- Ethereum prevented a dip below the threshold after the August dip despite the crippling fear of a crash in the market.

- Buying pressure for Ethereum is also declining, which could fuel the active downtrend, resulting in a price fall.

- Immediate support for Ethereum lies at $1,429, which is where ETH’s price will be headed if the broader market cues remain bearish.

Ethereum’s struggle to breach the $2,000 mark that started back in May this year has failed time and again. The biggest reason is the persisting investor fear thatis keeping the crypto market subdued.

Ethereum falls to July lows

The altcoin king has been facing bearish woes for about three weeks now after undergoing the crash of June and July.

Back in June, when Ethereum’s price fell to $996, the market capitulated, noting the worst levels observed in more than two years. The subsequent recovery took almost a month, but the dip in August almost invalidated this recovery.

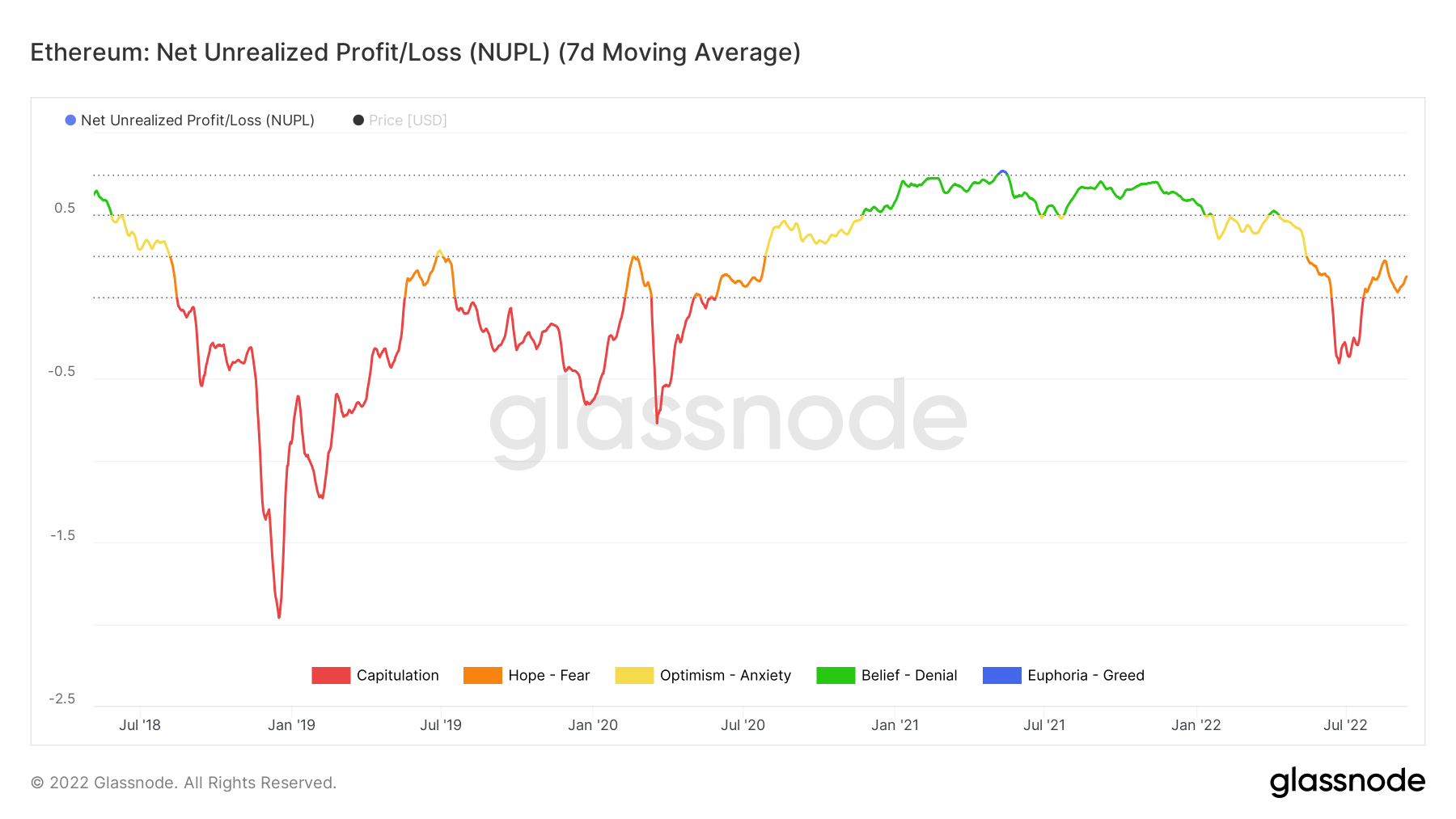

Ethereum NUPL

Ethereum NUPL

The net unrealized profit/loss (NUPL) ratio has been oscillating in the Hope-Fear zone, testing the threshold of capitulation at the beginning of this month.

Some recovery was observed at the time of writing, thanks to ETH rising to $1,776. But the next challenge for ETH lies in the direction it will take since broader market cues are displaying mixed signals.

Ethereum headed towards the highs or lows?

Lower highs and higher lows recorded since January 2021 indicate that ETH is looking to test one of these few levels. The first is the $1,777, which has been acting as a resistance for about a month now, even rejecting a breach 48 hours ago.

Ethereum 24-hour price chart

Ethereum 24-hour price chart

Secondly, the next critical support for ETH lies at $1,429, which it is bound to fall to if the bearish cues do not dissipate soon. However, should bullish cues take over the crypto market, ETH is looking to test $2,000 as resistance.

The reason why a breach through $2,000 is difficult is that the buying pressure is currently subsiding, which will keep the possible rise in prices limited to just the crucial levels.

fxstreet.com

fxstreet.com