Sam Bankman-Fried of the suddenly-ailing FTX exchange has insisted repeatedly that FTX US – a U.S.-based crypto exchange – is a separate legal entity, insulated from its own financial troubles. Some traders with balances on FTX US took no chances.

Prominent crypto trading firm Wintermute says it stopped trading and market-making operations on FTX US soon before FTX halted withdrawals on Tuesday, spokespersons for FTX US and Wintermute told CoinDesk.

The London-based trading firm also moved all its funds from FTX US, according to a Wintermute spokesperson.

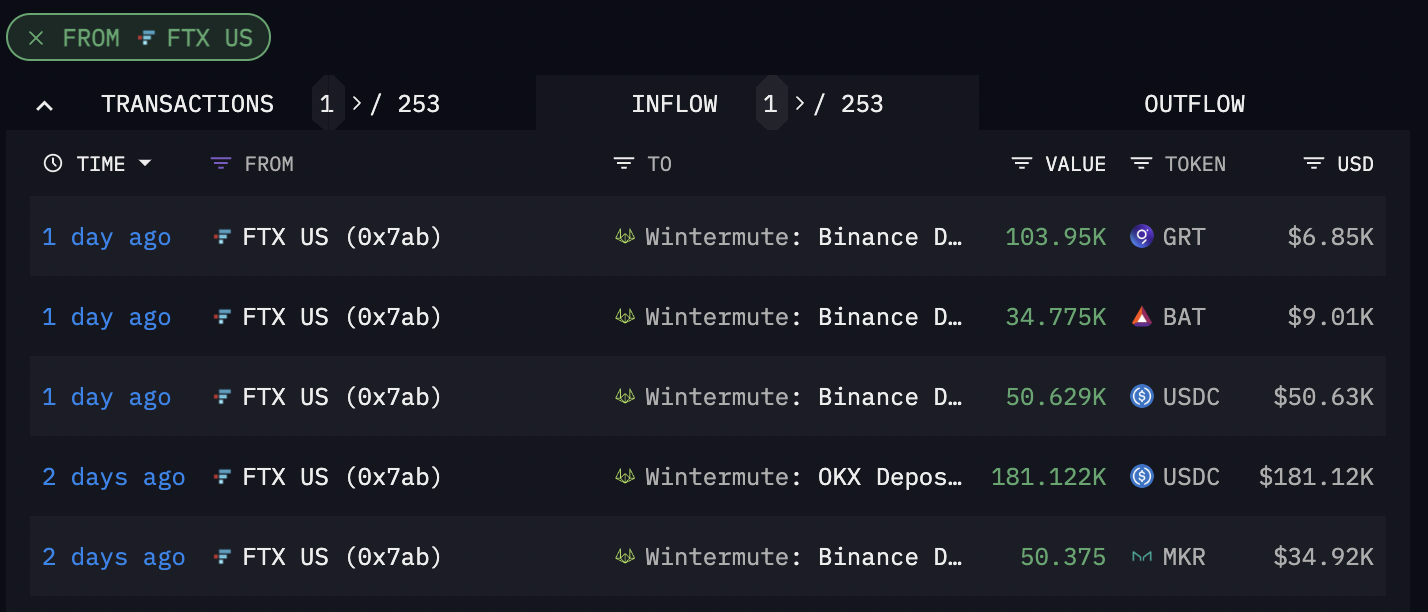

Blockchain data shows that Wintermute diligently moved stablecoins and multiple altcoins off FTX US and deposited them to other crypto exchanges such as Binance and Coinbase in the last few days up until Nov. 9.

In an earlier announcement, Wintermute said that it halted trading on FTX and withdrew funds to minimize its exposure to the ailing exchange, although some of its funds are still stuck on the exchange.

"We treated FTX and FTX US in a similar way and stopped trading on both," Marina Gurevich, COO of Wintermute, wrote in an email.

Blockchain data shows that Wintermute’s last withdrawal came one day before FTX.US’s warning about the possibility of halting trading. (Arkham Intelligence)

Wintermute’s early move is significant because market makers are essential for any exchange to work efficiently. They trade assets in large volumes to provide liquidity and facilitate match-making between buyers and sellers.

The trading firm was one of the largest market makers on FTX US. According to blockchain crypto intelligence platform Arkham Intelligence, it was the second largest trading firm by deposit and withdrawal size on FTX US after the trading shop Alameda Research, the corporate sibling of FTX.

Wintermute’s departure from the exchange came before FTX US issued a warning Thursday that “trading might be halted in a few days,” despite Bankman-Fried’s assertion that it was “100% liquid” and not financially impacted” by the global FTX exchange’s liquidity problems. In the same thread, he announced that Alameda, the largest market maker on FTX US, would be winding down.

Read more: Divisions in Sam Bankman-Fried’s Crypto Empire Blur on His Trading Titan Alameda’s Balance Sheet

coindesk.com

coindesk.com