There are countless ways to engage with Non-Fungible Tokens, otherwise known as NFTs. And because these NFTs are typically created with smart contracts, there are countless ways to financialize them.

To have a closer analysis, ConsenSys has taken a look at three different ways to use NFTs financially:

- Collective bidding

- Fractionalization

- NFTs as Collateral for Loans

The Web3 revolution is well underway. Therefore, the most inventive users of this open environment continue to find different ways to create value for other users. Let’s take a look at three of these:

1. Collective Bidding of NFTs

First, ConsenSys explained how the average collector could buy Blue-Chip NFTs with their friends. To do this, you can use Partybid. This platform allows users to pool money together to buy NFTs as a team. Anyone can create a party, join a public one, and collectively bid on or buy most NFTs!

NEW from PartyDAO…

Now supporting @OpenSea: party on the largest NFT marketplace

Token-gated parties: party with your on-chain friends

Plus a new website! fresh homepage, live activity feed, trending parties, user profiles & morehttps://t.co/pfQ1JdOKHs

Join a party now ⬇️ pic.twitter.com/oM9a4R1GHa

— PartyDAO (@prtyDAO) November 18, 2021

Most collectors cannot afford higher-value pieces. Additionally, people outside of our little bubble may be interested in this technology. But are they willing to risk thousands of dollars on what looks like a JPEG to them? Probably not, but they may be more inclined to risk a few hundred or less.

This is the difference between traditional and digital art. Regardless of their location, people across the world can enjoy the same ownership of a piece of art. There is no difficulty sharing between friends or people you don’t even know. This is an entirely trustless way of making significant collective investments.

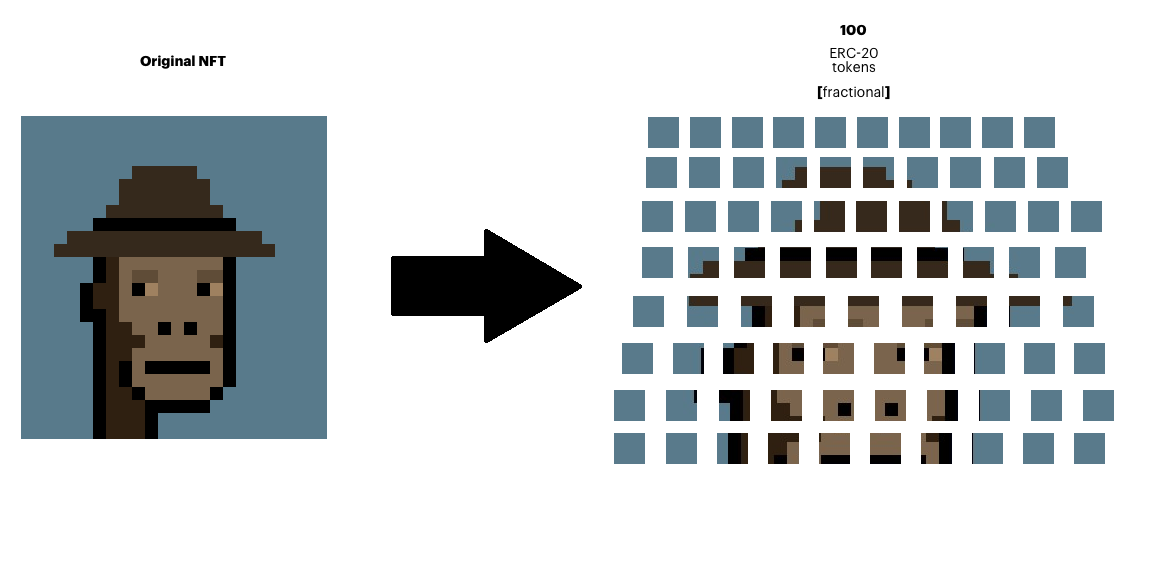

2. Fractional NFTs

There is a slight variation in collective bidding, called fractionalized NFTs. ConsenSys names platforms like Fractional allow any user to buy fractions of NFTs. In this case, users can purchase and own a % of an NFT. Users can also fractionalize their own NFTs. This way, they can see some liquidity without selling the entire asset.

For example, take an early Cryptopunk or BAYC investor. Maybe they only have one left in their collection or only bought one, to begin with. This NFT has a floor value of upwards of 52 ETH right now. How do they see any value from this investment without selling the entire thing? They could very quickly fractionalize this NFT. They could slowly sell these fractions over time. Or, they could also sell 49% of the NFT for quick liquidity with ensured ownership.

3. NFTs as Collateral Loans

Digital assets are beginning to be recognized as actual assets, and ConsenSys has the data to back that up. Platforms like NFTfi allow users to loan using their ERC-721 tokens as collateral. When a user locks an NFT into the platform, other users can offer loans. Once accepted, the platform closes the NFT into a smart contract and freezes it until either:

- The loan is paid in full, with APR%

- The duration of the loan runs out

At this point, the NFT is either returned to the original holder, or the lender can collect the NFT. ConsenCys reports that NFTfi has already supplied USD 4 billion in loans.

#NFTfiFam leaders' board time.

Our top lender gave over $6M in 2 months earning an impressive $330k. Pretty slick APR we think.Join the #LiquidityRevolution on https://t.co/jFQ7k6JHd1 now – we're whitelisting top projects every week, so you can put new #NFT cuties under your🎄 pic.twitter.com/u0bSIxcOih

— NFTfi.com (@NFTfi) December 22, 2021

While an inherently risky way to get liquidity, as NFTs are volatile and relatively challenging to get an actual value, this is another innovative use of this technology. Not advisable for long-term loans, with the fluctuations in price over time, the NFT could very well be worth much more or less than the collateral provided.

On the other hand, NFTfi allows loans as short as seven days, and users can get these loans incredibly fast. With proper use, smart investors could use their NFTs to make further gains with short-term loans.

NOTE: Remember always to do your research, make your own decisions and invest in projects that interest you!

altcoinbuzz.io

altcoinbuzz.io