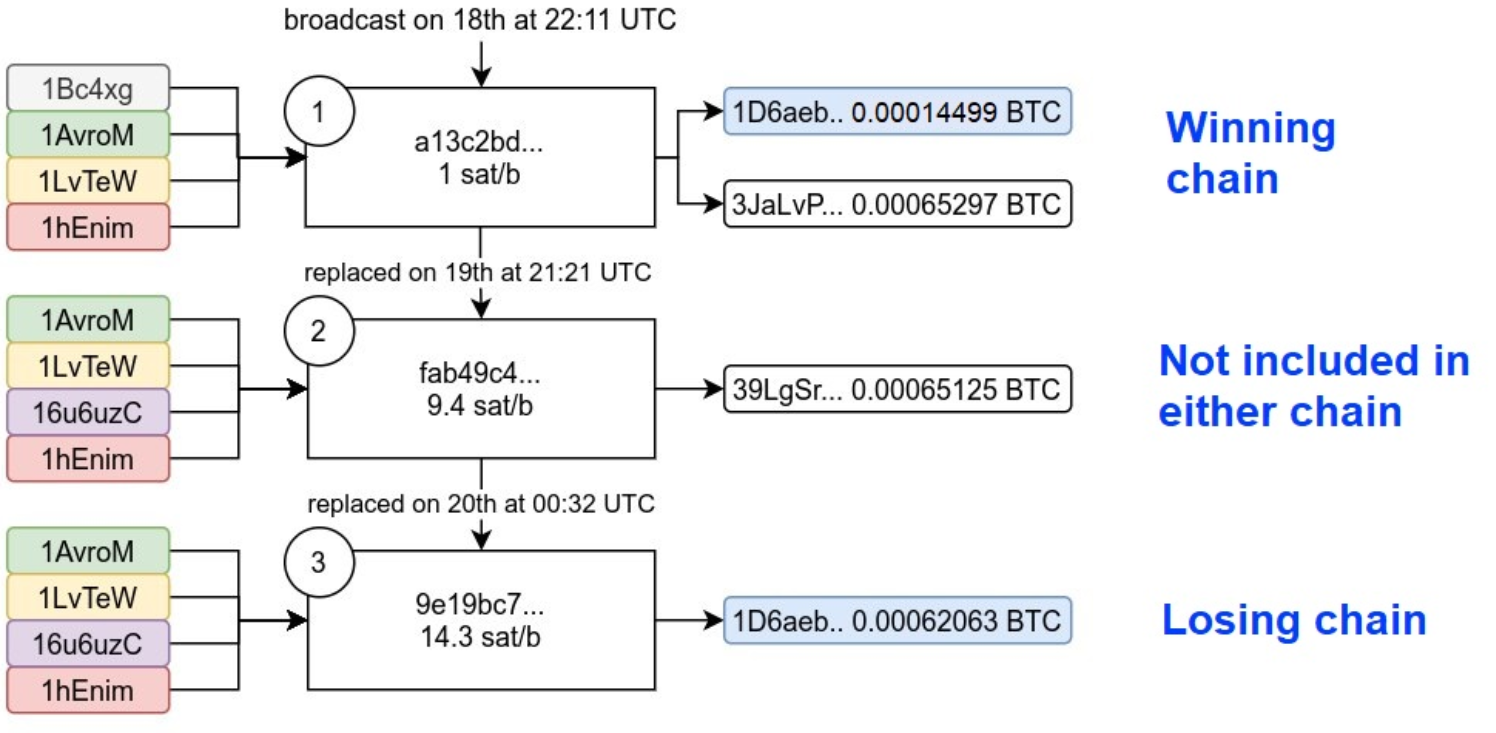

This particular user had an unconfirmed transaction sent on Jan. 18 from four Bitcoin addresses.

Later, the user attempted to send another transaction to a different address on Jan. 19. Bitcoin full nodes rejected this.

On Jan 20., an RBF attempt to make miners accept the transaction finally sent the amount.

However, when the RBF transaction was initiated, the first transaction from Jan. 18 also went through in the second block. Thus, the input addresses spent more than their total input.

Note that the transaction to a different output was not included in either chain.

The intentions of this user are unclear at the moment.

Nonetheless, until the next block confirmation, which is ten minutes for Bitcoin, both transactions were verified simultaneously. This could have created minor issues.

For instance, merchants of the BTCPayServer would have received a successful invoice confirmation of the dropped transaction. Nicolas Dorier, Bitcoin developer and founder of BTCPayServer, told Crypto Briefing:

“It is a double spend because two blocks spend the same input with different output.”

Nevertheless, as the output address was the same in both transactions, many debated against calling it a double spend.

What Happens to Bitcoin Now?

Temporary block reorganizations are a common occurrence. Bitcoin educator Andreas Anotonopolous noted that one or two block reorganizations happen every few weeks. The chances of adding two different transactions from the same address are rarer.

The concern remains as to what happens to the transactions that are ultimately disregarded in the losing chain. Antonopoulos answered:

“If they [transactions] are also in the winning block then all is well. If they are not in the winning block, each node puts them back into its mempool as ‘unconfirmed’ and they wait for another opportunity”

The chances of the above situation happening again are very rare and possible only with small amounts.

Moreover, panic regarding possible double-spend attacks in the future has little basis. According to Dorier, the cost of conducting such an attack is in the millions.

Ideally, more than two, or a maximum of three-block confirmations, guarantees finality every time.

Disclosure: This author held Bitcoin at the time of press.

cryptobriefing.com

cryptobriefing.com