Hacash Diamonds founder Ken You recently joined the Neo Live AMA series to talk about the new NFT project that has launched on Neo. In May 2022, Hacash Diamonds joined the Neo Ecoboost program and stated intentions to build tools to connect the Hacash and Neo blockchains. Participants of the AMA shared rewards from a prize pool comprised of 15 HACD NFTs.

Hacash is a proof-of-work blockchain where the first Hacash Diamond NFT was minted in May 2019. The team claims the HACD series was the first proof-of-work NFT project to combine text and generative art on-chain. Hacash is launching its second collection, 1H1B, a cross-chain NFT that has already begun being minted on Neo.

In the AMA, You talked about the philosophy behind a proof-of-work NFT collection, development goals for the 1H1B DAO, updates on the number of H and B NFTs minted on Neo, how the team seeks to implement support for Neo, and much more.

The full transcript can be found below:

Q1: What is the Hacash Diamonds project?

Ken You (Hacash Diamonds founder): Hacash Diamonds is the world’s first and largest marketplace for the first proof-of-work NFT, HACD.

It is committed to spreading the energy of generative art through HACD NFTs and promoting HACD to become a mainstream store of value. The team members are serial entrepreneurs from the Chinese and American blockchain industry. Hacash Diamond’s products and services include the HACD browser, scarcity tools, a decentralized exchange, HACD QuickBuy, OTC guarantee services, NFT platform guarantee services, and NFT art exhibition services.

Here’s an example of our exhibition displays for HACD collectors.

Q2: Why is the Hacash Diamonds team optimistic about proof-of-work NFTs?

Ken: There are three main reasons. First, the entire NFT market is rapidly growing. The future size of the NFT market will be very large, and an NFT is something more accessible to ordinary people than cryptocurrencies.

In addition, many NFTs are currently just pictures, of which the hottest collection is the PFP type, completely dependent on social influence and team.

Second, proof-of-work NFTs have several natural features. Most importantly, they need to be mined by global miners. They can have an inherent production cost, which is very important. We think that a quality asset should have three elements: pricing, liquidity, and store of value. And proof-of-work is an excellent solution to the pricing and store of value, which other NFTs do not solve.

Finally, the NFT market comprises PFPs and game NFTs – proof-of-work NFTs are a niche market. We need to start a business to do something others still do not understand, which is an ample opportunity for us.

Q3: Why has the HACD collection been the primary focus of Hacash Diamonds?

Ken: We researched the major proof-of-work NFT projects on the market, and I also wrote two articles on Hackernoon. One can be found here.

Currently, there are mainly three proof-of-work NFT projects, including Atom (Proof-of-workNFT), HACD (Hacash Diamond), and MineableNFT (MPunk). Of course, some entrepreneurs are developing new Proof-of-work NFT projects. Here are some points that differentiate us from the rest:

- HACD is the earliest proof-of-work NFT project. It was mined on May 16, 2019, while the other proof-of-work NFTs were established in 2021. We believe that gives us an advantage because NFT collectors can be particularly concerned with series that were “the first” to something.

- HACD’s proof-of-work mechanism is very mature, it will not be like Atom and Mpunk in the early days of being monopolized by large hash proof-of-worker, and at the same time, there will not be particularly large hash proof-of-worker fluctuations, resulting in poor stability of mining. Hacash’s on-demand output for HACD is very stable at the output level.

- HACD also has a bidding system where miners need to bid with another proof-of-work coin after mining. So, the pricing of HACD will be clearer for the NFT collectors to measure.

- Sustainability is important; if the scale of a proof-of-work coin is trying to be like Bitcoin, it needs the ASIC machines, and we found that currently, only HACD can achieve this possibility.

- The “Diamond” brand is known to people worldwide, so it has a potential network effect.

- HACD has many combination-type plays. There are nine shapes, and collecting all nine is very difficult. HACD is more of a collection when compared to other proof-of-work NFTs.

So from provenance, proof-of-work mechanism maturity, asset pricing, future scale possibility, network effect, and collectability are better than other proof-of-work NFTs.

