Data analytics provider CryptoCompare has published its latest exchange review; a monthly report intended to capture the cryptocurrency exchange market’s critical developments.

The report does this by examining monthly trends in exchange volume and assessing exchanges based on spot 24-hour volume, derivatives volumes, and pricing data. The October edition featured three key findings.

First, the report found that “OKEx had the highest open interest across all derivatives products ($1.56 billion) in October.” The upshot being, institutional open interest remains high, with $0.82 billion on the Chicago Mercantile Exchange (CME).

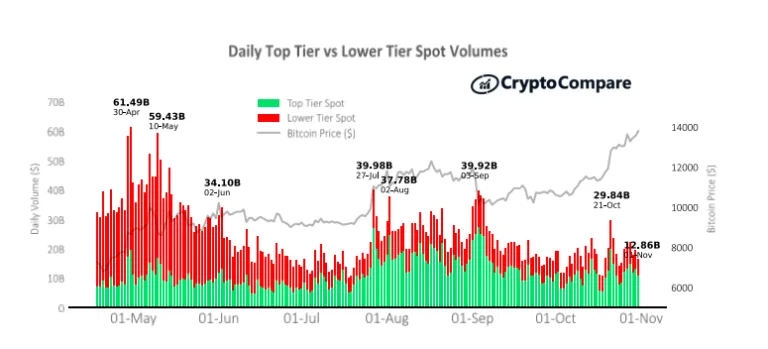

Second, “large decreases in monthly spot trading volumes were seen on top-tier exchanges.” Binance maintained its position as the largest exchange by volume in October, reporting a trading volume of $75.7 billion, down 33.1% from the previous month.

This was followed by Huobi Global trading $41.7 billion and OKEx trading $32.1 billion.

Third, “monthly derivatives volumes remained relatively stable throughout October while spot volumes decreased more significantly.”

Despite Bitcoin surging above $13,000 towards the end of the month, trading activity across all spot markets throughout October fell considerably compared to September. All told, spot volumes dropped by 17.6% during October.

Meanwhile, derivatives volumes decreased by just 2.4% during the month to $619.9 billion. The report touched on several other issues; the full version can be downloaded here.

beincrypto.com

beincrypto.com