Founded all the way back in 2013, Huobi Group is one of the leading blockchain companies in the industry.

It’s safe to say that the company has come a long way since then and it’s currently offering a variety of services for its wide user base. Employing people globally, Huobi offers a myriad of crypto-related services, including digital asset trading, wallet, mining pool, incubation, research, proprietary investment, and so forth.

Cryptocurrency trading has surged in interest throughout the past few years and exchanges such as Huobi have worked hard to expand their offerings. Derivatives products, apart from traditional spot trading, have exploded in interest, and Huobi is doing its best to accommodate.

Among its popular trading products are the futures, perpetual swaps, and options platforms. In this guide, we will take a closer look at how these tools operate and provide a step-by-step explanation of how to use them.

Quick Navigation:

- How to Register on Huobi

- How to Deposit and Withdraw

- How to Trade Bitcoin Options

- How to Trade Bitcoin Futures on Huobi

- How to Trade Bitcoin Perpetual Swaps

- Customer Support

- Security: Is it Safe to Trade on Huobi Futures?

- Trading Fees

Pros

- Simplified trading interface with a variety of features, veteran exchange

- One stop shop for trading futures, options, and perpetual swaps

- An abundance of trading pairs to choose from

Cons

- Limited assets for perpetual swap trading

- Verification is mandatory for Huobi Futures

How to Register on Huobi?

Before anything else, however, you’d first have to register for an account. The process is fairly simple. There’s no mandatory Know-Your-Customer (KYC) procedure for spot trading, but if you want to start using the derivatives platforms, the ID verification is obligatory.

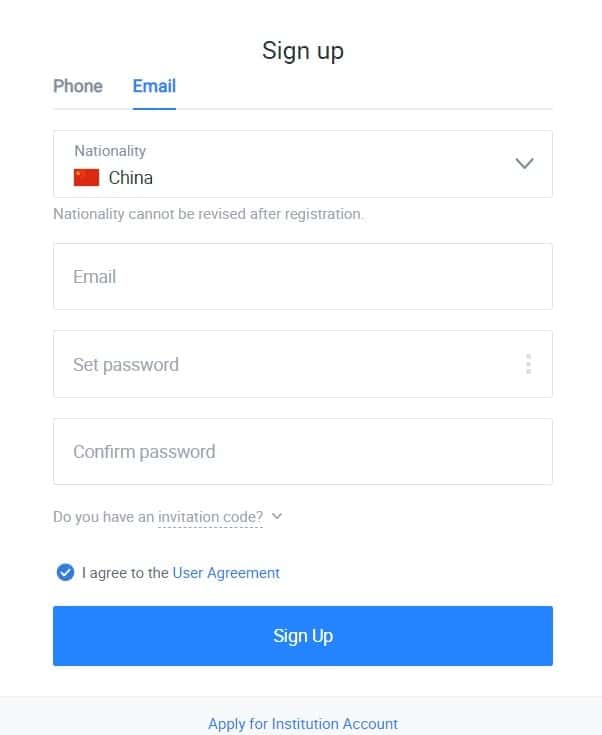

This is how the registration screen looks like:

All that is needed here is an email address that has to be verified through a verification code later on.

Once you have your account opened, it’s highly recommended to take a few additional security steps. First, it’s important to enable the Two-Factor Authentication (2FA), using the Google Authenticator app.

In addition, Huobi has taken a few extra steps that protect your account in the event of it being hacked such as email verification codes, phone verification codes, a designated fund password to ensure fiat asset security, and so forth.

If you want to trade on the derivatives platform, you’d have to go through an additional ID verification step which requires you to input your names, a government-issued passport, driving license or ID number, and upload a picture of it.

We’ve completed all the steps and, in our experience, the process was seamless and the KYC took no more than a few minutes to be completed and approved by Huobi’s team.

How to Deposit and Withdraw Funds?

