Robinhood trading platform faced severe issues when GameStop longs were fueled by social media. 'Meme Stock' trading is when a stock is heavily bought via a coordinated action using social media forums.

A similar event recently occurred with Revlon that filed for bankruptcy.

Retail traders flocked into the stock, 8.3 million stocks were purchased in a single day (a record for the stock). It is worth noting that a similar event took place when Hertz Corp (car rental company) surged by more than 500% after filing for bankruptcy in 2020.

The rally was reminiscent of the more than 500% surge in the shares of car rental firm Hertz Corp after it filed for bankruptcy in May 2020 following economic restrictions during the early stages of the coronavirus pandemic.

In the case of GameStop, an infamous reddit group initiated a buying spree on GameStop as a hedge fund was shorting the stock. GameStop rallied over 1,000% before long traders liquidated their holdings.

It appears Robinhood faced liquidity difficulties due to the extraordinary rally according to the US House Committee on Financial Services. GameStop rallied from approximately $20 to over well over $250.

Robinhood Could Have Defaulted over Its Collateral Obligations

Robinhood became aware on the 28 January that it lacks $3 billion (approx.) to meet its collateral obligations. The result could have been being cut off by the clearinghouse.

Later on that day Robinhood received $9.7 billion from Deposit Trust & Clearing Corporation. The firm avoided defaulting on its daily deposit requirements due to a waiver by the NSCC (The National Securities Clearing Corporation, a subsidiary of DTCC). The report was unable to explain why the waiver was issued.

Robinhood's Head of Data Science said that position closing only (PCO which would limit clients form buying the stock would dent the image of the company.

He also said that PCO restrictions may cause greater volatility in the market as Robinhood's clients were 10% of the market at the time.

