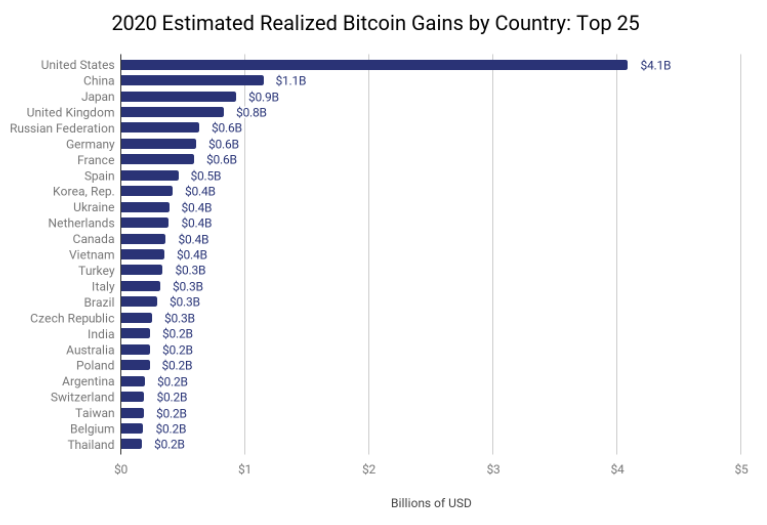

The price of Bitcoin rose from $3,800 in March 2020 to almost $30,000 at the end of the year to an all-time high of $65,000 in mid-April. This meteoric rise in the price of the cryptocurrency resulted in American traders locking in $4.1 billion in profits trading Bitcoin last year. US investors account for the lion's share of all the realized gains, as it is three times more than the next highest country China, despite the latter historically having the highest raw cryptocurrency transaction volume, according to the latest report from Chainalysis. The New York-based research firm published a report this week ranking the top 25 countries with the most realized gains.

“Investors in nearly all countries saw the biggest increases toward the end of the year.” “That’s when U.S. investors really broke away from the pack, with most of their gains coming from activity on Coinbase.”

The fact that the US-focused exchanges saw huge inflows in 2020 towards the end of the year likely accounts for the country’s large gains noted in the report.

Long-term investors around the world basically sold their cryptocurrency to newer investors as prices rose, thereby adding to their realized gains. While American investors sold at higher prices, those in other countries held more, it said.

China captured the second spot by locking in $1.1 billion in profits, followed by Japan, the UK, Russia, and Germany. Smaller emerging-market countries, such as Vietnam, Turkey, and the Czech Republic, were also among the top 25.

The fact that the US-focused exchanges saw huge inflows in 2020 towards the end of the year likely accounts for the country’s large gains noted in the report.

Long-term investors around the world basically sold their cryptocurrency to newer investors as prices rose, thereby adding to their realized gains. While American investors sold at higher prices, those in other countries held more, it said.

China captured the second spot by locking in $1.1 billion in profits, followed by Japan, the UK, Russia, and Germany. Smaller emerging-market countries, such as Vietnam, Turkey, and the Czech Republic, were also among the top 25.

“The data suggests that Bitcoin has given investors in emerging markets access to a high-performing asset, the likes of which they may not have otherwise had access to.”At the same time, countries with harsher regulations like India are preventing their citizens from taking advantage of the opportunity. [top_coins]

bitcoinexchangeguide.com

bitcoinexchangeguide.com