An interim investigative report filed in the ongoing bankruptcy of Celsius Network provides more context about its business practices and shows a predictable pattern of irresponsibility.

The report lays out a timeline where, in response to state investigations by New Jersey, Texas, and Kentucky in May of 2021, Celsius attempted to appease regulators by preparing a ‘Custody’ product.

These initial three states were followed by Arkansas, Oklahoma, Pennsylvania, and Washington. The Securities and Exchange Commission (SEC) had also served requests or subpoenas by August 2021, and in September both New Jersey and Kentucky announced cease-and-desist letters against Celsius Network.

After this cease-and-desist, the firm received additional requests from the SEC, along with new requests from Alabama, Massachusetts, and New York; Texas filed to enforce its own cease-and-desist and Washington filed charges.

In short, Celsius was being pursued on all sides, with the controversy centering on the accusation that it offered unregistered securities to unaccredited investors.

Celsius was also paying close attention to the SEC’s ongoing case against competitor BlockFi. When BlockFi settled with the SEC and 32 states on Valentine’s Day in 2022, the SEC turned its attention to Celsius, and Celsius begin seriously developing Custody.

This was a decision described by chief revenue officer Roni Cohen-Pavon as “mostly about number and effect on growth” and was about remaining viable in the United States since it could no longer offer ‘Earn’ to unaccredited investors.

Another Celsius employee described it as a “defensive play” meant to “retain some sort of relevance.”

The launch date for the Custody product was not determined based upon when the offering was complete, but the date on the New Jersey cease-and-desist. Celsius had an office in New Jersey, so enforcement of the cease-and-desist in the state could have ended the Celsius Earn product across the United States.

How did Celsius Network’s Custody work?

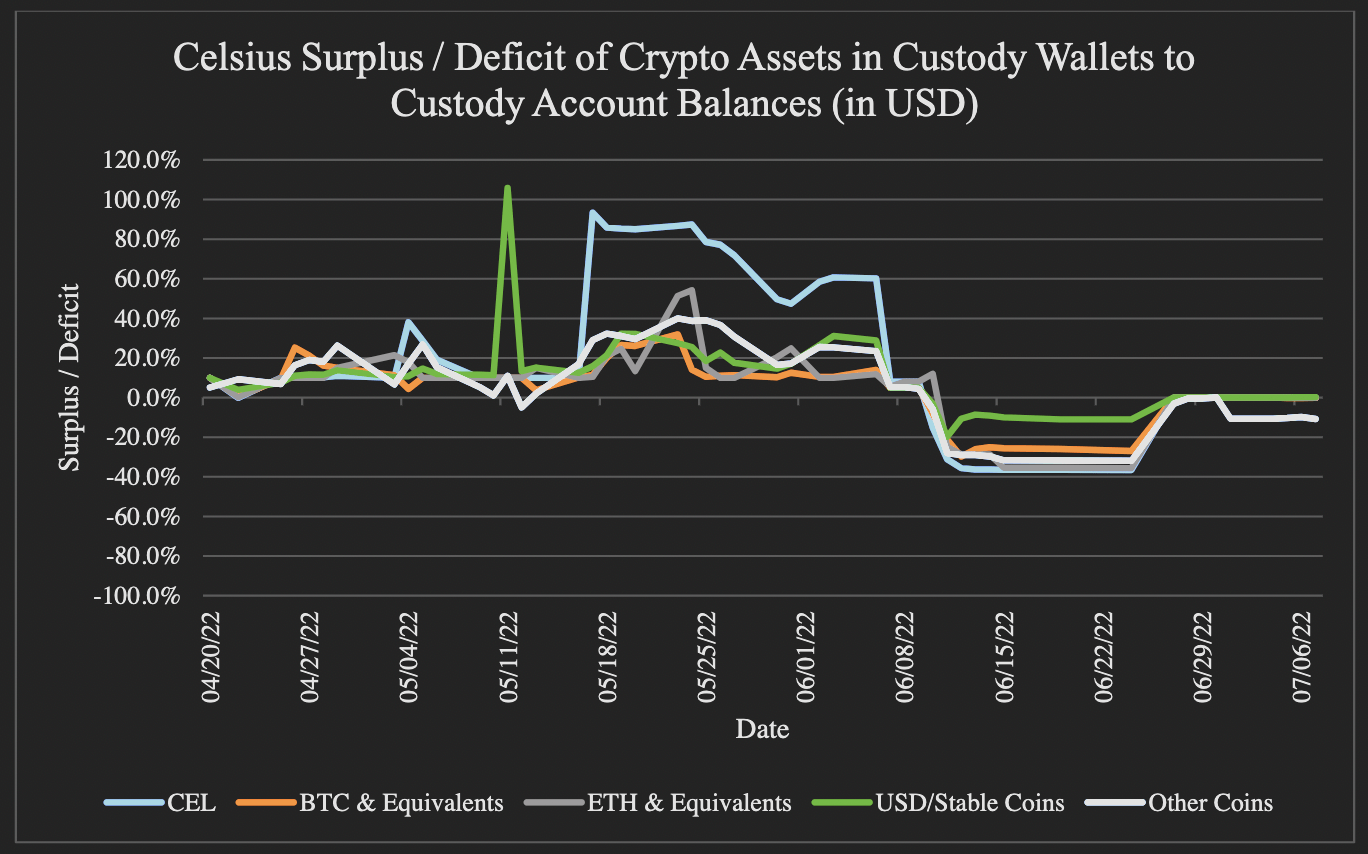

The Celsius Network Custody product functioned very differently from most custody products in the crypto industry. Rather than creating segregated wallets for each client and keeping track of which assets were owed to customers, Celsius instead decided to throw all of the custody wallets in one wallet, only check it occasionally, let it regularly have shortfalls, and then occasionally refill it.

This isn’t how custody offerings normally operate. Generally, separate wallets are created for each client and the assets they deposit. This allows the company to easily ensure that its assets in custody match the liabilities it owes customers.

Read more: FTX and Tether were closer to Celsius than anyone realized

Celsius’ legal team instructed employees to tell customers asking about the safety of their funds that “Celsius continues to safeguard customer assets,” even when there were deficits in the Custody accounts.

Due to the haphazard setup of Celsius’ custody offering, all user assets were first passed through the main wallets before sometimes being sent over to Custody. The practical import of this is that when Custody experienced a shortfall, those funds were being used by Celsius Network to fund its activities, despite the promise in the terms of service that it would “not transfer, sell, loan, or otherwise rehypothecate” those assets.

In the nine states where Celsius was unable to convince regulators to provide adequate licensing for its Custody offering, it created a new type of account described as a ‘withhold’ account. These accounts could still accept deposits but were ineligible for earning rewards. However, the funds deposited were still swept to the main wallets that Celsius was using for its activities.

Users with withhold accounts couldn’t earn rewards, but Celsius could still use its assets for deployment and other purposes.

Many of these issues were, at least in part, a byproduct of Celsius’ inadequate record-keeping systems. Prior to May 2021, it lacked a system to track assets and liabilities and instead would just check individual wallets. Starting in May of 2021, Celsius began tracking its assets and liabilities in a Google Sheets document that regularly failed to break out the different types of accounts. It wasn’t until 24 days after the launch of Custody that this report started showing the Custody accounts broken out, and it was a shortfall when they finally added it.

As the investigator explains in the filing: “Celsius chose to rely on manual reconciliations and transfers of crypto assets without robust controls for the Custody program.” Celsius didn’t bother to develop a custody solution, preferring a Custody solution, to buy time.

protos.com

protos.com