Zero-fee trading app Robinhood is set to debut on Nasdaq tomorrow, July 29, in a blockbuster initial public offering that some observers say could value the company at US$35 billion, although some have warned of risks lying ahead for the platform.

Robinhood — which offers options, equity and cryptocurrency trading services — will sell 55 million shares in a range of $38 to $42 per share.

The California-based trading app came into the spotlight earlier this year when it became the center of the GME saga, in which a group of day traders on Reddit coordinated a short squeeze on GameStop shares, causing huge losses for several hedge funds. The incident was the first major incidence of “memestocks” — shares or assets whose value is driven by a community joke or meme — which in turn led to the prominence of memecoins such as Dogecoin and Shiba Inu.

What makes Robinhood’s IPO unusual is that it is setting aside up to 35% of its shares for its customers to buy.

Robinhood CEO Vlad Tenev said earlier this week during the company’s roadshow — which took an unusual approach by livestreaming for the public to watch rather than being exclusive to institutional investors — that “we anticipate this will be one of the largest retail allocations ever,” according to Bloomberg.

However, the company’s decision to allow such a large proportion of retail investors to buy the shares has led to concerns in the industry.

“Such high allocation to retail creates more risk, and bankers tend to prefer to allocate IPO shares to institutions, which will hold shares for a long period of time,” a New Constructs research report said.

Ben Caselin, head of research at crypto exchange AAX, told Forkast.News that over the short- to mid-term, Robinhood was likely to attract significant capital and support from its retail investor base.

“Regardless of a few unfortunate moves during the GameStop saga, Robinhood has generally been able to position itself as a platform of the people,” he said.

“This also introduces new vulnerabilities to the market, where a large community of users, who are also shareholders, will be able to express discontent over platform controversies in a much more impactful way — as opposed to boycotting or bad-mouthing on Reddit,” Caselin said.

Active push into crypto

Robinhood appears determined to make a strong push into crypto trading. In the first quarter of the year, it generated 17% of its total revenue from crypto transactions, compared to just 4% for the first quarter of last year, according to a company prospectus updated on Tuesday.

In the first quarter of the year, its cryptocurrency assets under custody amounted to $11.6 billion, a robust increase from $481 million in the same period last year, according to the prospectus.

Robinhood also said in its prospectus that its daily average revenue trades for cryptocurrencies during the first quarter of the year had increased by 1,375% to $1.4 million.

“The crypto space continues to grow, despite the volatility, and is attracting a growing user base which Robinhood, along with probably every other trading platform out there, is trying to capitalize on,” Justin d’Anethan, head of exchange sales at EQONEX, told Forkast.News.

Also in the first quarter of 2021, about 34% of Robinhood’s crypto transaction-based revenue was driven by Dogecoin, compared to 4% for the fourth quarter last year.

However, risks could follow, as Dogecoin accounted for a substantial portion of the company’s crypto-related revenue.

“If demand for transactions in Dogecoin declines and is not replaced by new demand for other cryptocurrencies available for trading on our platform, our business, financial condition and results of operations could be adversely affected,” Robinhood warned in a filing.

Despite the company’s push into crypto trading, the New Constructs report said “it still pales in comparison to Coinbase’s custodial crypto assets,” which expanded to $223 billion in the first quarter of this year from $17 billion in the same period last year.

Coinbase set a benchmark for crypto firms when it went public in April, riding the wave led by Bitcoin and the overall cryptocurrency market retail and institutional boom.