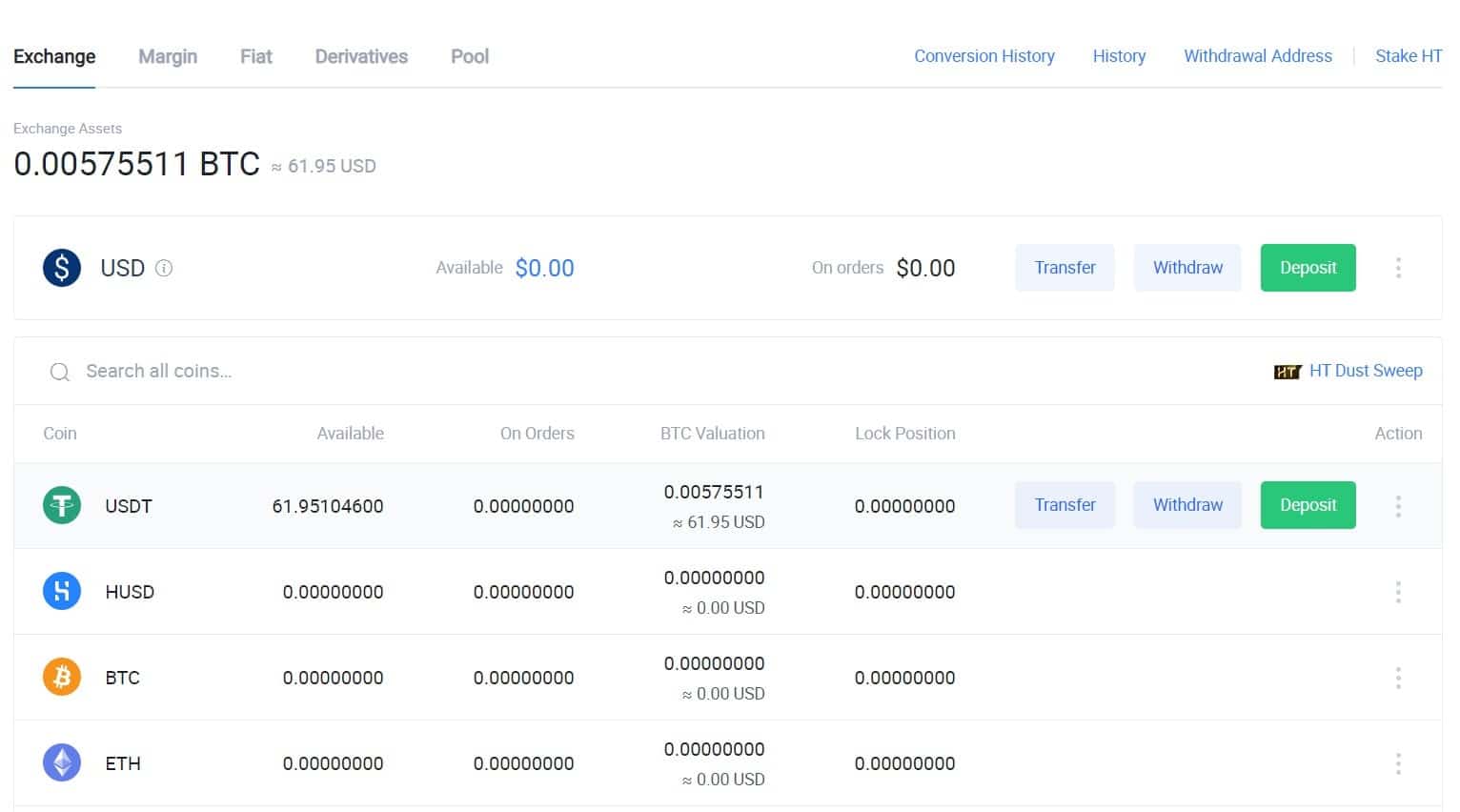

Now that you have your account set up, it’s time to load it with some funds. Depositing is fairly straightforward and users can choose between a myriad of cryptocurrencies, including Bitcoin, ETH, USDT, and many others.

From the top navigation bar, you need to hover over “Balances” and choose the account you wish to fund. Regardless of where you deposit initially, you can easily transfer the funds between the accounts – it’s instant.