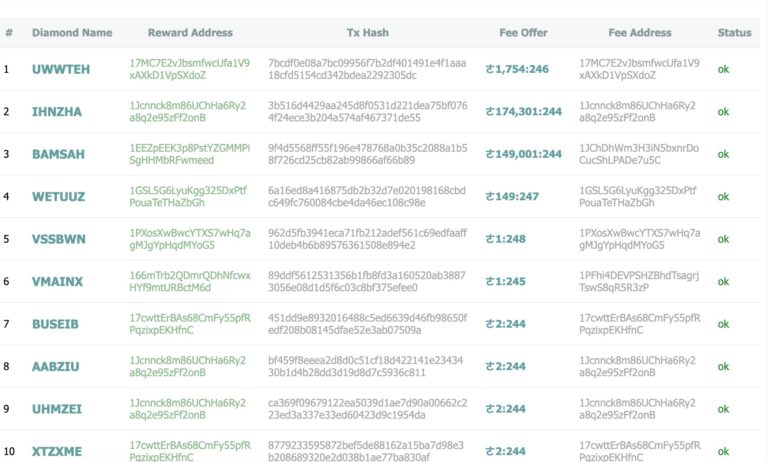

Source: Hacash Diamonds

This screenshot is showcasing the bidding HACD miners, which can be viewed in real-time at the link below:

https://explorer.hacash.org/

Q4: How will the HACD community participate in the 1H1B DAO? Why mint the 1H1B NFT series on Neo?

Ken: You will find that HACD has three elements of a quality asset: pricing, liquidity, and store of value. Pricing and store of value are well ensured because of the proof-of-work mechanism and bidding mechanism of HACD.

The most convenient way to access cryptocurrencies or NFTs is the centralized exchange or a mainstream public chain’s marketplace. HACD is different from most NFTs. It exists on Hacash’s chain. Hacash doesn’t support smart contracts or EVMs, so it is especially difficult for HACD to be compatible with other mainstream chains.

I am also a long-time user of Neo and saw Neo’s Ecoboost Program. Neo Global Development found that HACD met their requirements. The Neo team was also very optimistic about the potential of the proof-of-work NFT market and HACD. So, our team decided to boost HACD integration into the Neo ecosystem.

At the same time, as you know, a good asset needs to be known by more people, but since HACD does not have a team, we launched 1H1B DAO with the community to promote HACD and let key opinion leaders complete Twitter or YouTube tasks to promote HACD.

1H1B DAO will also mint 1H1B NFTs to verify who the early HACD supporters and promoters have been. The 1H1B DAO NFTs will also serve as membership passes into the DAO.

So far, 27 collectors have donated HACD to mint 1H1B NFTs. They include:

https://docs.google.com/spreadsheets/d/16OCc_51AjEIaAUS9BGPtTnN1T8JA2Hks2aVg91qKUrQ/edit#gid=0

Further, three KOLs have met the social media requirements, and the 1H1B NFTs have been minted and can be viewed at the link below:

https://ghostmarket.io/collection/1h1b/

Q5: Why does Hacash Diamonds believe that HACD proof-of-work NFTs serve as a better store of value than Bitcoin?

Ken: We have compared HACD with other proof-of-work NFTs and judged them by six criteria: the creation time, proof-of-work mechanism maturity, asset pricing, future scale possibility, network effect, and collectability are better.

First, we need to be very clear about why Bitcoin has the function of a store of value. Bitcoin has the three elements of a quality asset: pricing, liquidity, and store of value. And the core reason for this is proof-of-work.

Then proof-of-work, we have to look at the mechanism for adjusting the hash proof-of-worker difficulty because this is about the “Cost.” The difficulty adjustment of Bitcoin is once every two weeks, based on the difficulty of the two weeks of computing proof-of-worker combined to adjust. And the difficulty adjustment of HACD is constantly increasing, and the hash proof-of-worker of each HACD mined is higher than the previous one, which means the hashing cost of HACD is constantly increasing.

Also, Bitcoin is always mined regardless of the market’s supply and demand. The HACD NFT, on the other hand, can reduce or even stop its output when the market demand is not strong, thus ensuring a balance between supply and demand in the market. So HACD is better at adjusting the supply to meet the market’s demand than Bitcoin.

The last one is the artistic value of HACD. HACD creates a new form of art we call “Energy Generating Art.”

“Generative Art” refers to art given to an automatic system to be constructed. So energy generation art is to generate artworks on the blockchain through the proof-of-work mechanism. If Bitcoin is turned into an artwork, it will take 2,140 years to complete this work.

This generative artwork is created through the efforts of miners across the globe. So, the HACD can be seen as a global artwork that spans centuries and is made by people worldwide.

However, HACD’s network effect and liquidity are currently much lower than Bitcoin, and that’s our opportunity and our reason for being here. To expand its network effect and increase its liquidity, giving everyone an additional option to store value and create new types of art.

