- Rothschild Investment has acquired more Grayscale’s Bitcoin and Ethereum trust shares in Q2 2021

- With the acquisitions, the firm has increased its cryptocurrency exposure by 300% since April

- Michael Sonnenshein noted that institutional investors are taking little notice of short-term price moves

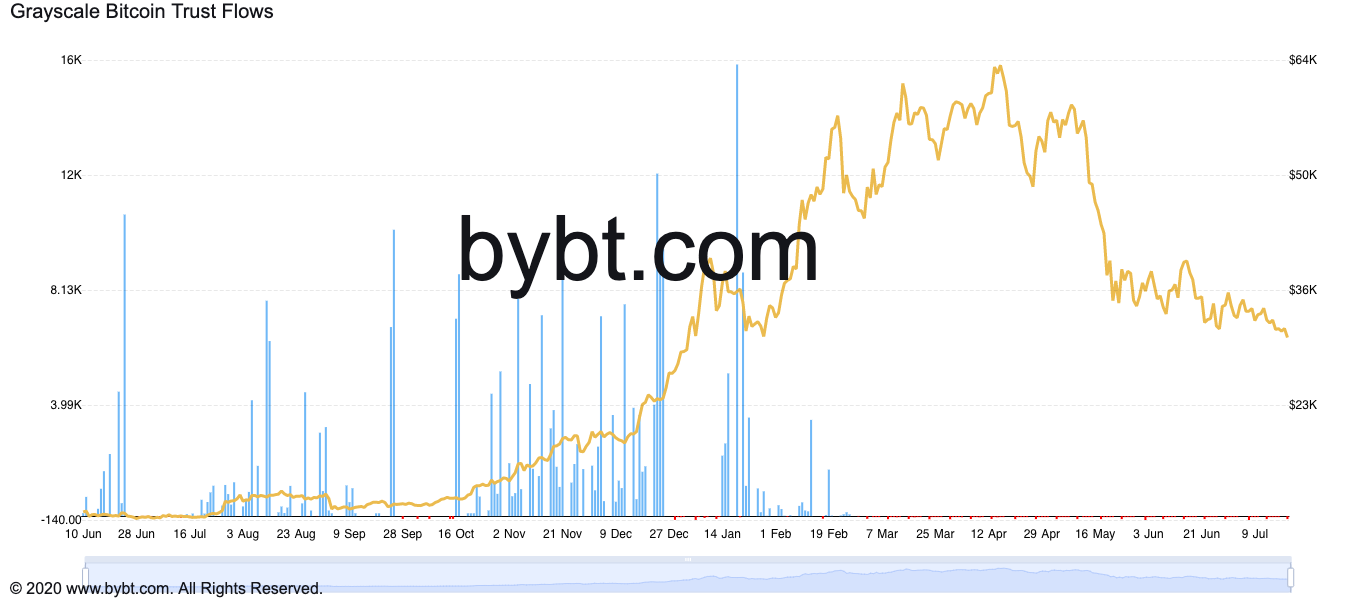

- Grayscale Trust unlocked 16k BTC worth shares, bringing itself at the center of discussions this week

Rothschild Investment, which provides wealth management and fundraising advice to governments and businesses, recently purchased Grascale’s shares. Grayscale Trust is one of the world’s biggest cryptocurrency investment trusts. The firm allows institutional investors to invest in Bitcoin and Ethereum like cryptocurrencies. According to a recent filing with the United States, the Securities and Exchange Commission (SEC) has revealed that the firm is increasing its crypto exposure by 300% since April. Indeed, the firm has more than tripled its crypto acquisition in Q2 2021.

Rothschild is pumping its Grayscale Trust shares

Rothschild Investment has pumped its holdings in Grayscale Bitcoin and Ethereum investment Trust. The financial advisor has reportedly purchased 1,03,059 shares of Grayscale Bitcoin Trust. Moreover, the firm has also purchased 13,817 shares of Ethereum Trust.

The recent purchase of the financial advisor makes the value of its GBTC holdings $4.2 million when each GBTC share was worth 0.000939767 BTC. And ETHE holdings to $6.3 million. Notably, the firm has disclosed its initial stake in ETHE in the month of April.

It is also noteworthy that the firm had invested less than a million dollars at the beginning of this year.

Investors looking allocation for mid-long term

Michael Sonnenshein, the CEO of Grayscale Trust, has noted that institutional investors are taking little notice of short-term price moves. Indeed such investors are focusing on a much lower-time-preference strategy in terms of digital assets.

Sonnenshein stated that crypto investors are really not focused on short-term movements in price. Instead, these investors are seeking to allocate their funds in the medium to long term. Therefore, the factor will protect the investors from any volatility or dampening of volatility.

Unlocking of 16k BTC worth shares

Grayscale Trust unlocked 16k BTC worth shares on Sunday, bringing itself at the center of discussions this week. Concerns, while arguably unfounded, long proliferated that the event would create downward BTC price pressure. And the fact sharpened the drawdown on Monday and Tuesday, fuelling the fire.

Since Grayscale Bitcoin Trust investors cannot redeem shares for Bitcoin and then sell for a government-issued fiat currency, BTC markets are, in fact, left out of the equation when it comes to unlockings. The trust itself only sells a tiny amount of the Trust’s BTC holdings for fund management purposes.

thecoinrepublic.com

thecoinrepublic.com