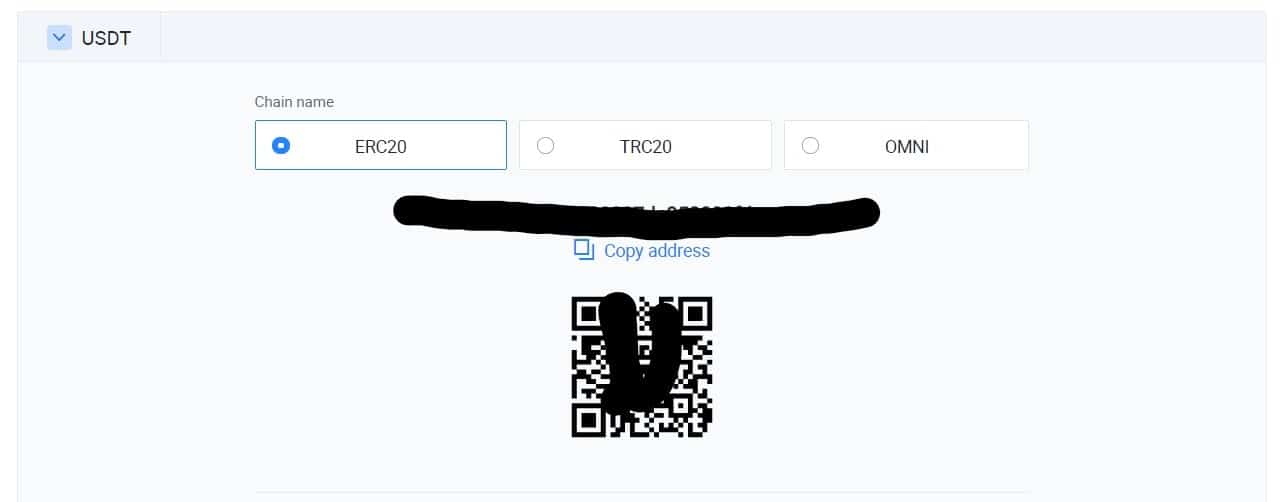

After you select the cryptocurrency you want to deposit, all you need to do is click on the “deposit” button, which will pull up this screen. In this case, we’ve deposited the stablecoin USDT.

In any case, regardless of the cryptocurrency you deposit, make sure to correctly select the transaction network (when applicable) – in our case, we used USDT on Ethereum’s ERC-20 standard.

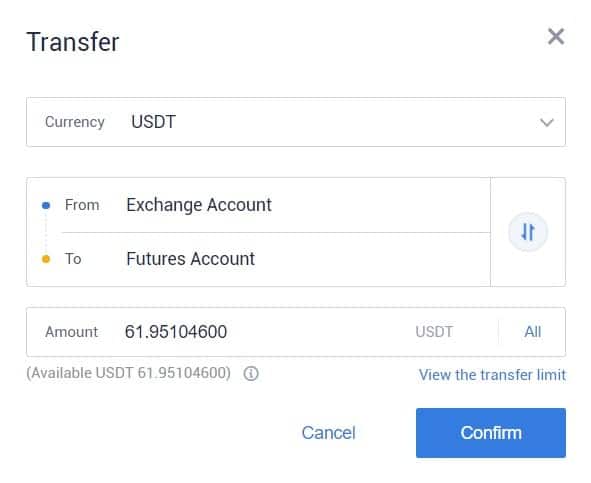

From here, you can make quick, zero-fees transfers between the different internal accounts and fund your derivatives one. All you need to do is open the account, select the currency that you want to transfer, specify the amount, and confirm the operation:

Once this is done, you are ready to begin using the offered derivatives products. Let’s have a look at all of them.

How to Trade Bitcoin Options on Huobi?

Options contracts are one of the most popular derivatives, used constantly in traditional finance. Lately, there’s a huge demand for cryptocurrency options as well. However, keep in mind, derivatives and options are not recommended for beginners as they carry more risk.

Huobi Futures has a dedicated options platform where currently users can trade both Bitcoin and Ethereum options. In this guide, we will focus on Bitcoin.

By definition, an options contract represents an agreement between two parties to facilitate a transaction on the underlying asset (in this case – Bitcoin/USDT index), at a preset price (known as the Strike Price), prior to the expiration date.

Purchasing a CALL option means that the buyer has the right to buy BTC corresponding to the contract face value at the strike price. On the other hand, a PUT option means that the buyer has the right to sell BTC under the same conditions.

