Non-fungible tokens (NFTs) have sold for millions and drawn the attention of mainstream publications from the New York Times to Vanity Fair.

Recently, though, prices for the tokens and their trading volumes have declined, raising questions the sustainability of the NFT frenzy, according to a leading website set up to track the fast-growing corner of the cryptocurrency industry. Is an NFT market crash in the offing?

“It almost seems that some have been eagerly awaiting a market correction, to finally prove that NFTs have just been in a bubble,” according to an April 6 blog post on Nonfungible.com.

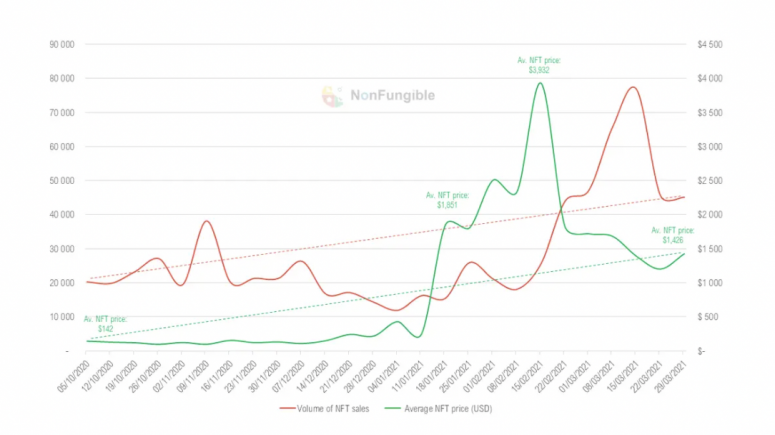

- “The average price of NFTs spiked quite astoundingly in February, peaking at around $4,000 in mid-February. Since then, record sales continue to follow, averaging around $1,500.”

- The volume of NFT sales has also declined from a peak of 80,000 in early March to around 40,000 as of March 29. Volume tends to lag price, which could be explained by a growing interest of new buyers following record sales.

- The average price of the 3 most expensive NFT type on the market peaked around $95,951 last month before declining by about 53% in just a few weeks.

- However, NFT average values tend to fluctuate over time, according to data from Nonfungible.com going back to May 2020.

The slowdown could calm what some experts have described as an NFT frenzy and bring inflated values to more reasonable levels. After all, market stability is important for professional investors who view long-term potential for NFTs.

It’s not enough of a pullback to call it an NFT market crash, though, Nonfungible.com said in the post. For example, the current average price of an NFT is about 10 times what it was six months ago.

“The trend seems more to show a stabilization on a high plateau following a speculative peak,” according to the website. In other words, if there’s an NFT frenzy, it hasn’t popped.

Jeff Dorman, chief investment officer at Arca, a cryptocurrency investment firm, wrote Tuesday in a newsletter that he sees further growth coming to the NFT space.

“NFTs will expand beyond current use cases such as collectibles, art and gaming into more traditional use case,” wrote. “Companies and projects that facilitate the growth and trading of NFTs could be big winners.”

coindesk.com

coindesk.com