After a tumultuous couple of weeks with bearish pressure causing the majority of cryptocurrencies to extend to the downside, Bitcoin today, May 13, has reclaimed the crucial $30,000 level.

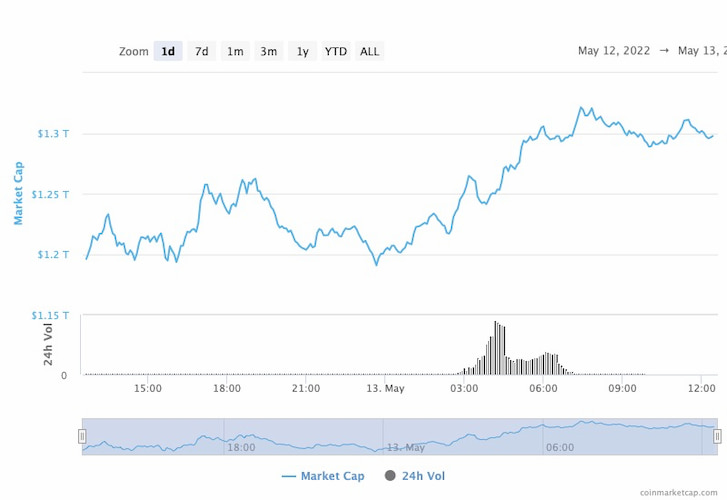

As a result, the price of altcoins has increased, which has led to an infusion of cash into the global cryptocurrency market cap, which has increased by over $100 billion in the last 24 hours.

In fact, as of May 12 at 11:25 UTC, the overall market capitalization was $1,193 billion, compared to $1,301 billion on May 13. At the time of publishing, CoinMarketCap data indicates that $108 billion has entered the market.

Crypto market analysis

The precipitous decline of Bitcoin and other cryptocurrencies seems to have slowed, leaving investors to tally their losses following one of the most severe drops in recent times.

Despite this, there are indications that the rapid decline may be coming to an end. BTC has gained 14 percent in the previous day, passing again over the critical psychological threshold of $30,000, while the cryptocurrency market as a whole has gained 13.5 percent during the same period.

A ripple of panic rippled through the cryptocurrency market this week as the Terra (LUNA) cryptocurrency plunged by more than 99% overnight. The broader drop had driven another stablecoin, Tether, below its dollar peg, further eroding confidence.

Bitcoin price analysis

Indeed, the price of Bitcoin has once again reclaimed $30,000; as things stand, BTC is trading at $30,384, up 9.31% on the day and down 16.44% in the last week.

Currently, Bitcoin has a total market of $578.4 billion with a total market dominance of 44.5%. Interestingly, just 24 hours earlier, Bitcoin flash crashed below $26,000 as it fought to hold $28,000 as experts projected more red ahead.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com