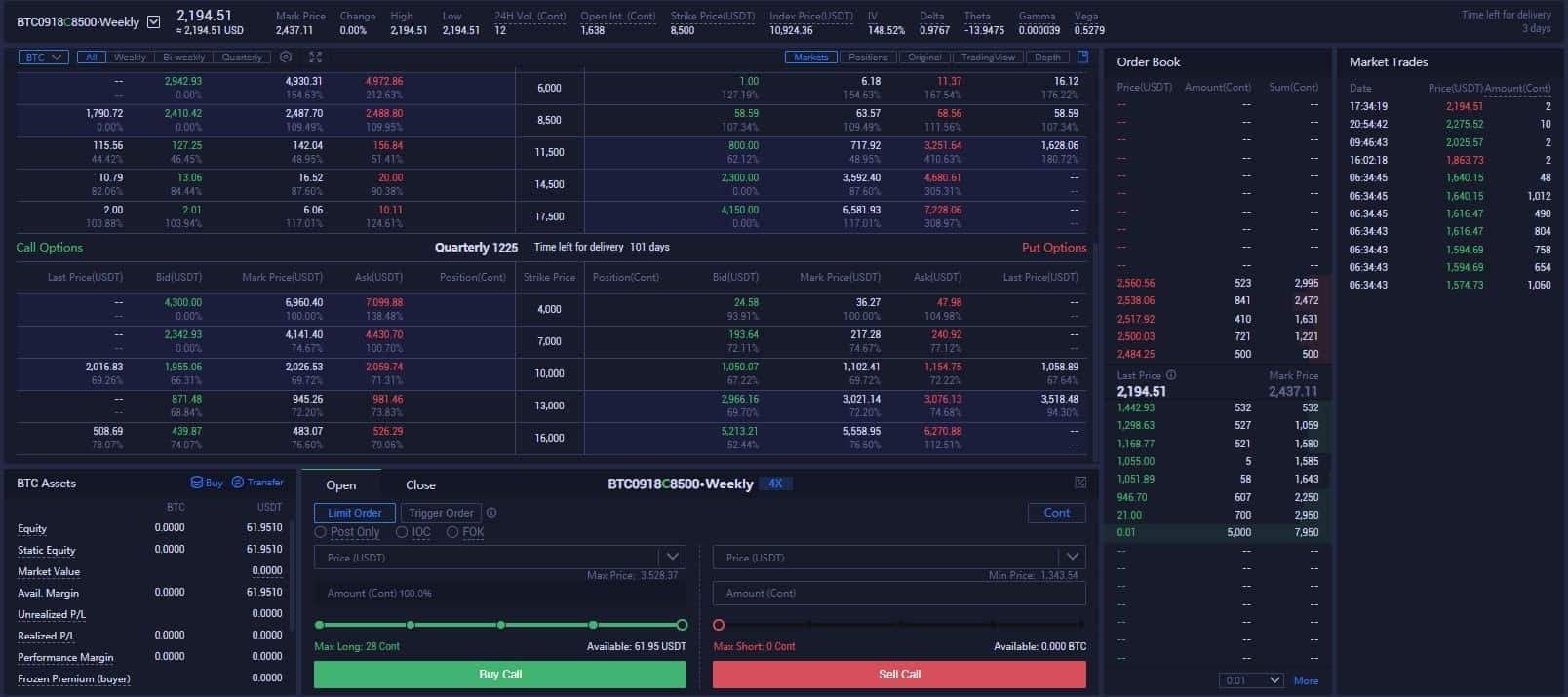

In the below example, we will show how you can buy a CALL contract on Bitcoin and all the necessary details. First, when you land on the Huobi Options trading platform, that’s what you will see:

In the top left corner is where you select the type of Bitcoin options contract you want to trade with. For this example, we’ve used the Weekly BTC contract with a strike price of $8,500 and expiry on September 18th, and a leverage level of 5x.

Below is the board where you can monitor the prices for the different contracts based on their strike price factor.

As can be seen in this example, our contract costs around $2,400 to buy (bid). Huobi uses a system where traders can open positions based on contracts, where one BTC options contract equals 0.001 BTC or about $10 at current rates, as of writing this guide.

The par-value for a contract of ETH option equals 0.01 ETH, or about $3 at current rates. Unlike other margin exchanges, users can join options trading on Huobi with fairly low entry barriers.

Now, let’s see how to open a CALL position, as we assume the price of Bitcoin will close above the strike price of $8,500 on September 18th.

From the order menu, we’ve selected a price that we want to buy the contract at – it’s $2414 and the number of Contracts that we want to purchase, in this case, it’s the maximum amount of 25 contracts, which is about $250.

