Since the early ages of this industry, Ethereum has been the second-biggest cryptocurrency in market cap. This year, the long-awaited ‘Merge’ is coming. Also, early next year, sharding should enter the playing field. Big moves and changes ahead of Ethereum. What will this do with the Ethereum ecosystem?

In a long Twitter thread, @pastryEth, who works on NFTs on ETH at BakeryDAO, discusses 14 reasons why you don’t have enough ETH. Let’s dive in and find out what these reasons are to stack more Ethereum.

-

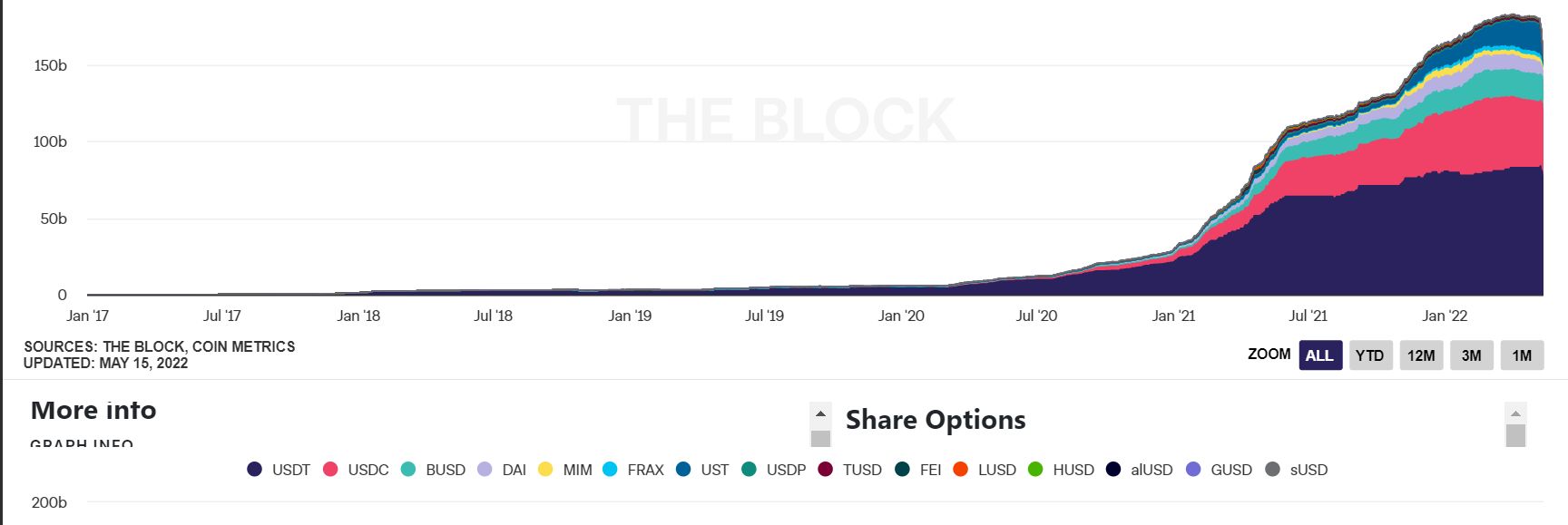

The Majority of Stablecoins are Placed on Ethereum

Stablecoins are the oasis of rest in the volatile crypto world. They allow you to store your investment inside the crypto ecosystem. Stablecoins protect you against the volatility of the crypto market. At the time of writing, the current market cap of all stablecoins is just under $180 billion. Out of this, we find 75% of them back on Ethereum.

Source: The Block Crypto

-

Manage your DeFi With Ethereum.

As long as you have access to the internet, you can manage all your finances in a trustless way. In other words, without middlemen or other financial institutions, like banks. This is a key pillar for the crypto space. However, it is most at one’s fingertips in DeFi.

-

Developers

Ethereum has the most developers working on its blockchain. This means that Ethereum is street lengths ahead of all other L1 chains. Together with Polygon and Cosmos, they are the fastest-growing L1 ecosystems. For instance, Ethereum sees up to 4,000 monthly active developers. On the other hand, Bitcoin doesn’t even hit 700 per month.

-

NFTs

Everybody and his dogg want to join the NFT revolution. Especially the art market is popular now. However, that is only the tip of the iceberg. More utility and use cases are underway for NFTs. This area still has plenty of room to grow. Ethereum dominates the NFT space.

-

dApps

Ethereum keeps growing on a daily basis. All these new protocols and platforms bring new use cases to the ecosystem. Currently, Ethereum hosts well over 3,000 dApps and 200,000 ERC-20 tokens. One way or another, they all bring value to the Ethereum ecosystem.

-

DAOs

The DAOs offer a new way to govern crypto organizations. Instead of a traditional setup with a board, the members govern the organizations. This is all organized by smart contracts. Another important part of the decentralization of the crypto and blockchain space.

