Amidst the fervor of Bitcoin [BTC] readying itself to breach the $9,000 mark, a notable exchange has seen the king coin’s price backtrack. Touted as one of the nine exchanges with “real volume” by several research firms, Kraken saw the price of Bitcoin drop by 98 percent to lows unseen since 2013.

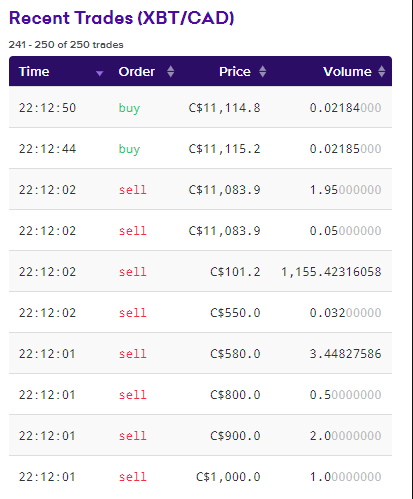

The one-day Bitcoin chart as seen on June 2 saw its wick as low as $101.2 Canadian Dollars [CAD] on the San Francisco-based exchange.

Source: Twitter

According to a Reddit thread discussing the same, a trader or a trading bot may have mistakenly sold over 1,100 BTC [$9.94 billion] for $101.2 CAD, each triggering a massive change in the order book of the exchange. Despite such a massive movement, the thread called into question the exchange’s software that should have limit checks in place to catch such movement.

Reddit user, dooglus, detailed the ordeal explaining,

“Someone placed a sell order of over 1160 BTC at a price below $101.20. The exchange works its way through the orderbook matching the highest bids first. You can’t sell BTC for $100 if someone is offering $200 per coin – you get the best price available. That’s why you see the trade at $900 before the trade at $800, etc. Someone had a big bid at $101.20 which wasn’t entirely filled by the large dump.”

Another user, bell2366, criticized the exchange’s software, stating,

“Just shows how unsophisticated Kraken’s exchange software is. Allowing an order like that through.”

Kraken and the fluctuating price of Bitcoin has been a persistent affair for a few months now, with several notable players in the cryptocurrency space taking aim at the exchange for this. Some have even equated this to “price manipulation.”

Source: Imgur

This is not the first time Kraken has been called out for showing a vastly divergent Bitcoin price, with members of the crypto-community stating that this is “the 3rd flash crash on Kraken in less than 6 months.” Further, some analysts even equated this crash to “price manipulation” by the exchange, tweaking orders for “its [Kraken’s] own financial benefit.”

Back when the Bitfinex-Tether fiasco broke out, the price of Bitcoin declined from $5,800 to $5,200 in less than a day. Interestingly, prior to the news being published, Bitcoin dropped below $5,000 on Kraken, triggering rumors that insider information had led to BTC’s drop on the San Francisco-based exchange.

Last week, veteran cryptocurrency trader and analyst Peter Brandt scored Kraken an “F-,” questioning the exchange’s “order” and “liquidity,” as the 1-hour chart showed the wick dropping down to $8,000, while the larger market had the king coin trading well over $8,700. Following this episode, some crypto-proponents opined that “dirty spillage” occurred on Kraken’s “illiquid book,” leading to this obscure market movement, in stark contrast to the collective market.

Commenting on last week’s price drop, Jesse Powell, CEO of the exchange had stated,

“I think the community has already answered but what keeps us from trading against/front running our own clients is 1. It’s bad for business 2. It’s immoral. An orderly market is one that does not prevent you from making the trade you want to make. We welcome government liquidity.”

However at press time, Powell had not addressed the recent incident of Bitcoin dropping to $101.2 CAD. Additionally, AMBCrypto has contacted the exchange for a comment on the matter and is awaiting its reply.

ambcrypto.com

ambcrypto.com