Bitcoin miner Core Scientific (CORZ) will shut down mining rigs tied to Celsius Mining, Core's largest client with over 37,000 machines, after moving to reject its contract in recent days.

Both companies are undergoing Chapter 11 bankruptcies: Celsius Mining filed on July 13, 2022, along with its parent company Celsius Network, while Core filed on December 21. The two companies have been in engaged in ongoing litigation over their contract. Core claims that Celsius is not paying its dues, whereas Celsius argues that Core unilaterally increased its power rate, which isn't stipulated in their services agreement.

In a Tuesday hearing, Core's bankruptcy Judge David R. Jones said that the motion to reject doesn't violate the automatic stay on Celsius's property (under U.S. bankruptcy law, once a petition for a Chapter 11 bankruptcy is filed, creditors are no longer able to collect debts from the bankrupt debtor, and Core is likely a Celsius creditor given their dispute over unpaid dues). Jones also called Celsius' objection a "strategic" maneuver in which Celsius is trying to "take advantage" of the judge in its own bankruptcy case, without that judge being able to voice his concerns.

On Dec. 28, 2022, Core Scientific asked the Southern District of Texas bankruptcy court to reject Celsius Mining's contracts as an emergency measure, with the hosting firm claiming it is losing about $2 million in incremental revenue a month. If Core Scientific were released from the obligation to host Celsius Mining's machines, the company said it could generate $2 million per month either by finding other clients or by using the space for its own machines, the firm said in the motion.

Core Scientific asked for a hearing on Jan. 3, citing the urgency of the matter, which it says is leading itto lose $28,840 per day in power costs.

Celsius, in its response, said it agrees with cancelling the contracts and taking its machines back, but disagreed with Core Scientific's hastiness to do so. "This purported 'emergency' is entirely of Core’s own making and does not warrant a hearing on just two business days’ notice," Celsius Mining said in its Jan. 2 response to the motion. Celsius will have to consult with its own lenders before it can fully respond to Core's request, which it says it can't do in two business days. Celsius thus wanted to move the hearing to Jan. 23.

Celsius further argued that the motion to reject violates the automatic stay on Celsius' estate, and the mining rigs in question are under the jurisdiction of the bankruptcy court of the Southern District of New York (SDNY), where Celsius' case is currently being processed.

Celsius was open to having its rigs cut off from electricity on Jan. 3, meaning they wouldn't produce any bitcoin, its objection said.

In Tuesday's hearing, Celsius attorney Chris Koenig, of the Kirkland & Ellis law firm, said "we've agreed that they can turn off our rigs effective today, and that they don't get to charge us, we don't continue to pay for it."

All that's left is to hammer out a transition plan. Judge Jones gave attorneys representing each party some time to draft an agreed upon proposed order, which he said he would announce regardless of whether he signed it by mid-afternoon Tuesday. As of 7:30 p.m. ET (half-past midnight UTC), no proposed or signed orders were available in PACER, a federal court database system. Alfredo Perez, the attorney representing Core Scientific, hung up on a CoinDesk reporter, while Koenig did not immediately return a voicemail.

Celsius is not only Core's largest customer, with more than 37,000 machines hosted in its facilities, but one of its largest secured noteholders, holding about $54 million of secured convertible notes, or 10% of the total issuance, Kirkland & Ellis lawyer Chris Koenig, who represents Celsius, said in the first day hearing of Core's bankruptcy case.

Not only has Core tried to increase Celsius' hosting fee, contrary to their agreement, but they also blocked them from joining an Ad Hoc committee of secured convertible noteholders, who have been in discussions with Core to restructure debt, citing the ongoing litigation, Celsius said in its objection.

The "most important" part of the conversation around the contract is the transition period, Judge Jones said.

