In recent interviews, former Secretary of State Hillary Clinton has been claiming that an increase in the use of Bitcoin will take power away from the US and hand it to Russia and China. Although an increase in the prominence of Bitcoin could weaken the US dollar’s status as the world’s reserve currency, it is not as clear-cut if this would translate to more influence for China and Russia.

Invoking Russia to Tackle Crypto

The Clinton campaign from 2016 has maintained its argument that the election suffered from Russian interference. This may be a possible reason for Clinton seeking to create cold war-style “red-menace” fear around Bitcoin, as this taps into her support base’s concerns.

In Singapore on Friday, in a virtual appearance at the Bloomberg New Economy Forum, the former presidential candidate positioned cryptocurrencies as a threat to the USD:

“One more area that I hope nation-states start paying greater attention to is the rise of cryptocurrency — because what looks like a very interesting and somewhat exotic effort to literally mine new coins in order to trade with them has the potential for undermining currencies, for undermining the role of the dollar as the reserve currency, for destabilizing nations, perhaps starting with small ones but going much larger,”

Furthermore, on her appearance at MSNBC’s Rachel Maddow on November 24, Clinton spoke about how Bitcoin could destabilize the US dollar:

“We are looking at non-state actors, either in concert with states, or on their own, destabilizing countries, destabilizing the dollar, the reserve currency. There are so many big questions that Biden administration must address.”

Join our Telegram group and never miss a breaking digital asset story.

The Crypto Regulation Roadmap

As Hillary Clinton signed off from Rachel Maddow’s show, she pressed for urgency, saying:

“We don’t have much time, and therefore, I hope from everything I’m hearing from them that’s exactly what they are going to try to do.”

This is likely a reference to the recent “Crypto-Asset Policy Sprint Initiative”, in which a banking consortium, led by the Federal Reserve, laid out a roadmap to regulate stablecoins and the interaction of traditional banking institutions with crypto assets. Then, there is the last-minute crypto amendment in the recently passed infrastructure bill, taking effect in 2023 that will alter how crypto is taxed.

The framework for US crypto regulation has been outlined in this tweet by Ian Mair:

The Fed, OCC and FDIC lay out a crypto regulatory roadmap for 2022: pic.twitter.com/0fJ7Eq1ssm

— Ian Mair (@ISDM27) November 23, 2021

At the same time, the Congressional Blockchain Caucus is growing, backed by crypto lobby organizations, which themselves have increased their funding. Some of the most notable ones are the Blockchain Association, Chamber of Digital Commerce, and Coin Center. In turn, they receive funding from established crypto firms, reflecting a growing lobbying base for the industry.

I'm thrilled to announce that Coin Center has received donations to claim the amazing $1 million match from @Grayscale in full.

— Jerry Brito (@jerrybrito) February 10, 2021

We’ve been stunned by the outpouring of support from the community. Thank you @Sonnenshein and team! 🙏

But there's one more thing…

On-Chain Finance Is Inherently Resistant to Regulation

It is notable that different markets use Bitcoin differently. In the West, Bitcoin is largely viewed as a speculative investment asset and a hedge against inflation. In developing nations, Bitcoin is viewed as a more convenient cross-border tool for remittances. Case in point, no matter the repeated ‘bans’, Nigeria leads the world in crypto adoption at over 30% of its young population. Clinton’s calls for more Bitcoin regulation could therefore be equally ineffective if the regulation attempts a total ban such as in Nigeria or China.

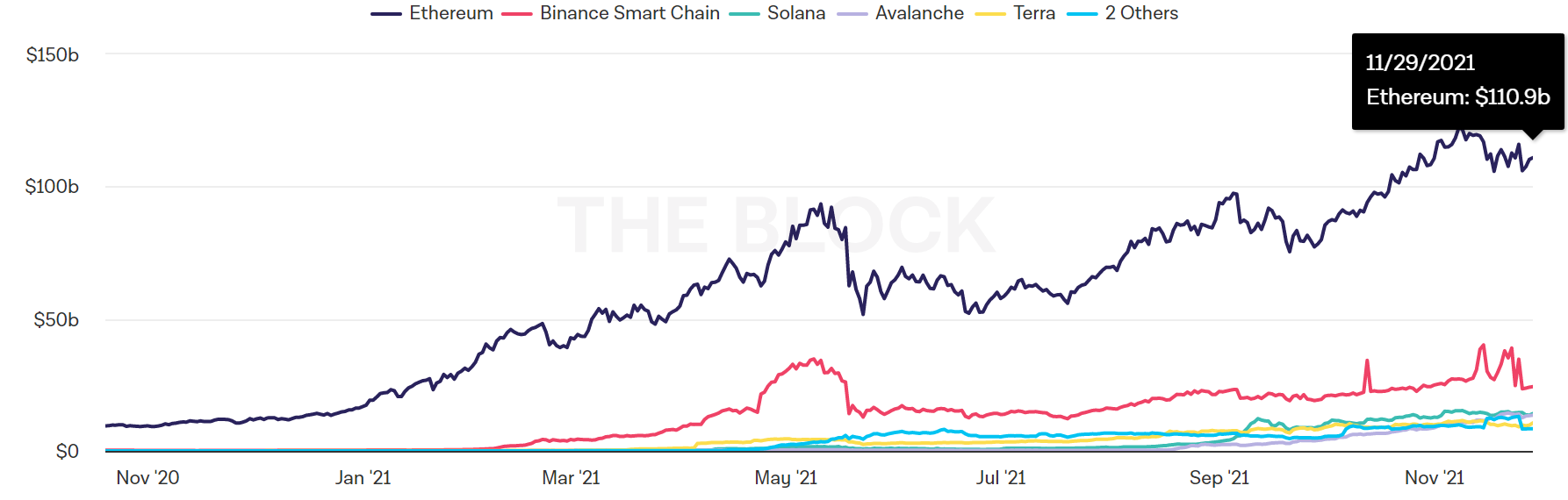

Rampant inflation combined with near-zero interest rates are powerful forces for greater crypto adoption, which in turn are both driven by central banks. At the same time, Decentralized Finance (DeFi) has already made a foothold on the back of smart contract platforms; from Ethereum and Binance Smart Chain, to Solana, Avalanche, Radix, Polkadot, and Cardano — with many more in the works.

Smart contracts themselves change how the financial game is played. Instead of worrying about malicious tampering and mediators, as shown with the GameStop saga, DeFi can rest easy. In effect, smart contracts are poised to regulate themselves when it comes to consumer protection.

Because on-chain finance is so far removed from the traditional financial playbook, DeFi is exceedingly difficult to regulate. This is why the brunt of the regulatory focus relies on stablecoins, as the bridge between TradFi and DeFi.

With Russia similarly struggling to work out how to approach crypto regulation, there is little validity to the claim by Clinton that the shift of power would go from one nation to another — is it is more likely that the US’ loss of monetary influence would be the developing world’s gain.

Do you think crypto and DeFi adoption will weaken US hegemony? Let us know in the comments below.

tokenist.com

tokenist.com