As part of its recent year-end market update, Pantera Capital analyzed the current state of the initial coin offering (ICO) market both as it relates to their firm and in general. Notably, the report was written by Pantera co-CIO Joey Krug, the founder of Augur (REP), which conducted the first ICO on the Ethereum (ETH) blockchain back in 2015.

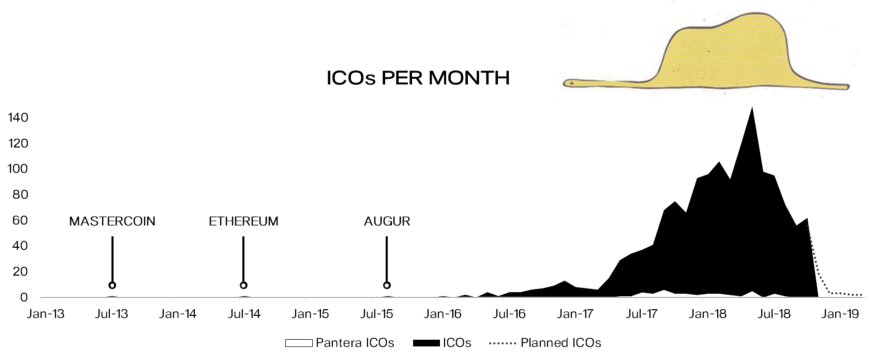

In his analysis, Krug gives some much-needed context to the ICO explosion that started after Kik announced their token sale at the Consensus/Token Summit in May of 2017. While the decentralized fundraising method seemingly appeared out of nowhere, the ICO boom actually began as a trickle with Mastercoin first testing the waters in 2013 and Ethereum following the next summer.

“ICOs have existed for five years,” writes Krug. “For the first three years, there were a few really amazing projects where the token was absolutely necessary to the functioning of the network. They were pretty rare.”

And quality projects remained just as rare once the ICO explosion started, according to Krug.

“For a protocol token to have value it must be absolutely necessary for the functioning of the network and the value is only because more and more people want to use it or find it useful — it has utility,” explains Krug. “In 90+% of those offerings, the token was not required.”

If true, this would imply millions of dollars, possibly billions, have been wasted on projects that are hypothetically worthless — and Krug says as much in his analysis, writing, “As the token has no reason to exist they will, unfortunately, go to zero.”

Unsurprisingly, this year’s lingering crypto bear market has taken its toll on the ICO industry, with the SEC providing a secondary reason not to try and raise money through a token sale. The changing climate has pushed crypto startups toward more traditional fundraising methods like equity — a far-less risky prospect for firms like Pantera.

Despite this, Krug notes that Pantera still invests in an ICO every few months, “We’re still seeing extremely compelling projects, but they’re rare.”