The recent bear market has had telling effects on every crypto sector, and new data suggests that the NFT sector has also been affected.

Dune Analytics data shows that the trading volume for NFTs is now down by 97% from the start of the year. In January, the trading volume peaked at $17 billion, but the figure has now significantly dropped to $470 million.

The decline is not surprising given that there was a clear sign of it even before the bear market set in. Since trading volume peaked in January, interest in NFTs has declined gradually with a drop in Google search trends and the number of daily unique wallets.

Blue chip NFTs sales volume drop

What makes this decline even more evident is how the sales volume for Ethereum Names Service has increased by 133.95% in the past 30 days. Compared to it, the sales volume of blue chip NFTs such as Bored Apes, CryptoPunks, Azuki, etc., are in red.

However, Bored Ape still has the highest sales among NFTs in a month, but its trading volume is down by 42.96%. CryptoPunk is down by 21.24% and Mutant Ape by 29.95%, according to available data.

Meanwhile, the recent market crash has also played a role in dropping the US Dollar value of these NFTs. In ETH, the top 100 NFTs by market cap saw their value decrease by 27%, but the decline in USD is 44%.

On-chain metrics remain bullish

A DappRadar report has shown that despite the significant wane in the market, on-chain metrics suggest that the NFT industry remains bullish.

According to the report, the number of unique traders in 2022’s third quarter increased by 36% compared to that of the previous year.

The report also highlighted the growth in other NFT-compatible blockchain networks. In the third quarter, Ethereum NFTs for 91% of the total trading volume, but only 26.2% of the sales count.

Even with the decline in interest and value of crypto assets, the market still witnessed the sale of CryptoPunk #2924 for 3,300 ETH, which is $4.4 million, only a few days ago. This makes it the fourth most expensive CryptoPunk.

Solana dominates GameFi

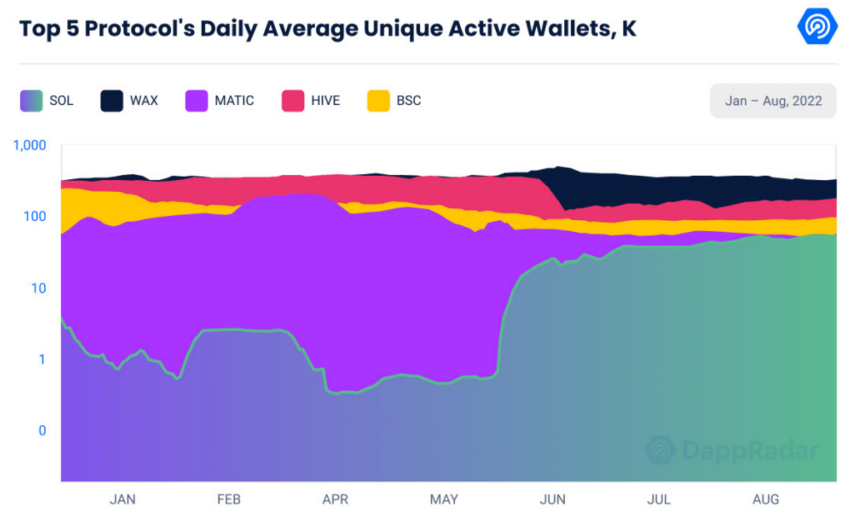

While interest in NFTs generally might have declined, the GameFi market is seeing increasing interest. In August, the number of Unique Active Wallets (UAW) registered daily in this sector was 847,000, with Solana seeing a continuous rise in UAWs with a 21% growth on the monthly metrics.

beincrypto.com

beincrypto.com