Leading digital assets manager CoinShares says Ethereum (ETH) institutional investment products just had their biggest week in over a year.

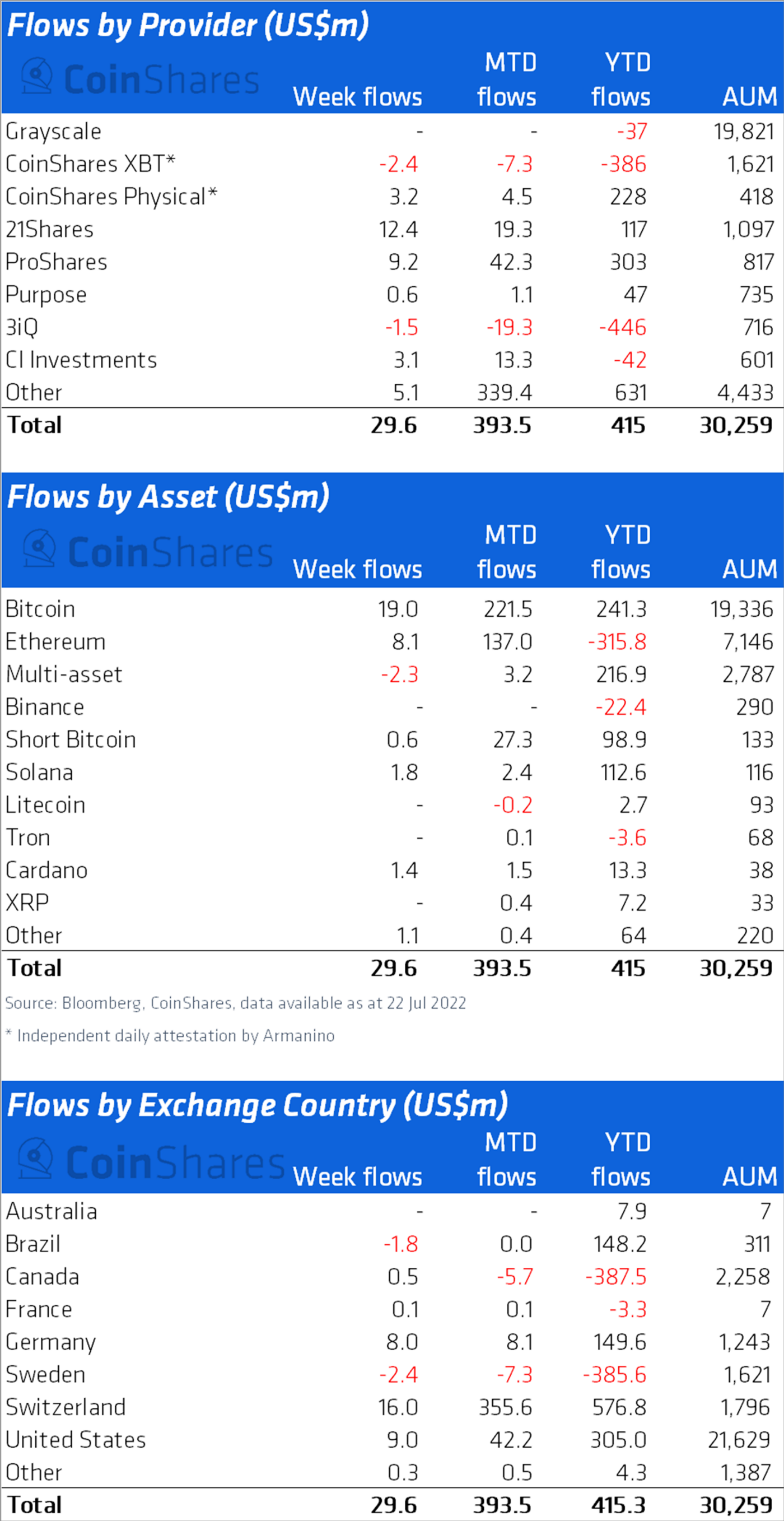

According to the latest Digital Asset Fund Flows Weekly report, late trade reporting added $120 million to the previous week to ETH’s weekly inflows of $8 million, making it the largest on record since June of 2021.

“Ethereum saw inflows totaling $8 million, while the corrected prior week data saw inflows totaling $120 million. These inflows mark the largest single week of inflows since June 2021 and imply a turning point in sentiment after a recent 11-week run of outflows. It also suggests that as The Merge progresses to completion, investor confidence is slowly recovering.”

