The importance of mining has never been questioned; Simply put, mining is the process of generating new Bitcoins in the network and facilitating transactions on the blockchain.

Miners are rewarded for their efforts in BTC for the addition of a new block, but over the past few years, the profitability of mining has been under scrutiny.

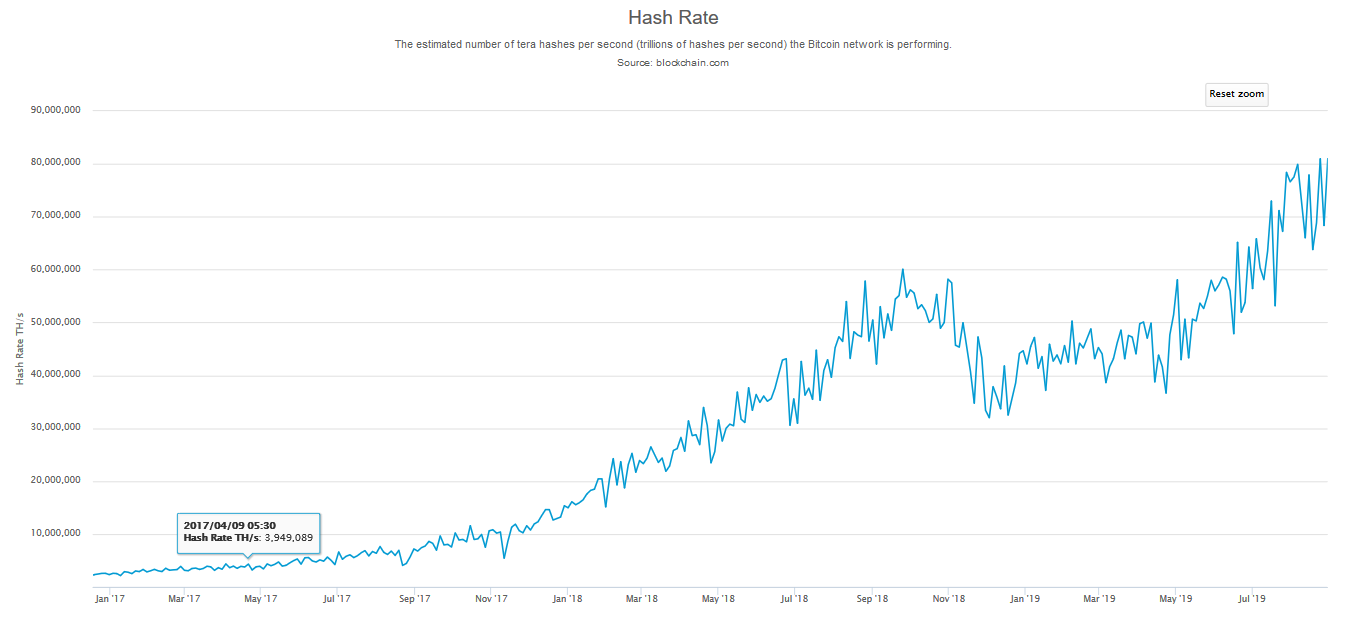

Source: blockchain

The hashrate of the network has progressively increased since the start of January 2017. The network hashrate was recorded to be 2.5 TH/S on 3rd January 2017 and on 30th August 2019, the hashrate was 80.9 TH/s.

However, such an incremental rise in difficulty has failed to depreciate the miner’s revenue income. According to a recent report, Bitcoin mining revenue surpassed a total valuation of $14 billion to date.

The report stated that it took a period of over 8 eight years for the total revenue to reach a valuation of $5 billion but the revenue skyrocketed exponentially in the next 8 months to breach the $10 billion mark. The interesting point to note is that the hashrate had consistently increased in the same time period but it failed to slow down the mining revenue. An increasing hashrate would usually mean larger operational cost for the miners but the vigorous revenue rise invalidated impact of hashrate.

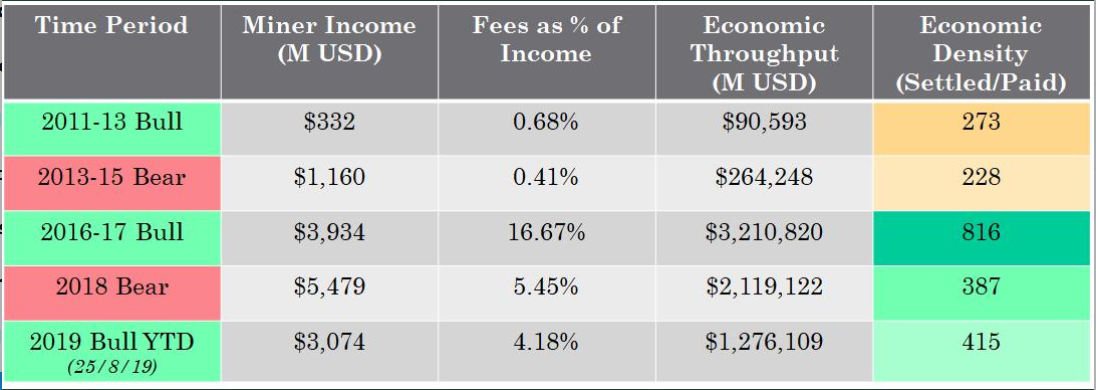

According to data from Coinmetrics.io, it was observed $7 trillion worth transactions occurred across the Bitcoin network. The total miner revenue was $14 billion and the total fee revenue (fee paid by user for a transaction) amounted to $975 million.

Source: Twitter

According to data, the percentage of miner’s revenue spiked during 2018 bear cycle which indicated that even when the market was down the security of the network was maintained and miners were active without incurring a loss.

The transaction fee paid by the users (per transfer) amounts to 3 percent of daily miner revenue but on an average, users pay less than 0.02 percent fee of the total value they transfer on the network.

The above fact indicated a profitable market for Bitcoin miners in the present-day, despite increasing hashrate on a daily basis.

Recently, the litecoin halving had a major impact on its miners as it was reported that, following the event, mining profitability had significantly reduced. Bitcoin’s next halving is slated for 2020, and it is speculated to have a big impact on mining revenue

ambcrypto.com

ambcrypto.com