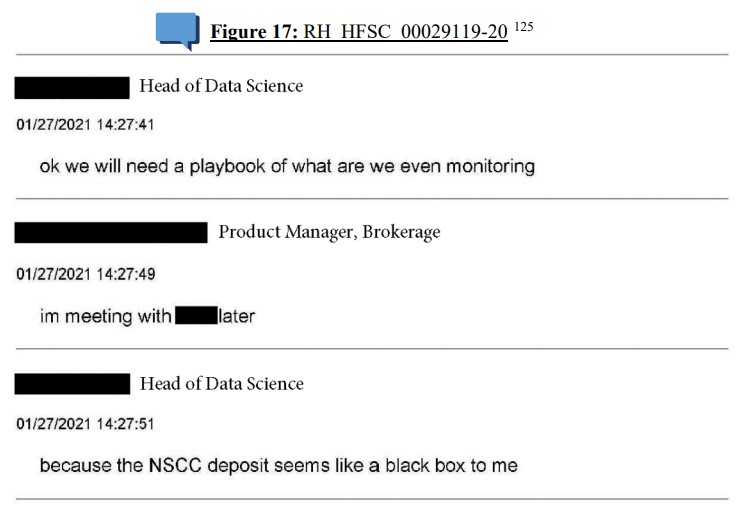

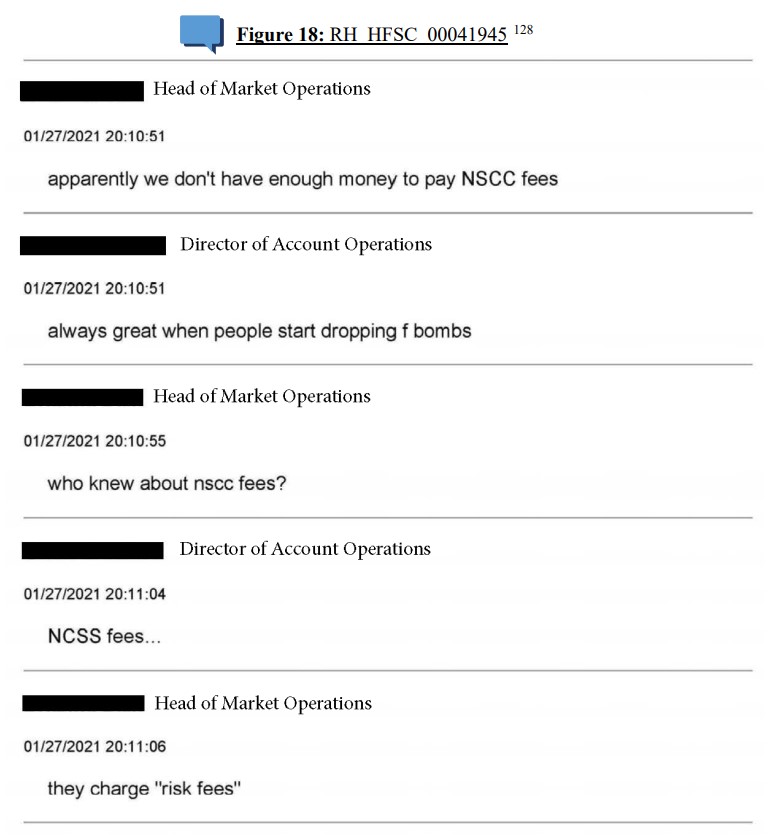

Robinhood was unaware how the NSCC calculated its collateral charges. Documentation from the report reveals how the firm's employees discuss mitigating risks.

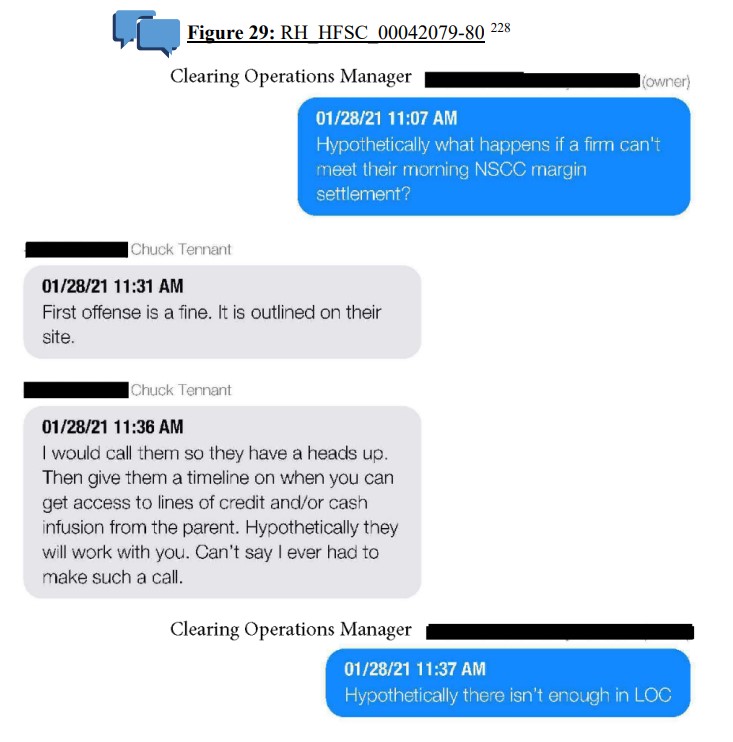

The clearing operations manager in Florida, the first Robinhood's employee to understand the firm's NSCC collateral charge on 28 January contacted Chuk Tennant, former head of Robinhood's clearing. He wanted to understand what would happen if the company was unable to reach its NSCC collateral obligations.

Robinhood turned off the auto approval for newly registered accounts. on 28 January Robinhood only had around $696 million in collateral instead of the required $3 billion (approx.). Failing to meet the requirements means Robinhood risk in violating the NSCC's rules and may be unable to clear trades for their clients.

The Excess Capital Premium charges were not calculated, which took Robinhood by complete surprise. The Chief Legal Officer informed officials at the DTCC that the company is unbale to meet its collateral obligations before market opening on January 28, 2021.

Robert Crain, an equity market risk executive at DTCC said that the DTCC agreed to reduce the Excess Capital Premium charge from $2.3 billion (approx.) to approximately $835 million. Robinhood said that such a reduction is insufficient as it may strain on the company's liquidity.

Robinhood was informed that the NSCC 'was subject to rules and oversight that did not allow it to waive nondiscretionary charges' according to the report.

19 minutes before the market opening, Robinhood received an update that the Excess Capital Premium charge dropped to $0. Robinhood wired the around $734 million and satisfied the reduced aggregate deposit requirements.

Without this waiver, over which Robinhood had no control, the company would have defaulted on its regulatory collateral obligations.

The report called for regulators to act by providing new brokerage liquidity rules. The report also suggested to act on gamifying online trading that only encourage individuals to trade more.

financemagnates.com

financemagnates.com