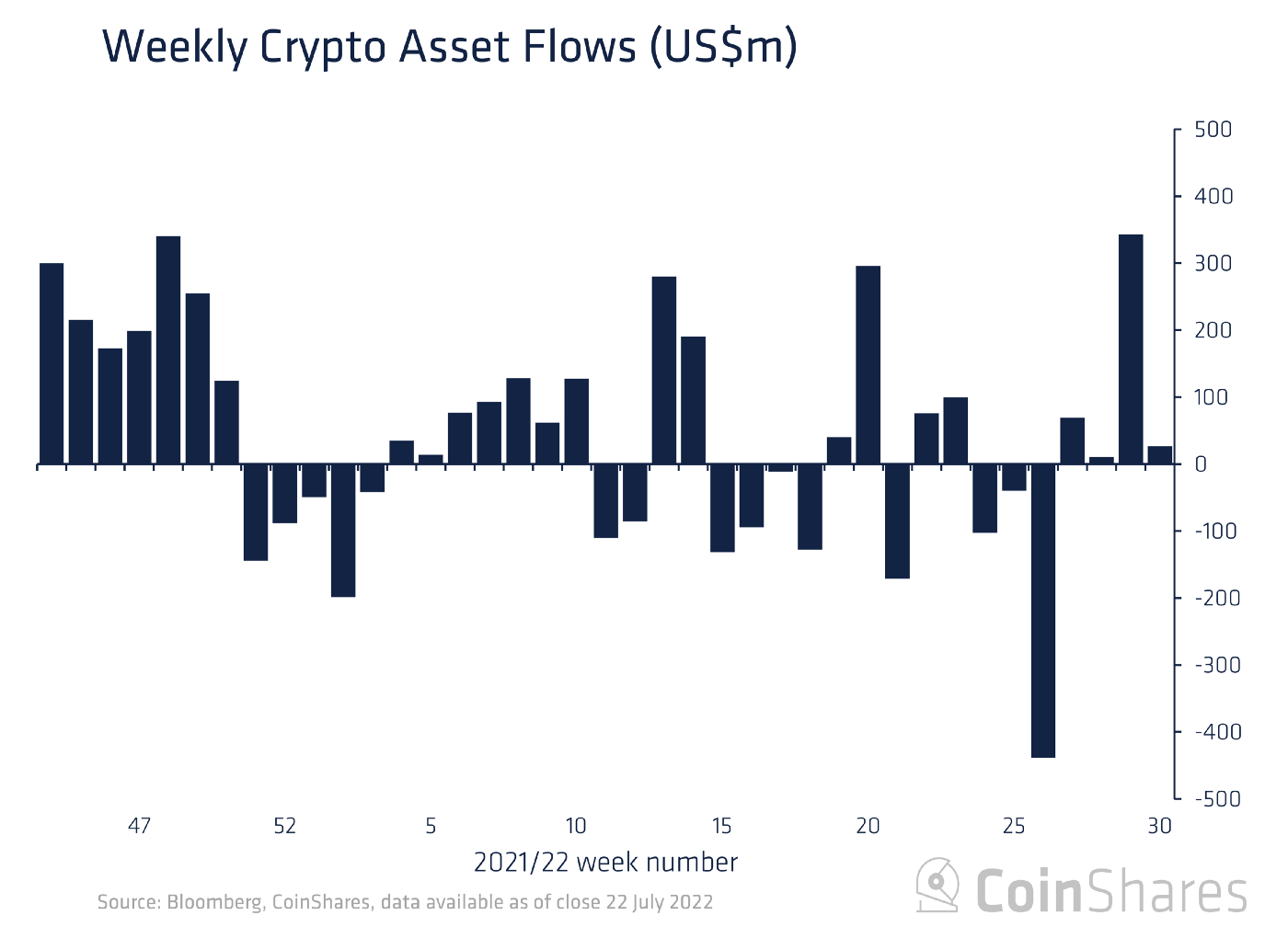

Late reporting of the previous week’s trades also raised digital asset investment products from $12 million in inflows to $343 million.

“Digital asset investment products saw inflows totaling $30 million last week, while late reporting of trades from the prior week saw inflows corrected from $12 million to $343 million, marking the largest single week of inflows since November 2021.”

Corrections from the previous week also gave Bitcoin (BTC) its biggest week of inflows in three months.

“Bitcoin saw inflows totaling $16 million last week with the prior week of inflows corrected to $206 million, the largest single week of inflows since May 2022.”

Altcoins Solana (SOL) and Cardano (ADA) enjoyed $1.8 million and $1.4 million of inflows, respectively, while multi-asset digital investment products suffered $2.3 million of outflows.

dailyhodl.com

dailyhodl.com