You might also like

Ex-FBI Special Agent Says Mango’s $114M Exploit Was Market Manipulation, Not A Hack

Nearly 80% Of El Salvador’s Population Believes Making Bitcoin Legal Tender Is A Failure

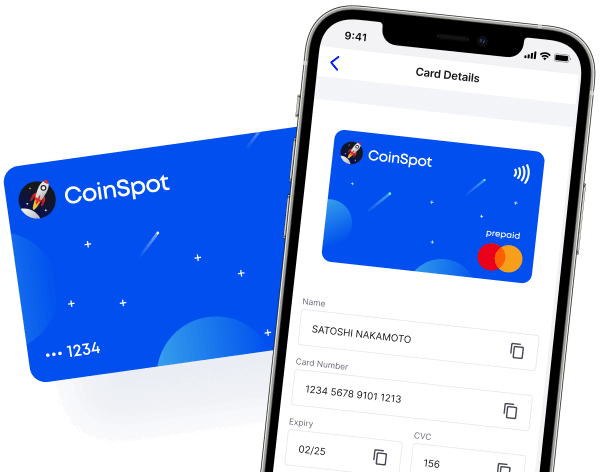

The largest and most trusted Australia-based crypto exchange CoinSpot has officially released its new crypto-backed Mastercard. The launch comes soon after CoinSpot became the first crypto exchange in the land Down Under to complete an external statutory financial audit that manifests its commitment to security and transparency.

CoinSpot Mastercard: A New Payment Method

The prepaid CoinSpot debit card supports both Apple Pay® and Google Pay®, so customers can spend any of their crypto holdings from their mobile device.

It’s worth noting that the card is digital only, as CoinSpot explained they had no intention of introducing more plastic cards into circulation.

CoinSpot Mastercard. Image: CoinSpot

Remarkably, as various crypto cards out there are currently rewinding benefits and imposing new, prohibitive fees, the CoinSpot fee structure is highly competitive. Users don’t have to pay any ongoing, annual or activation fees except a small conversion fee of 1%.

Cardholders can only link one asset to their card at a time, but they can change their choice of crypto whenever they like or pick their favourite coins to pay.

As CoinSpot users make purchases, the crypto linked to the CoinSpot Mastercard is converted into Australian dollars (AUD) and then used to finish the transaction.

CoinSpot users can also access multiple in-app security options, such as setting up spending limits, “freezing” the card, and turning ‘on’ and ‘off’ the card. You can read our detailed CoinSpot review to learn more about this reliable exchange’s services.

No Rewards But a Broad Selection

CoinSpot virtual Mastercard doesn’t offer buybacks or rewards. Still, users can use CoinSpot Mastercard to pay in-store or online anywhere Mastercard is accepted, such as Bunnings, McDonald’s, Coles and BWS.

CoinSpots’ digital card is used to pay for stuff. Image: CoinSpot

CoinSpots’ digital card is used to pay for stuff. Image: CoinSpot

As one of the largest exchanges that supports a wide range of digital assets (370+), CoinSpot allows cardholders to select their favourite coin to pay using the CoinSpot App. In addition, users can select up to five wallets to link to their Mastercard.

Regarding the newly launched product, CoinSpot’s Chief Product Officer Gary Howells said:

“The launch of the CoinSpot Mastercard effectively makes this the easiest and most secure way to spend your cryptocurrency in Australia and around the world.”

CoinSpot’s new card is powered by EML Payments (ASX: EML), the global payment solutions platform that enables millions of Australians to use their cryptocurrency securely and conveniently.

The card release comes at a good time when crypto adoption in Australia is on the crease. According to a recent survey, Australia has the third-highest rate of crypto ownership (17.8%), with 65.2% of Australians investing in Bitcoin (BTC) and 31% of Australia’s Generation Z owning some cryptocurrencies.

EML Payments Australia CEO Rachelle St. Ledger opined about the high rates of Australian crypto adoption:

“Australia has one of the world’s highest cryptocurrency adoption rates, with 23% of all Australians owning one or more digital assets….. As cryptocurrencies move from the fringe to the early majority with industry shapers like CoinSpot, EML Payments is creating leading-edge solutions to allow crypto businesses and their users to utilise their assets in the real world with the speed, security and simplicity of traditional payment methods.”

How to Use the CoinSpot Mastercard

To be eligible for CoinSpot Mastercard, you need a fully verified account and have Two-Factor Authentication (2FA) enabled.

To use CoinSpot Mastercard, you must log into your verified account via the CoinSpot mobile app, activate your CoinSpot Mastercard, link it with the crypto wallets, and choose the cryptocurrency you want to connect to the card.

When you make a transaction using the CoinSpot Mastercard, the cryptocurrency linked to that card is instantly converted to AUD and then used to finish the transaction in real-time.

Cardholders can only assign one digital asset to the card at a time. However, you can change the connected cryptocurrency easily at any time and select up to five wallets to link to your CoinSpot Mastercard.

Inside the CoinSpot app, you can opt for various easy-to-use security options, such as card ‘freezing’, setting up spending limits and turning the card ‘on’ or ‘off’.

coinculture.com

coinculture.com