The Bitcoin Bull Run is already here. However, the bullish forces have manifested differently on virtual currency exchanges. BitFinex, one of the leading crypto exchanges, had one of the highest price differences, or premiums, of up to 6 percent compared to other leading exchanges.

Fortunately, the bullish forces are now leveling up across exchanges with premiums on BitFinex wiped out as the exchange turns out to be trading at a discount relative to other liquid ramps. With such a considerable shrinkage, the price difference of Bitcoin on BitFinex and other exchanges such as CoinBase, Kraken, Gemini, ItBit is less than or equal to $100.

The BitFinex Discount

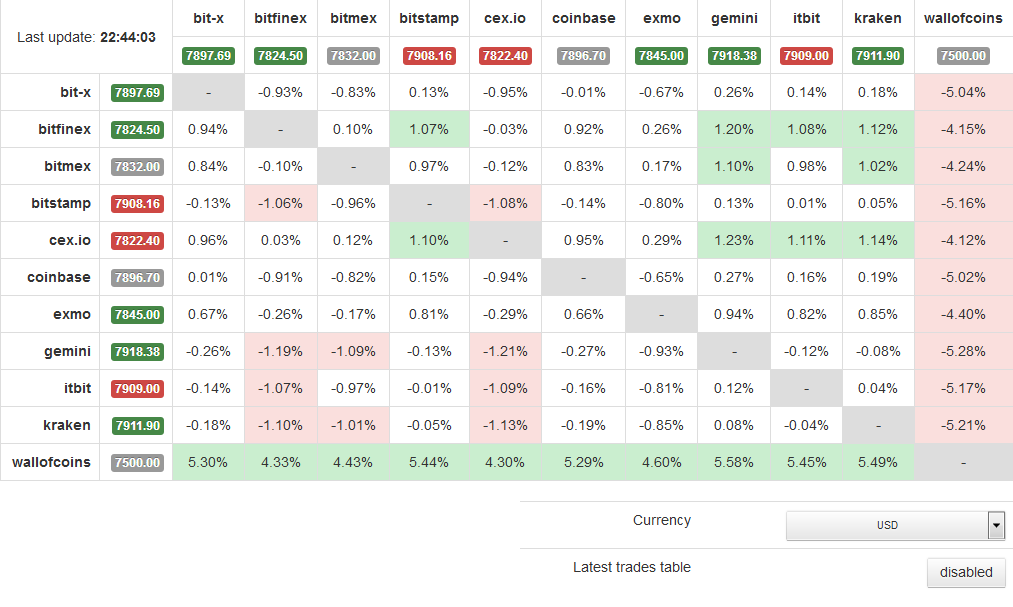

For example, a live Bitcoin markets arbitrage table provided by bitcoinity captures Bitcoin at $7800 on BitFinex while on CoinBase, Gemini, Kraken, and ItBit Bitcoin is exchanging hands at $7896, $7896, $7899, $7894 respectively. Although these prices continue to keep fluctuating independently on each exchange, the price difference is within the $100 range.

The reduction in BitFinex’s premium comes after the crypto exchange recorded massive premiums a few days ago. The trading volume on BitFinex dropped significantly earlier this month as traders were converting their USDT into cryptocurrencies and presumably taking them out of the crypto exchange.

Coincidentally, while BitFinex premium is reducing, Tether’s stablecoin (USDT) maintains its 1:1 ratio to the green back. The USDT token is trading at $1 per coin despite Tether giving away some of its reserves to cover a gaping $850 million hole on BitFinex’s financial books.

BitFinex Heavily Criticized By Crypto Analysts

As a cryptocurrency exchange that continues to immerse itself in one scandal after the other, BitFinex has been facing heavy criticism from crypto analysts. BitFinex recently indicated that it’s conducting an IEO to raise $1 billion with reports emerging that it has already netted the full $1 billion through a private sale.

We are currently in the process of conducting our first IEO. A newly formed subsidiary of iFinex, Unus Sed Leo Ltd. (USL), is selling up to 1 billion USDt of newly created LEO tokens in a private sale. To read our announcement in full, please head here – https://t.co/okIKjWnIrp

— Bitfinex (@bitfinex) May 10, 2019

However, the move to hold an initial exchange offering was met with criticism. Ran Neuner, the host of Crypto Trader at CNBC, pointed out that “this is crazy. A shareholder at BitFinex is admitting that Tether may not be backed by fiat and is now comparing it to fractional lending by the banks???”

This is crazy. A shareholder at Bitfinex is admitting that Tether may not be backed by fiat and is now comparing it to fractional lending by the banks??? pic.twitter.com/t5ncBrZWTn

— Ran NeuNer (@cryptomanran) April 26, 2019

It is with this ‘craziness’ that the crypto community is still not appreciative of BitFinex premiums falling to below half.

For instance, a Redditor noted that even if the premiums were cut by more than half, “USDT is still less than 75 percent backed.” Although the USDT: USD ratio is still at 1:1, the crypto community is flaunting an idea of jumping to other less controversial stable coins such as DAI. However, their failure to outdo USDT is still one of the major concerns. Nonetheless, amidst the falling premiums, BitFinex has reported a profit (net) of more than $400 million.