As soon as we hit the Buy Call button, our Limit order will be placed and when the Mark price of the contract reaches it, the order will be executed and we will have 25 Contracts ($10 each) giving us the right to buy Bitcoin at $8,500 (strike price) when the contract expires on September 18th.

If the price of Bitcoin is above $8,500, we will realize a profit, if it’s below that, we will lose the options premium.

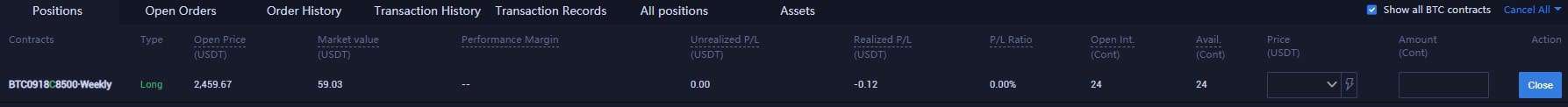

Below is our open position – we managed to get in at a price of $2,459 – and we got 24 contracts open. Below the order box is where you can track your positions and their performance.

If you want to close the position, you can specify the price at which you want to close and the overall amount of your position that you want to close.

Now, in this example, we’ve only shown how to buy a CALL option for Bitcoin, but users can also buy PUT options and they can sell contracts as well. For detailed information on how to do those operations, you can check the official guide.

How to Trade Bitcoin Futures on Huobi?

Moving on, Bitcoin futures are also available on Huobi. Here, users can buy these contracts and speculate on whether or not the price of Bitcoin will be above or below the current price on a pre-set date.

From the left pane, users can choose from a verity of the over 60 cryptocurrencies and the available futures contracts. For Bitcoin, Huobi offers weekly, bi-weekly, quarterly, and bi-quarterly contracts, and supports leverage up to 125x.

Basically, if you believe that the price of Bitcoin will be higher than the current price at the expiration date of a given contract, you should open a long (buy) position. If you think it’s going to be lower, you should open a short (sell) position.