More insights can be found in the following article:

https://hacashtalk.com/t/why-is-hacd-an-encrypted-asset-which-is-more-scarce-suitable-for-wealth-storage-than-btc/65

Q6: How many types of diamonds are there? What do the shapes and colors mean? If we have a rare diamond, what benefit does it give us?

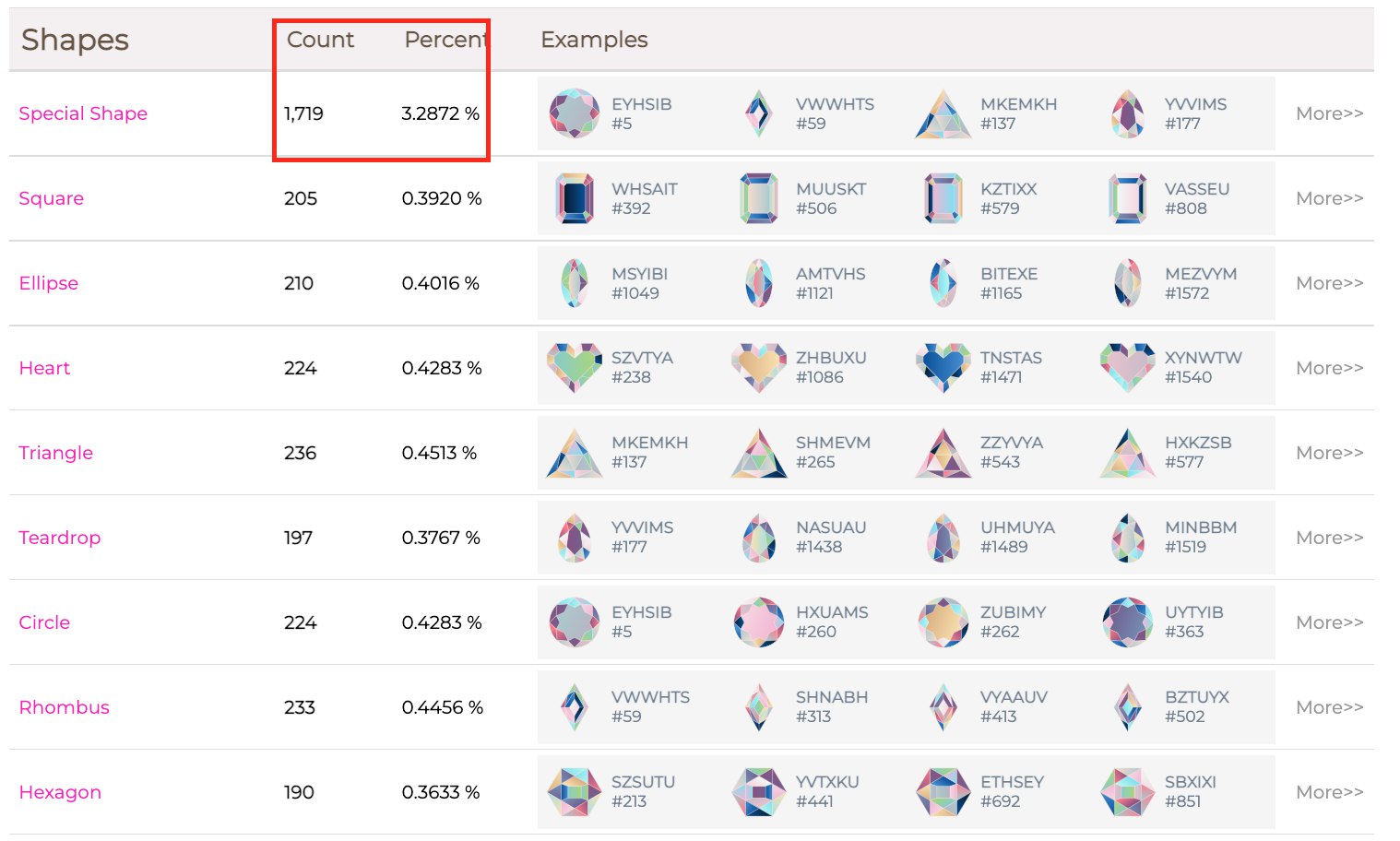

Ken: Hacash Damond has nine shapes and 16 colors. Regarding the scarcity of shapes, one is an ordinary shape, and the probability of being mined out is 97%, and the other eight are special shapes, and the likelihood of being mined out is 3%. Examples of special shapes can be seen below:

Source: Hacash Diamonds

Source: Hacash Diamonds

But since each HACD is composed of a different color, even 97% of the common shape HACD will be scarce due to the combination of colors. For example, we call pure HACD, there are only 20, and the probability of minting one is currently 0.0382%, which is very difficult to collect. Its price has exceeded two bitcoins.

