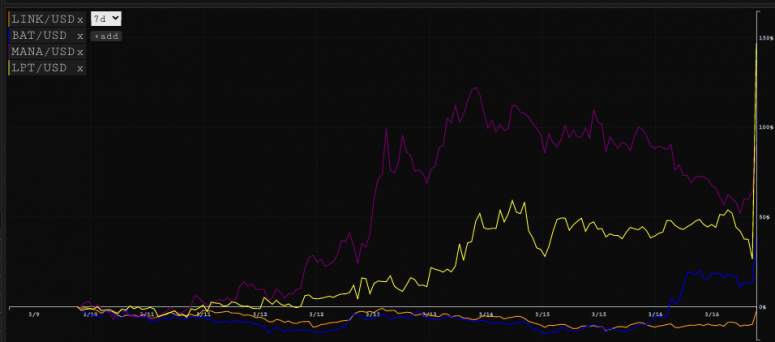

Prices for Chainlink’s LINK token and Decentraland’s MANA shot up after the conglomerate Grayscale on Wednesday disclosed plans for new investment trusts linked to the digital assets.

Grayscale CEO Michael Sonnenshein announced the trusts on Twitter at around 13:00 coordinated universal time (9 a.m. ET), and soon afterward LINK rose 7% to above $30. Grayscale is known for its bitcoin trust, ticker GBTC, which has become one of the most common ways for new investors to bet on the cryptocurrency’s price, since the vehicle can be bought and sold in stock markets, somewhat like an exchange-traded fund. (Grayscale is a unit of Digital Currency Group, which also owns CoinDesk.)

MANA, the native token of virtual reality platform Decentraland, jumped nearly 20% to above $1. Grayscale also launched products dedicated to Basic Attention Token (BAT), Filecoin (FIL), and Livepeer, powering gains in these lesser-known coins.

The new trusts could unlock the exotic digital tokens for a new breed of well-capitalized investors, since Grayscale’s trusts are seen as a way of gaining exposure to cryptocurrency prices without taking on the extra procedures and risks of owning them directly.

Chainlink provides price feeds to automated, blockchain-based lending and trading platforms built using blockchain technology, collectively known as decentralized finance, or DeFi. These data “oracles” are used by smart contracts – mini computer programs running atop blockchain networks, primarily Ethereum.

Price-chart analysis, however, shows that LINK has yet to cross above a descending trendline, a key hurdle for traders looking for predictive patterns.

Also read: Grayscale Offers New Trusts to Invest in 5 More Cryptos Including Filecoin, Chainlink

coindesk.com

coindesk.com