Coinbase, the biggest exchange in the US, has announced the listing of new cryptocurrencies.

Four new tokens to be listed on the platform are 1inch (1INCH), Enjin Coin (ENJ), NKN (NKN), and Origin Token (OGN), for which inbound transfers have already started. Trading for the same will begin on April 9th.

Support for 1INCH, ENJ, NKN, and OGN is available in all of Coinbase’s supported jurisdictions, with the exception of 1INCH and ENJ in New York State.

All four cryptos will be tradeable against USD and BTC with support for two additional fiat currencies, GBP and EUR, for only 1INCH token.

These tokens will now gain exposure to the exchange's 56 million customers.

The Origin Protocol team called this listing a “milestone” as “Coinbase is by far the most common way US retail customers start their journey into crypto, and the spotlight on Coinbase will greatly increase when they go public.”

As a result of the listing, these coins are enjoying an uptrend of more than 50%.

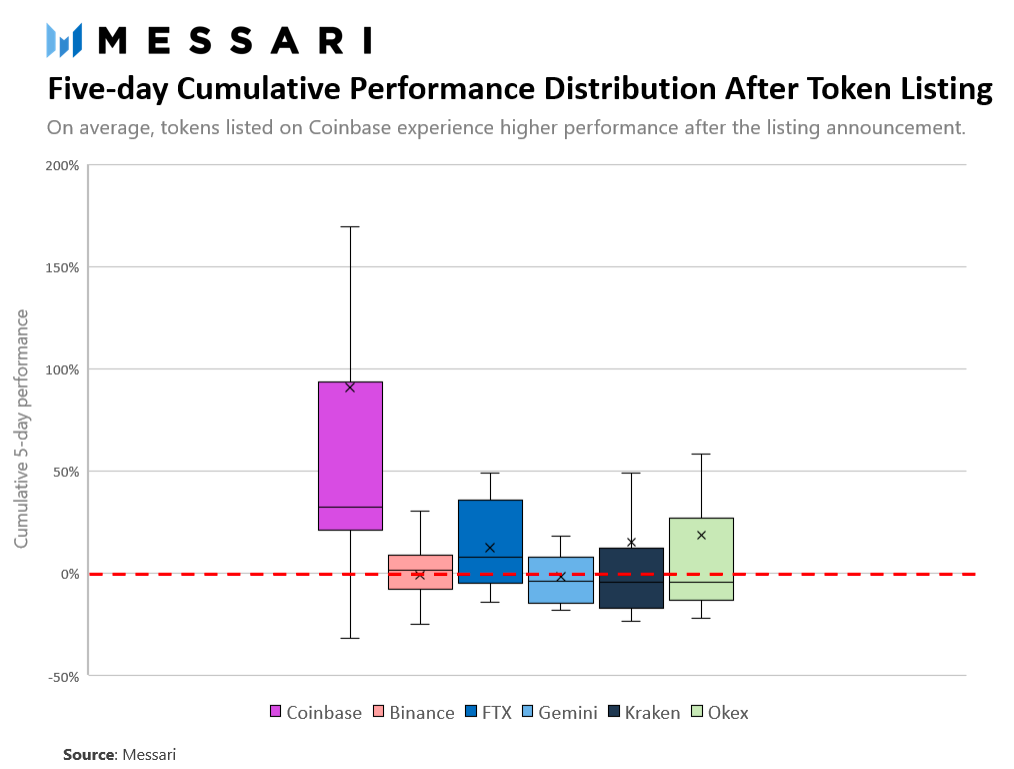

According to Messari, the ‘Coinbase Effect’ is very real, and in a five-day period, tokens enjoy an average of 91% price gain.

[caption id="" align="alignnone" width="1014"] Source: Messari[/caption]

The latest listings came less than a fortnight after the Ankr (ANKR) Curve DAO Token (CRV) and Storj (STORJ) supported on Coinbase Pro.

Before these, Coinbase also announced support for Polygon (MATIC), SushiSwap (SUSHI), SKALE Network (SKL), and tons of DeFi tokens that have been recently listed on the platform.

Coinbase continues to list more and more DeFi tokens and invest in the projects of the sector, such as Compound, ahead of going public on Nasdaq under the ticker “COIN” next week.

“A cryptocurrency exchange going public on the US stock market is a historic moment for the entire industry, and we are overjoyed to be a part of this movement that will further increase adoption of cryptocurrency and blockchain technologies,” stated the Origin Protocol team.

In its prospectus filing with the SEC, Coinbase had mentioned decentralized applications, DeFi, yield farming, staking, token wrapping, and governance tokens as a risk factor in terms of disruptive products.

Source: Messari[/caption]

The latest listings came less than a fortnight after the Ankr (ANKR) Curve DAO Token (CRV) and Storj (STORJ) supported on Coinbase Pro.

Before these, Coinbase also announced support for Polygon (MATIC), SushiSwap (SUSHI), SKALE Network (SKL), and tons of DeFi tokens that have been recently listed on the platform.

Coinbase continues to list more and more DeFi tokens and invest in the projects of the sector, such as Compound, ahead of going public on Nasdaq under the ticker “COIN” next week.

“A cryptocurrency exchange going public on the US stock market is a historic moment for the entire industry, and we are overjoyed to be a part of this movement that will further increase adoption of cryptocurrency and blockchain technologies,” stated the Origin Protocol team.

In its prospectus filing with the SEC, Coinbase had mentioned decentralized applications, DeFi, yield farming, staking, token wrapping, and governance tokens as a risk factor in terms of disruptive products.

“If we cannot keep pace with rapid industry changes to provide new and innovative products and services, the use of our products and services and, consequently, our revenue could decline, and our business, operating results, and financial condition could be adversely impacted."

bitcoinexchangeguide.com

bitcoinexchangeguide.com