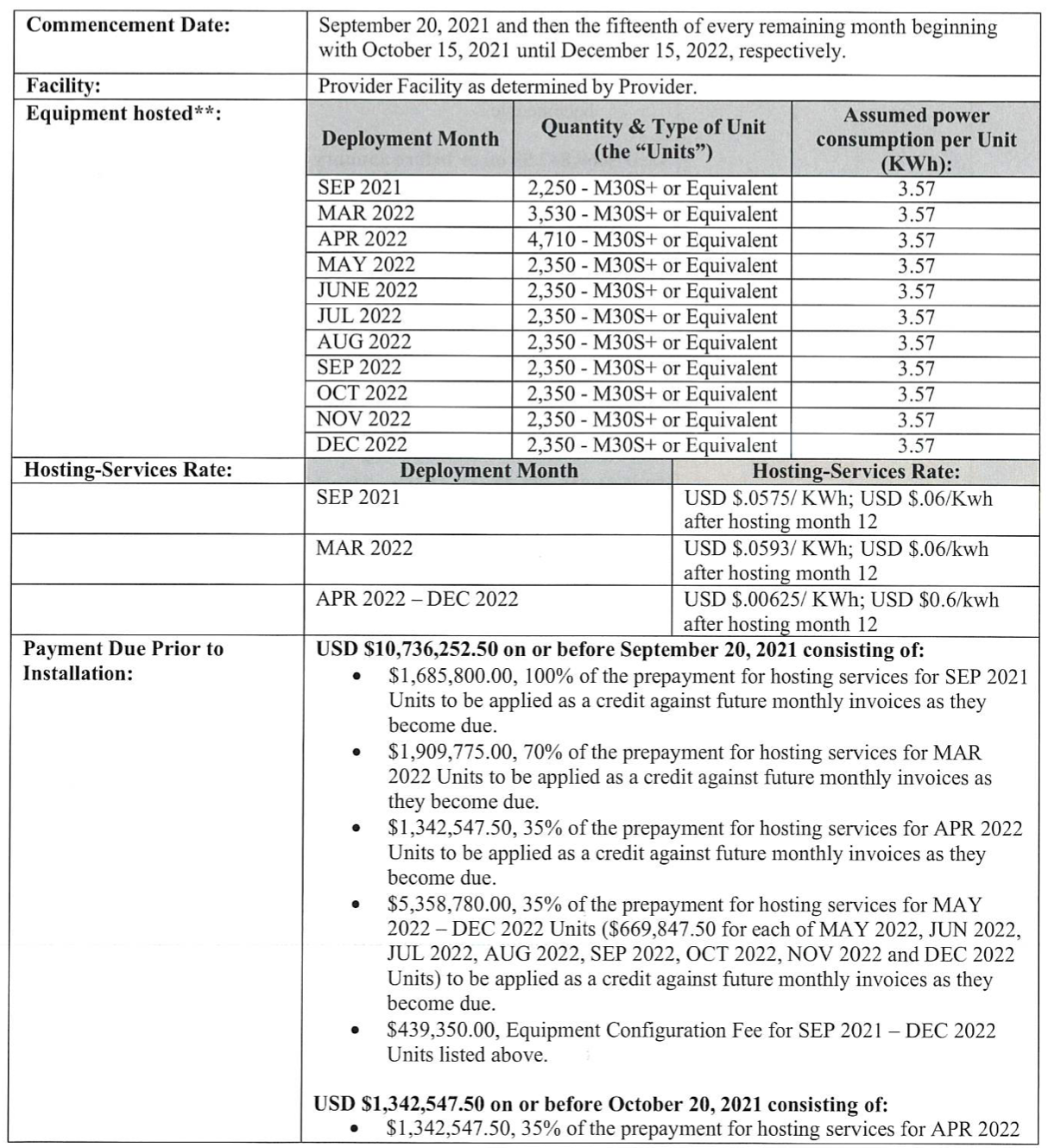

Core Scientific's 2020 contract with Celsius Mining (Eliza Gkritsi/CoinDesk).

A copy of the agreement between the two firms filed in an affidavit on behalf of Celsius shows that the contract specified a tariff, but didn't explicitly say it is a variable rate. But in his deposition, also filed as part of Celsius' affidavit, Core's Senior Vice President of Partnerships Jeff Pratt, said that it was implicit in the agreement.

Judge Jones said that the Celsius affidavit that this evidence is included in is "totally inappropriate for so many different reasons" and that it should "simply be struck" from the record.

coindesk.com

coindesk.com