How to Trade Bitcoin Perpetual Swaps

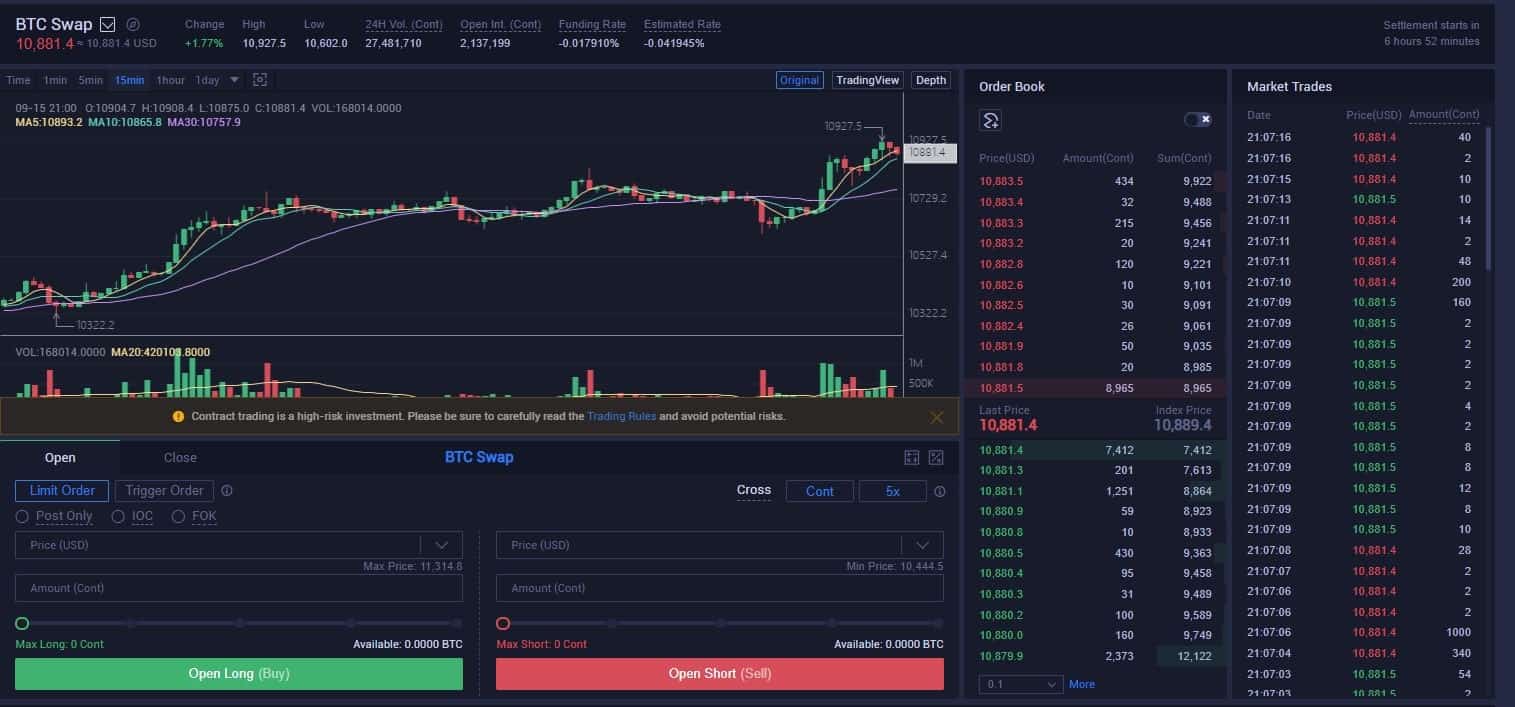

Perpetual swaps are probably the most popular cryptocurrency derivative instrument. They are like traditional futures with the exception that they don’t have an expiry date. In other words, traders can open and close them whenever they want to.

It’s worth noting that Huobi even offers USDT/USD perpetual swaps with leverage of 1X -1000X, becoming the industry pioneer in USDT derivatives.

Besides, for the non-stablecoins, traders can use perpetual swaps with extremely high leverage of up to 125X for BTC swaps and 75X for other swaps. In other words, you can open a position worth 125 times the amount you have in your account.

Huobi Futures offers different leverages such as 1x, 3x,5x,20x, 125x, and even 1000x. Users can choose freely according to their needs.

While this brings opportunities for big profits, please be aware that it’s also extremely risky as the slightest movement in the opposite direction of your position can liquidate your position, causing you to lose your capital. Using high leverage is definitely not recommended for inexperienced traders.

Customer Support

Huobi’s overall customer support is very satisfying. From our test experience, the team is very responsive and easy to communicate with.

Elsewhere, the KYC verification process is particularly quick. After we submitted the documents needed for the identity verification, the team took no more than a few minutes to have them checked and approved the account for trading.

Security: Is it Safe to Trade on Huobi Futures?

Huobi is one of the largest cryptocurrency exchanges in the world. It’s an established company with thousands of employees. While it’s never recommended to keep a large amount of crypto in an exchange, Huobi is regarded as being very safe to use.

The team has also added a myriad of additional security features that users can opt in to further protect their accounts. Of course, you should also beware of scam artists and phishing attacks.

Trading Fees on Huobi

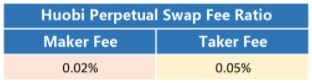

When it comes to the trading fees, Huobi has various fees on its platforms, so let’s have a look at a detailed breakdown for individual traders:

- Futures Trading Fees

- Huobi Perpetual Swaps Trading Fees

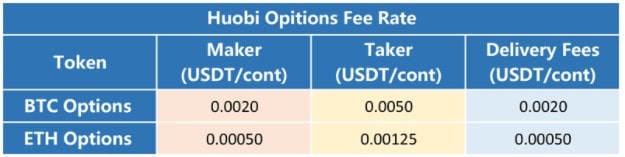

- Huobi Options Trading Fees

It’s also worth mentioning that Huobi Futures also provides VIP Sharing Program and Market Maker Program to lower big user’s switching costs to Huobi. For example, Huobi options maker fee rebate is as high as 0.003 USDT per contract.

Conclusion

In general, Huobi is one of the most reputable exchanges out there and they live up to the statements. The customer support is quick and easy to communicate with, the exchange offers a range of different tools to accommodate the needs of various traders.

Their Bitcoin Options trading platform is convenient, rather intuitive, and easy to work with. There’s a range of different contracts with various leverage options and expiration dates.

cryptopotato.com

cryptopotato.com