Damaged depositors to the embattled crypto exchange FTX, who face an uphill court battle to recover at least some of their hostaged funds, can sell their credit claims, but they’ll retrieve only a fraction of their holdings.

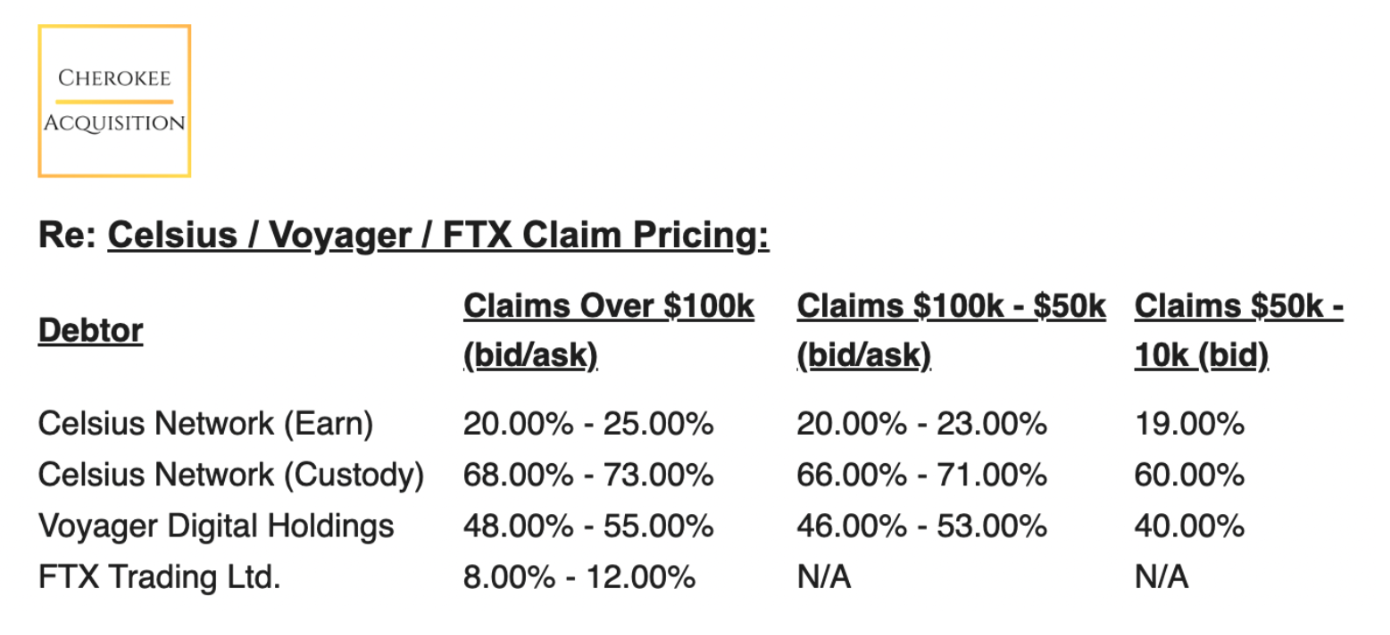

Cherokee Acquisition, a distressed asset investment firm that also has a marketplace for credit claims against bankrupt firms, put a guide price of 8 to 12 cents on a dollar for FTX users' deposit claims over $100,000 in the latest price table sent out Tuesday.

When a firm files for Chapter 11 bankruptcy protection as FTX did last Friday or declares bankruptcy, creditors who choose not to wait until the resolution of a lengthy bankruptcy proceeding to recover some or all their assets may sell their credit claims to distressed asset investment companies.

The relatively low prices for FTX claims suggest that the probability for FTX users to reclaim their funds is diminished.

By comparison, Earn account holders of bankrupt crypto lender Celsius Network may receive around 20 cents on a dollar after selling their claims, while creditors of Voyager Digital, the crypto brokerage platform that was auctioned off to FTX, may recover 40 cents on a dollar for their claims.

Even this depressed price tag might turn out to be too high for potential buyers, Thomas Braziel, managing partner at distressed corporate specialist 507 Capital, told CoinDesk.

“No one is buying them” at that price, he said. A more realistic market price for deposit claims, he argued, would be closer to 3 to 5 cents.

Table of bidding for crypto bankruptcy-related claims. (Cherokee Acquisition)

FTX, part of Sam Bankman-Fried’s crypto conglomerate of more than 130 firms, filed for bankruptcy protection Friday after it illegally used customer deposits for lending and investing and a bank run uncovered a $10 billion hole in its balance sheet. Countless users, including large trading firms such as Genesis Trading, Galois Capital and Ikigai Asset Management, left with their funds stuck on the platform.

Last week, users created impromptu Telegram chat groups to sell their hostaged deposits on the exchange after FTX first froze withdrawals a week ago.

coindesk.com

coindesk.com