As yield farmers scramble to deposit their crypto collateral in the latest and greatest thing in DeFi, volumes on the Uniswap DEX have surged to record levels. The milestone was noted by Ethereum developer and Uniswap creator, Hayden Adams.

🤯 Wow, @UniswapProtocol 24hr trading volume is higher than @coinbase for the first time ever

🦄 Uniswap: $426M

🏦 Coinbase: $348MHard to express with how crazy this is. pic.twitter.com/48o0xRkiUo

— Hayden Adams 🦄 (@haydenzadams) August 30, 2020

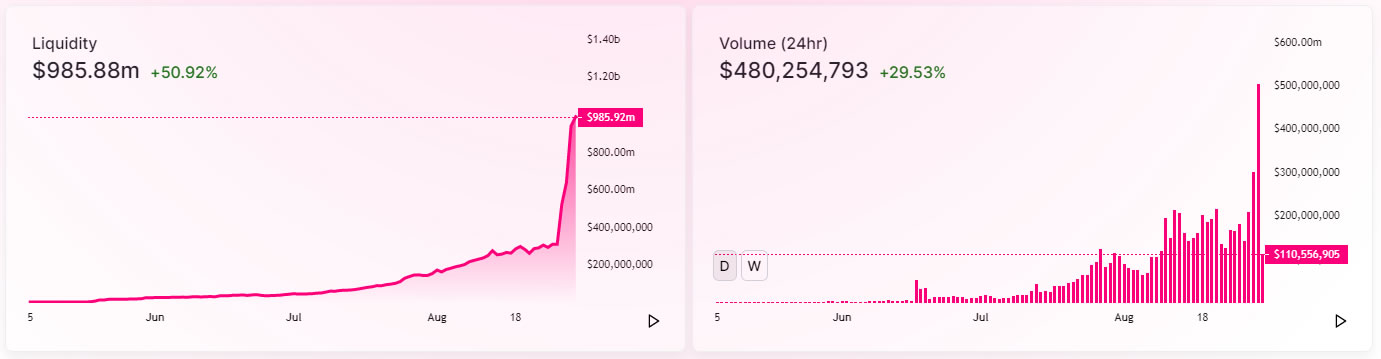

According to the snapshot, Uniswap was trading about 20% more in terms of 24-hour volume than Coinbase. At the time of writing, Uniswap.info was reporting a daily volume of $480 million, with almost a billion dollars in liquidity.

The wrapped Ethereum market was the highest source of this volume with stablecoins Tether, Dai, and USDC following. Uniswap essentially allows users to swap tokens or supply liquidity to various pools to earn a portion of the 0.3% fee it charges per trade.

Some of the responses questioned the surging numbers as network fees are also off the chart at the moment, making smaller transactions completely unfeasible. This lends itself to the premise that only whales can make money with DeFi at the moment.

Is SushiSwap Eating Uniswap?

The surge in Uniswap volume has been catalyzed by a forked version called SushiSwap, which is offering greater rewards for liquidity providers.

As reported by CryptoPotato over the weekend, SushiSwap claims to have built upon the Uniswap system by offering SUSHI tokens. These entitle users to continue earning a portion of the protocol’s fee regardless of whether liquidity is still being provided or not.

According to a Sushi analytics dashboard, the TVL on the protocol had surpassed $675 million, which has effectively leeched 68% of Uniswap’s liquidity.

facts:

in ~16 hours, @SushiSwap has 53% of @UniswapProtocol‘s liquidity

if SushiSwap AUM grows,

and if SushiSwap cooks dont pull out their LP shares for the transitionin 2 weeks time, SushiSwap will be larger than Uniswap, for its most high volume pairs pic.twitter.com/OXc9flOuLX

— 찌 G 跻 じ ⚡️ 🔑 (@DegenSpartan) August 29, 2020

Once 100,000 ETH blocks are mined, which will take around two weeks, the platform aims to migrate this liquidity into its smart contracts and pools.

CoinGecko is reporting a token price of $3.34 for SUSHI at the time of writing, an increase of 110% over the past 24 hours. If Uniswap doesn’t want to see all of its liquidity leeched away, it may need to seriously consider increasing its rewards to collateral providers.

cryptopotato.com

cryptopotato.com