The Bitcoin bulls have been suffering from a relentless bear assault over the past months. In the meantime, BTC’s price remains rangebound in higher timeframes as it moves between the lows in the $30,000 area and the highs in the $60,000 area.

Related Reading | The Biggest Risk For Bitcoin? How Quantum Computers Could Hurt BTC

Recently, the political situation in Kazakhstan led to a nationwide internet shutdown. After the China ban on Bitcoin mining, almost 20% of the network’s hashrate migrated to this country. Therefore, people started speculating on the possibility that the crisis could be impacting Bitcoin’s price.

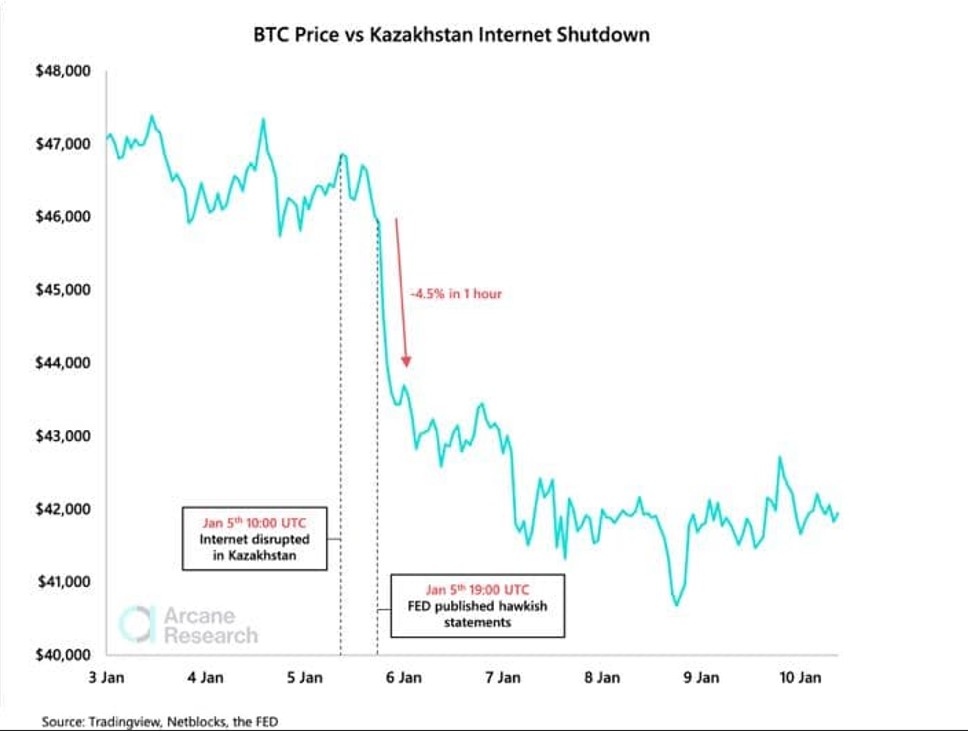

In a recent report by Arcane Research, the attempts to demonstrate that BTC’s recent price action was unrelated to the Kazakhstan crisis. As seen in the chart below, the price of Bitcoin barely stumbled $1,000 from its levels at the time of the internet shutdown in the Asian nation, around 10:00 UTC, January 5th.

The price was even able to recover from the incident in a relatively short amount of time. However, on January 6th, the U.S. Federal Reserve talked about a potential shift in their monetary policies. The financial institution hinted at a hike in interest rates and tapering of their asset purchase program.

As the chart shows, Bitcoin seems more correlated with the latter event and with the rest of the risk-on assets, Arcane Research found, as the cryptocurrency fell over 4.5% after the FED’s statements. At the same time, the U.S. S&P 500 Index dropped an estimated 1%. Arcane Research added:

Since the bitcoin price plummeted immediately after the FED published the statements, it’s far more likely that this caused the bitcoin price to drop – not the internet disruption in Kazakhstan, which happened hours before.

Bitcoin Vulnerable To Global Events?

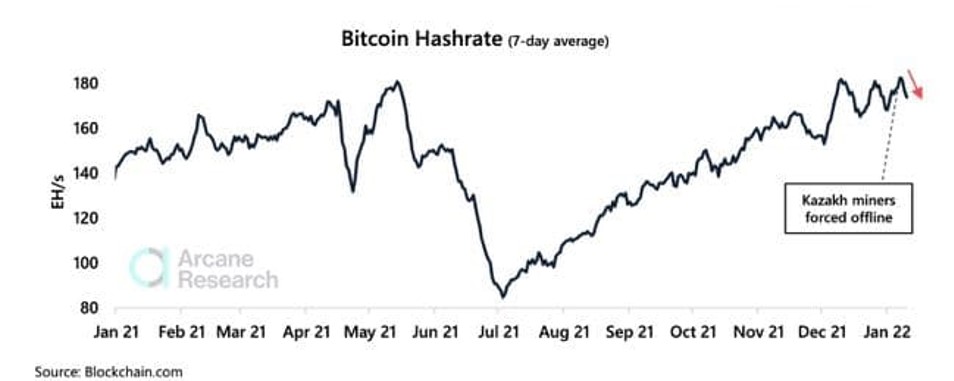

Therefore, the research firm concluded that the Bitcoin price action and the events in Kazakhstan were “just a coincidence”. Further data provided by Arcane Research claims this network lost around 12% of its hashrate as the crisis unfolded.

As seen below, the hashrate slightly moved to the downside in its 7-day average. Thus, the firm claims BTC has proven to be one of the strongest assets in terms of country risk.

During the China BTC mining crisis, the BTC hashrate suffered larger stress as the metric plummeted from around 180 EH/s to 80 EH/s causing an increase in selling pressure as well. This event led to more downside for BTC’s price but has demonstrated to have long term bullish effects.

Related Reading | Bitcoin Supply In Profit Drops To July Lows – Is The Bottom In?

As more miners and users are spread across the world, the network is less susceptible to any given eventuality. This decentralization has made BTC more resilient and has moved the network farther from being susceptible to the intervention of a single actor or nation-state. Arcane Research said:

(…) Lost Bitcoin hashrate in one country means mining become more profitable elsewhere, incentivizing miners in other jurisdictions to increase their hashrate. This game theory is part of what makes the Bitcoin network the most robust computing network globally.

In the long term, BTC must avoid geographical centralization as a risk factor that could jeopardize the entire network, Arcane Research said.

bitcoinist.com

bitcoinist.com