Another exciting thing is that the combination of collectors also determines the scarcity of HACD. It is difficult for a collector to have all nine shapes of HACD and even more challenging to have nine shapes of HACD with the same main color. HACD mining makes this expensive and hard to achieve.

At the same time, the scarcity is constantly adjusted by the market and the output of HACD. In the past, if you had a set of nine shapes, it was the most scarce, but then everyone collected it, resulting in a pure HACD being the most scarce. So scarcity is constantly changing.

Of course, I think every HACD NFT is rare. But the rarest in my collection is the KENYUU. Though it is a common diamond on the market, with a 97% probability of minting, its name KENYUU is priceless because it is the closest to my name, KEN YOU.

Source: Hacash Diamonds

Q7: On the Hacash platform, how many different ways can users make passive income? Are there special rewards for holding Hacash Diamonds?

Ken: The Hacash platform doesn’t offer any forms of passive income. All income requires your contribution. The whole system follows a high-risk, high-reward principle, similar to the Bitcoin system. The more computing proof-of-worker you invest, the more HACD you can mine. You need to invest more computing proof-of-worker and HAC to mine more HACD.

Now the Hacash community has proposed the HACD lending protocol. If this protocol is implemented, you can have HAC arbitrage through HACD lending. More information about the lending protocol can be found at the link below:

https://github.com/hacash/paper/blob/master/HIP/lending/lending_standard_specification.en.md

Q8: Will Hacash Diamond create an NFT marketplace? Where can users upgrade or swap HACD assets? Is there an NFT explorer or an interface that allows users to browse, track, and discover Hacash Diamond’s NFT collections?

Ken: There are currently two major HACD marketplaces, an HACD browser, a rarity explorer, and a non-custodial exchange. We plan to develop HACD swap tools, which is why we are excited to partner with Neo.

Q9: Can I access Hacash Diamonds with a mobile phone? How will users be able to join DAO? Can you give us a comprehensive overview of the protocol’s design, including how liquidity is sourced and incentivization is handled?

Ken: Hacash Diamonds currently supports web and desktop wallets developed by the Hacash developer community. A mobile app has not yet been developed. This is one reason why Hacash Diamonds and the HACD community established the 1H1B DAO.

1H1B DAO’s goal is not only to achieve the price target, the floor price of each HACD exceeds that of one Bitcoin, but also to increase the influence and adoption of HACD. We believe a mobile wallet app should be one of the goals to achieve success.

To join 1H1B DAO, applicants need more than 1,000 Twitter followers or YouTubers who can make videos about HACD (with more than 500 views) can mint 1H1B-B NFTs. Those who do not qualify can donate two HACDs to participate to mint 1H1B-H NFTs. This is the easiest way to participate in the DAO. Currently, six 1H1B NFTs have been minted and can be traded on GhostMarket. H and B NFTs can merge to mint HB for more rewards and benefits.

1H1B NFT is an NFT that serves as proof of DAO membership. The membership benefit is conferred by all DAO members. As a DAO member, Hacash Diamonds intends to distribute NEO or GAS monthly at the beginning of the DAOs life. More details can be found at the link below:

https://www.hacash.diamonds/1h1b

Q10: Why does HACD use proof-of-work, and what are the advantages of this consensus mechanism? Will there be listings on Sky Hut?

Ken: Let’s reexamine Bitcoin and why I think it can become the most prominent digital asset. What is the basis? My answer is its mechanism, and proof-of-work is one of the most important mechanisms. Without proof-of-work, Bitcoin might not have ever become what it is today. The same can be said for Ethereum.

Some might ask if proof-of-work coins have a future. This is because they are very similar to Bitcoin, and it is no longer necessary to have a proof-of-work digital asset like Bitcoin in the market. The market has determined which is the best one – Bitcoin.

We believe that proof-of-work NFTs are different. HACD is the first proof-of-work NFT to have been developed. From the point of view of NFT or artwork, let an NFT or artwork value will not be decided by capital or some top art galleries and auction houses. Instead, people around the world can determine the value. Just like Bitcoin, the value is decided by everyone, and it’s fully decentralized and secure.

Because HACD is on the Hacash chain, and the Hacash chain does not support EVM, it needs to build a cross-chain tool to access SkyHut, but 1H1B DAO NFT can currently be implemented.

Note: Some edits have been made for formatting and readability.

The full AMA can be found at the link below:

https://t.me/NEO_EN/240674

neonewstoday.com

neonewstoday.com