Bitcoin (BTC) could be in for a fresh battering this week after reports emerged that some mining pool players including HashCow and BTC.TOP, are reviewing their operations in China as a response to central government pressure on the mining sector, while some industry observers argue that this might mean "redistribution of the entire Bitcoin mining network."

Per Reuters, HashCow has stated that it will “stop buying new bitcoin rigs,” while BTC.TOP has “announced the suspension of its China business citing regulatory risks.”

The news agency added that the Chinese crypto exchange Huobi has also suspended its crypto mining services – as well as its “trading services” – to mainland Chinese clients, “adding it will instead focus on overseas businesses.”

Late last week, Cryptonews.com reported that one Chinese exchange was closing its doors after fresh regulatory rumblings from Beijing.

Also as reported, the Chinese government posted a warning on its website from the regulatory Financial Stability and Development Committee and members of the Central Committee of the Communist Party of China – Beijing’s top decision-making body.

The regulator promised to “crack down on bitcoin mining and trading activities,” as well as “prevent and control financial risks.” The statement’s authors also vowed to “punish illegal financial activities” and promised a “heavy crackdown on illegal securities-related activities.”

China has had the crypto mining industry in its crosshairs for some time. Earlier this year, there were clear signs that the Inner Mongolia Autonomous Region (IMAR) and the Xinjiang Uygur Autonomous Region (XUAR) – two hotbeds of mining activity – were coming under pressure from Beijing to meet key carbon emissions targets. The regions have been looking to respond by shutting miners who cannot switch to renewable power to shut down.

China has pledged that it will reach carbon neutrality by 2060, but many of the nation’s crypto miners have set up shop in the IMAR and XUAR, where they often make use of the output of highly polluting, older coal-powered stations.

Reuters quoted the BTC.TOP founder as writing, on Weibo:

“Eventually, China will lose crypto computing power to foreign markets.”

However, on Twitter, some disputed the veracity of the reports, with one claiming that BTC.TOP was “no longer servicing Chinese customers” per its announcement, rather than closing down its mainland activities. Cryptonews.com has reached out to BTC.TOP for comment.

@karimhelpme @gladstein very important! Translation error in Reuters report?

— Will Foxley 🧭 (@wsfoxley)

Mustafa Yilham, the Vice President of global business development at Bixin, wrote that it was significant that “this is the first time such a high-ranking member of the PRC” had declared a “crackdown,” adding:

“Usually, that means there will be some enforcement actions in the coming weeks. No one knows the level of enforcement action that will be taken at the moment. Uncertainty is creating bearish sentiment among Chinese miners.”

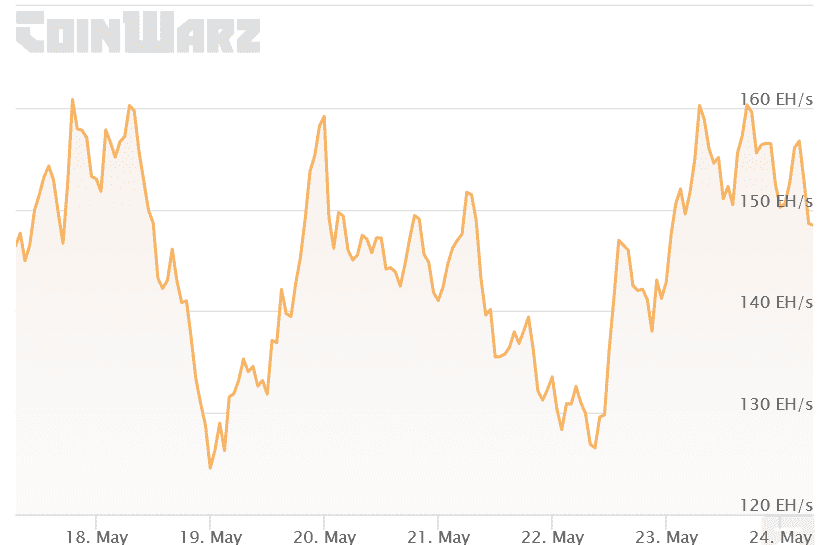

Bitcoin hashrate in the past week:

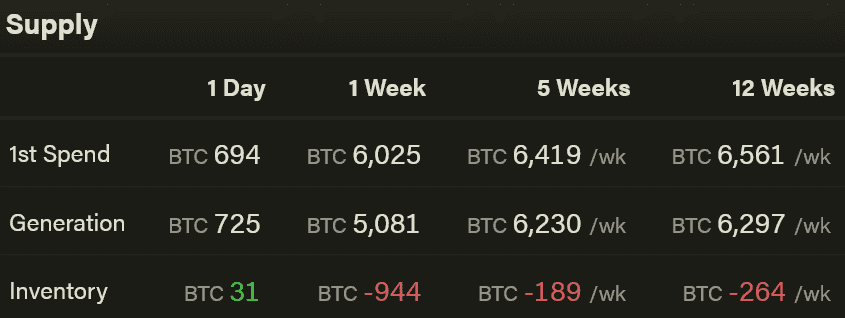

According to him, some miners have already "panic sold" BTC and "others had no choice."

"Not everyone [has] access to western hosting sites. There [is] also added level of uncertainty on current RMB [over-the-counter] trading channels. Need fiat to cover operational costs at end of the day," Yilham said.

6, Under this current crisis, there will be a massive opportunity - redistribution of entire Bitcoin mining network… https://t.co/nvxyM6OmqN

— Mustafa Yilham (@MustafaYilham)

Meanwhile, Nic Carter, the Founding Partner of crypto-focused venture capital firm Castle Island Ventures, wrote:

“I’ve effectively been able to confirm […] (unusually high) miner selling leading this last leg down. [...] Miner selling is a huge driver of price action here.”

BTC generation and sales:

Carter added that there could be a silver lining to a mass Chinese exodus from the mining sector in the form of cleaner power.

He wrote:

“Everything I’m seeing indicates an absolutely seismic shift of hashpower out of China and into the world at large. It won’t be elegant or pretty but obviously, it’s great for hashrate distribution and likely carbon intensity.”

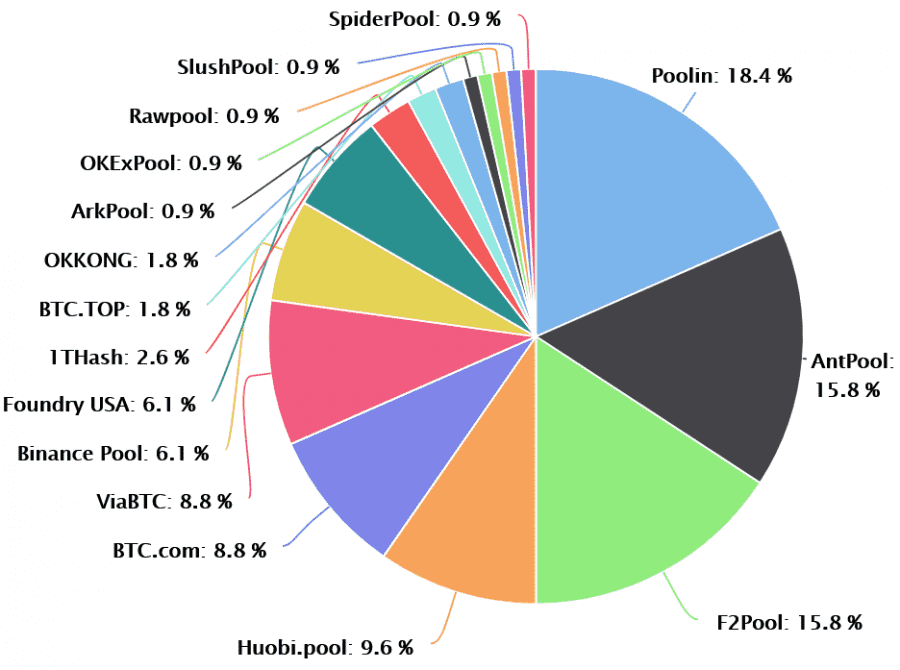

On a weekly chart, BTC.TOP had a 2.5% share among Bitcoin mining pools, while, in the past 24 hours, it dropped to 1.8%. OKExpool, Slushpool, Binance Pool have also decreased their share, while Foundry USA, AntPool, Poolin, and Huobi.pool have strenghtend their positions.

BTC hashrate distribution among mining pools in the past 24 hours.

In a video, Carter also opined that “it does look like Chinese miners are aggressively scouting out alternative domiciles overseas.”

He added that miners are looking at in Central Asia, Europe or the United States in a bid to continue functioning – although there was evidence of “miner selling,” with a possible bid to “hedge into fiat” in some cases.

At 08:13 UTC, BTC trades at USD 36,673 and is up by 3% in a day, trimming its weekly losses to 21%

cryptonews.com

cryptonews.com