(CoinDesk Research, Arkham Intelligence and CoinGecko)

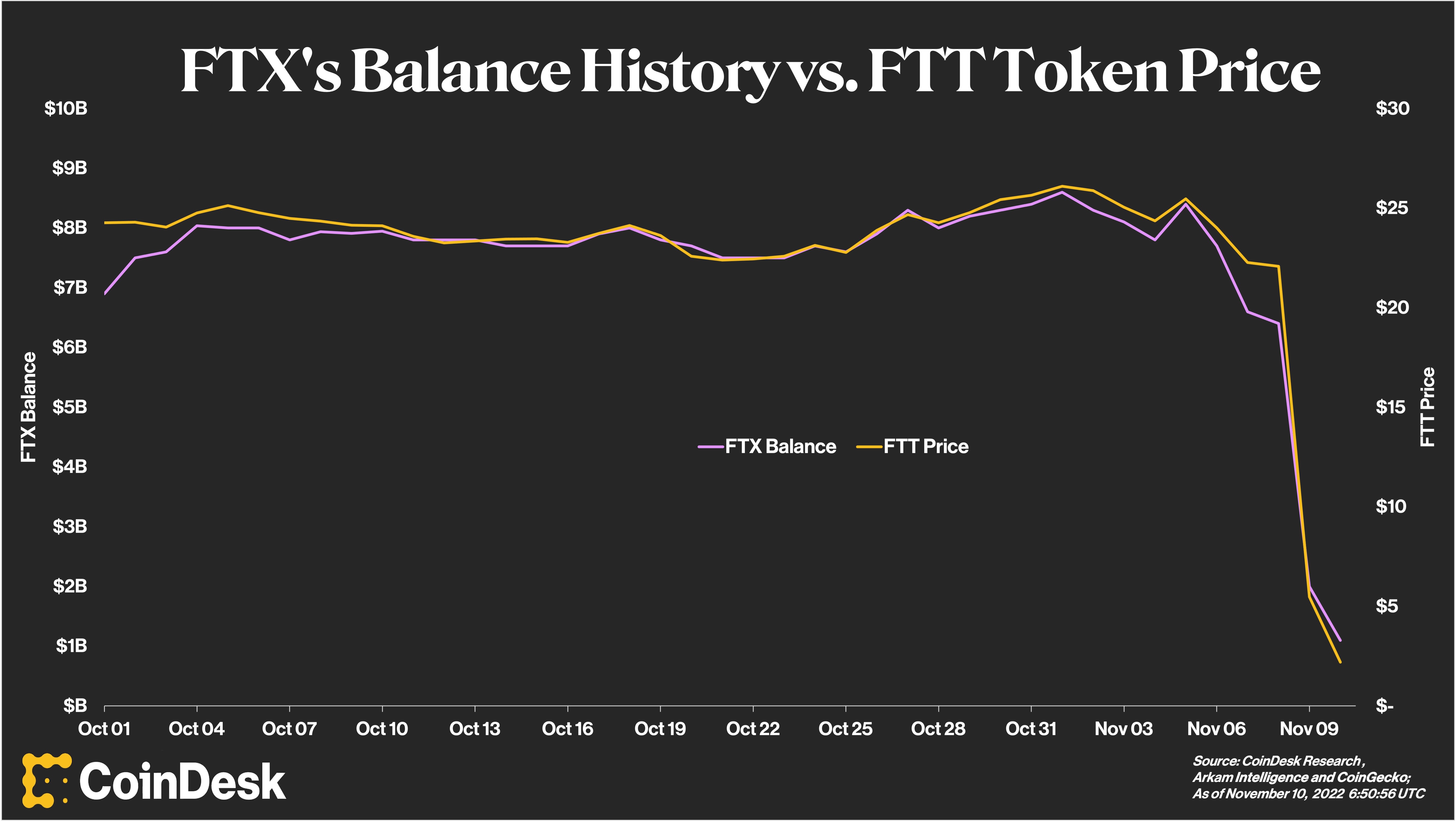

Withdrawals from the FTX crypto exchange were so rapid and vicious that the overall balance of digital assets on the venue has tumbled 87% over the past five days, data shows.

The blockchain-era version of an epic bank run culminated Nov. 8 when the exchange led by Sam Bankman-Fried announced a halt to withdrawals. (On Thursday there were fresh reports that some withdrawal requests were suddenly getting processed, though some Twitter posters wrote that they have since been shut off.)

The data, from Arkham Intelligence, might be a conservative estimate of FTX’s balance history, since there may be wallet addresses that haven’t been disclosed to the public.

FTX’s average total balances between Oct. 1 and Nov. 4 was $7.9 billion, and stood at $8.4 billion as of Nov. 5, Arkham data shows. The balances then dropped considerably to $1.1 billion as of Nov. 10.

The rush for the exits coincided with a steep plunge in the price of the FTX’s in-house exchange token, FTT.

From Oct. 1 through Nov. 4, the FTT price ranged from a lower bound of $22 and an upper bound of $26. Then all of a sudden, the floor fell out: FTT had sunk to about $2 as of press time.

Bankman-Fried (SBF) tweeted Thursday that FTX “saw roughly $5b of withdrawals on Sunday.”

The immense scope of this black swan-style event serves as a key reminder of just how rapidly confidence can erode in the parallel financial universe of digital assets – where there are no central banks to bail out the key players – as happened in 2008 when nearly all of Wall Street ran short of liquidity and had to turn to the Federal Reserve for emergency funding.

coindesk.com

coindesk.com