The cryptocurrency industry is muddled in a web of financial and technical intricacies, bound together by the principled opposition to the centralized currency of the sovereign behemoths. Decentralized currency is the brainchild of a continuously developing technology-centric world, and, according to its adherents, the biggest risk to the cryptocurrency world emanates from the same.

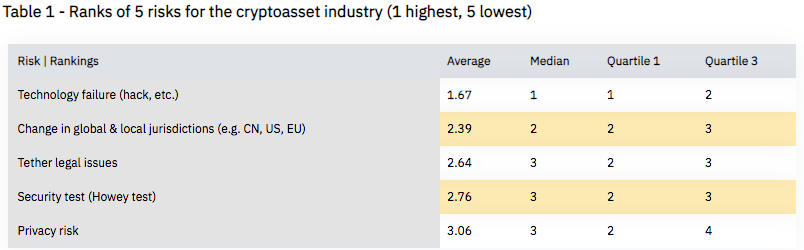

According to a recent study by Binance Research based on a May 2019 poll presented to institutional and VIP clients of the cryptocurrency world, technology is the prime concern of the industry. On asked to rank the top 5 risks facing the cryptocurrency industry today, the respondents choose “Technology Failure,” arising due to the preponderance of a hack or a leakage to be the most critical.

Source: Binance Research

The other prominent risk-related concerns within the digital asset space were, in order of their rank, the change in regulation, both domestic and international, legal issues pertaining to the top stablecoin, Tether [USDT], the growing debate around digital’s assets’ security connotation, subject to the Howey Test, and the staple privacy concerns.

Based on the average score of all the respondents, technology failure received a statistical rank of 1.67, the next three were between 2 and 3, with the concern about privacy, especially with the rise of privacy-centric coins like Monero [XMR], and Zcash [ZEC], not notching up to the other potential risks.

The report called the lack of elevated concern about Tether’s ongoing legal issues on its backing a “surprise.” Furthermore, the inner workings of the Bitfinex-iFinex-Tether matrix are also drawing considerable criticism from the larger community.

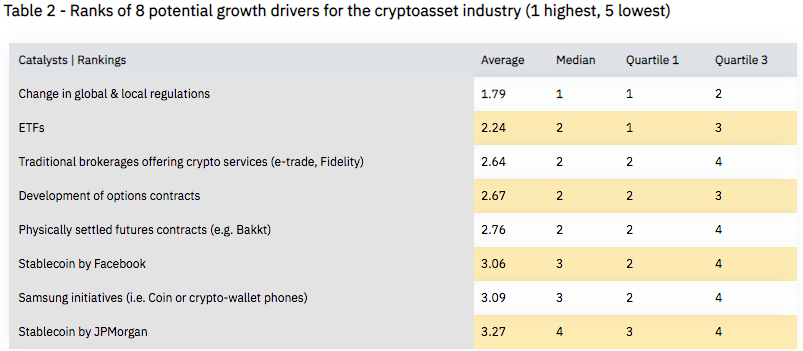

Binance Research also detailed the factors that could act as “potential drivers,” for the cryptocurrency industry with respondents listing out eight possible factors and the severity of the same. It should be noted that the responses to the above were answered in May 2019, hence the Libra fever has not been taken into account.

Source: Binance Research

Changes in global and local regulations were considered a top factor for growth in the cryptocurrency industry, with an average rank of 1.79. Continuing the regulatory emphasis, the second most concerning ‘growth driver’ was the notion of an ETF. The US Securities and Exchange Commission, at the moment, has two prominent Bitcoin ETF proposals, and a final decision on the same is due to be taken in October 2019.

Recent big-name entrants into the cryptocurrency space, including the likes of Fidelity with its dedicated digital assets branch focusing on exchange and custody services, taking the third rank. JP Morgan, with its internal digital asset, the JPM Coin, was considered the eight most important growth driver.

Facebook, with the much-talked-about Libra, backed by a basket of fiat currencies, operating on its own blockchain, with a custom wallet and pedaled on Facebook’s messaging applications was seen as key for removing the skepticism towards digital assets and hence took the sixth rank. Samsung, hinting at future integration of cryptocurrency wallets on their devices, was seen as a real cased of adoption and ease of access, ranking at seventh.

Wedged in the third and fourth spots were the trading cases of Futures and Option derivatives contracts propelled by ICE’s Bakkt platform, which is speculated for a late 2019 release.

The report should be taken with a pinch of salt, given the diversity, or lack thereof of the respondent’s pool. Binance Research presented this risk and growth driver rankings to institutional investors only, who view Bitcoin and the larger digital asset realm as any other “investment vehicle,” rather than a “medium of exchange,” or a “method of payment,” and a tool of “financial freedom.”

ambcrypto.com

ambcrypto.com