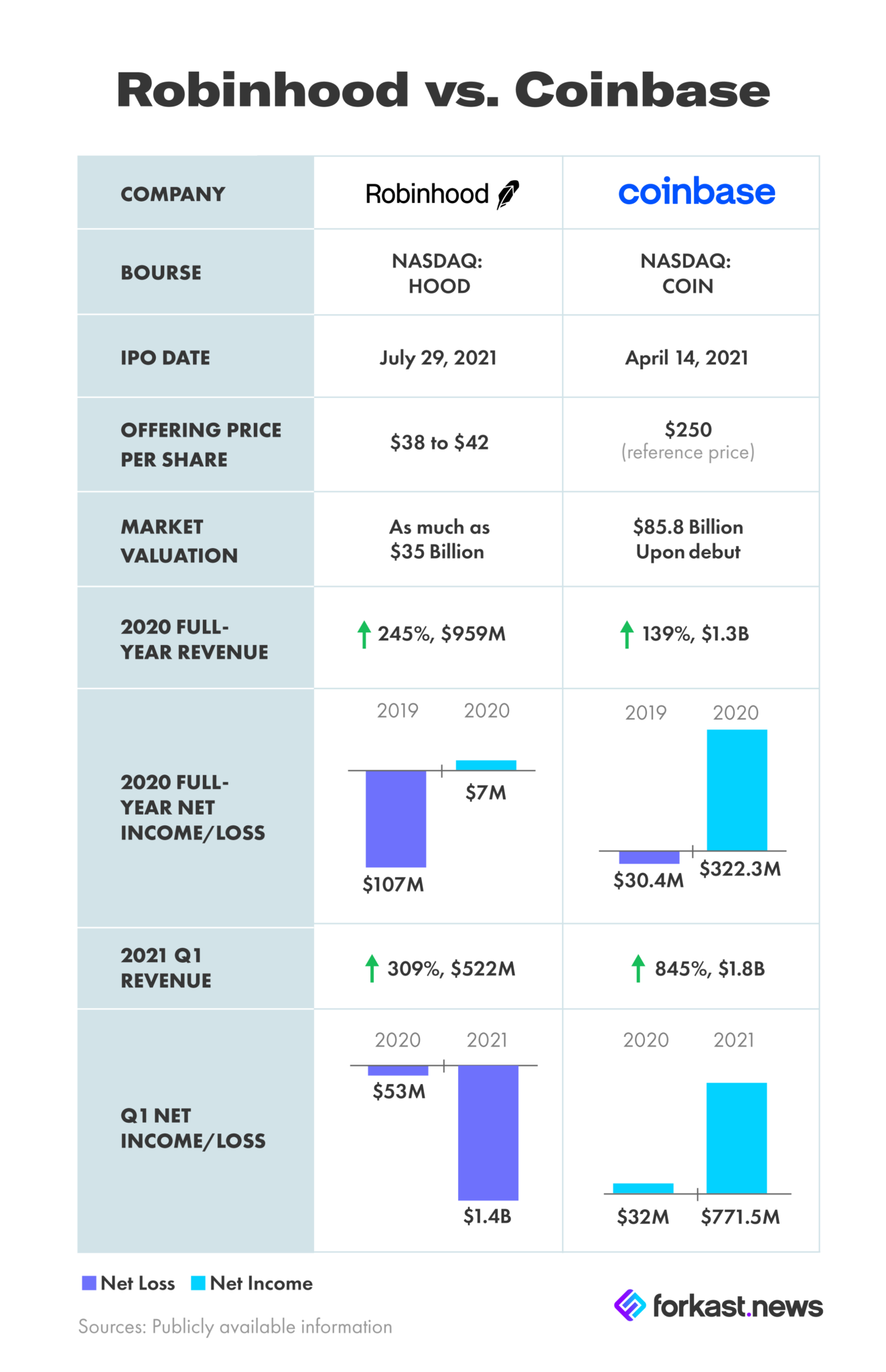

In the first quarter of the year, Robinhood booked a net loss of $1.4 billion, which included a $1.5 billion fair-value adjustment to its convertible notes and warrant liability, compared to a net loss of $53 million in the same period last year, according to its prospectus. The company’s revenue grew 309% year on year to $522 million in the first quarter of this year.

However, Robinhood was profitable last year, recording net income of $7.4 million, compared to a net loss of $106.6 million in 2019, the filing showed.

In 2020, Robinhood’s revenue increased by 245% year on year to $959 million, according to the filing.

Competition remains fierce

The company plans to use the proceeds to repay about $342.1 million that it expects to borrow, and to use the rest for working capital, expenditures and corporate purposes, including boosting its hiring efforts and customer support operations.

Although Robinhood takes pride in itself for reducing trading fees to zero, that advantage could soon fade. “This is part of a larger trend and will not remain a differentiator,” Caselin said.

Caselin added that in the crypto space, Strike CEO Jack Mallers had lowered transaction and trading fees significantly, in a direct challenge to Coinbase, which charges high fees, and that AAX also charges zero fees across all spot markets.

The New Constructs report also said that many other companies — such as PayPal and Square — already offered low-commission crypto trades.

Protecting investors

Robinhood is looking to introduce features to better protect users against the price volatility of crypto trading, according to a report by Bloomberg, based on an analysis of the platform’s code by iOS developer Steve Moser.

According to a message in the code, a new feature called “price volatility protection” says that to “protect your [customer’s] orders against price volatility, we may sometimes skip your recurring orders or buy less than your chosen amount.” This new feature is supposed to alert a customer when this has happened, and will never buy more than a user’s chosen amount.

“The cryptocurrency markets are volatile, and changes in the prices and/or trading volume of cryptocurrencies may adversely impact [Robinhood’s] growth strategy and business,” the company said in its prospectus.

Lachlan Keller and Lucas Cacioli contributed to this report.

forkast.news

forkast.news