-

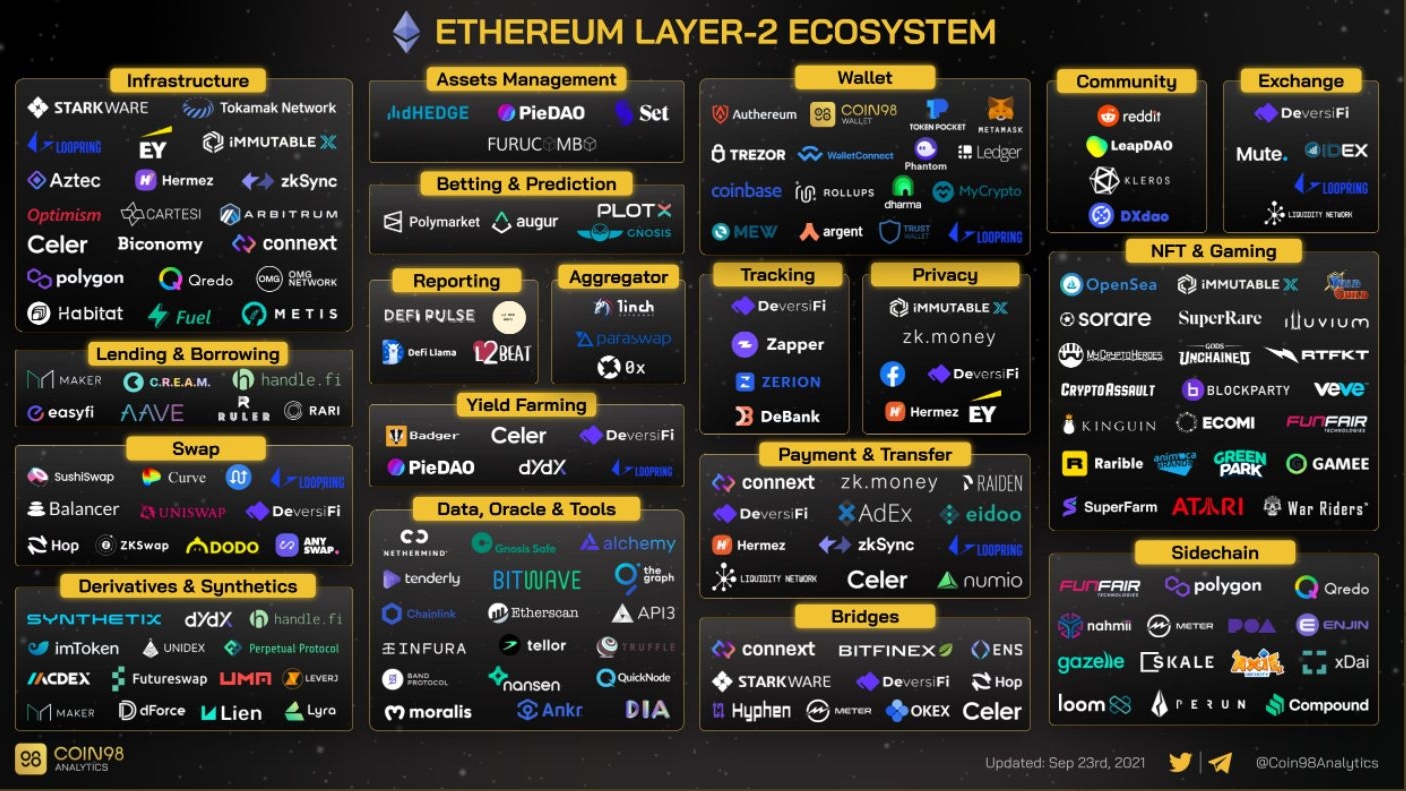

Layer 2 Solutions

Scalability is one of the main problems of Ethereum for the time being. However, there are a lot of L2 solutions that are helping to solve this problem. They manage to offer great scalability without giving up the decentralization aspect.

Source: Coin 98 Analytics Twitter

-

The Merge

The long awaited and often postponed switch from PoW to PoS. Supposedly now happening in Q3, 2022. A much eco-friendlier solution to secure the network. This could give a 99.5% saving of energy for the Ethereum chain.

-

Sharding

Together with the Merge, this is another important update for Ethereum. This should make the network up to 4x faster. The Ethereum blockchain will split into 64 shards. Running a node will need less hardware and the TPS will increase. As a result, there should be less congestion. This should happen during 2023. But it can only take place after the Merge has been in place for a little while.

Source: TXstreet

-

Triple Halving

After the Merge, Ethereum becomes deflationary. This will cause a supply shock. This is also known as the ‘Triple Halving’. It is the same as 3 Bitcoin halvings will cause. Twitter author @SquishChaos predicts a massive investment opportunity for stacking Ethereum during the next year or so. Check out his thread below.

Post-merge, $ETH sell pressure will drop 90%. For $BTC sell pressure to reduce this much, it takes 3 halving events. I’ll repeat:

ETH will undergo the equivalent of 3 halving events in the next 12 months.

— Squish (@SquishChaos) April 17, 2021

-

User Growth

Since Ethereum started, the unique addresses chart knew only one direction. That was straight up, even to this day. See the picture below. The number of users will keep growing with more use cases added. Furthermore, developers keep building new products.

-

Staking

You can already stake your ETH on Ethereum. Currently, ETH holders stake already almost 12.5 million ETH. After the Merge, with the expected APY, this will become more. It will also be easier to become a validator. Transaction fees will then go to the validators. With a deflationary token, the price is most likely going up as a result. A good reason for stacking Ethereum.

Source: Beaconcha

-

Liquid Supply

The liquid supply, or Ether that really circulates, is not as big as you may think. There’s ETH locked up on liquidity pools, staked in ETH 2.0, DeFi, and burning mechanisms. That doesn’t leave a lot of ETH in circulation.

At some point we have to ask, with:

-26% of $ETH locked in smart contracts

-$116B TVL in DeFi

-5.5% of $ETH staked

-EIP-1559 on pace to burn $4.5B worth of $ETH this year

-liquidity pools

-exchange balances reaching 3 year lowshow much of $ETH supply is ACTUALLY circulating?

— croissant (@CroissantEth) August 7, 2021

-

No More Intermediaries

In almost all aspects of our lives, there are middlemen. For example, banks, E-commerce, or social media. The Ethereum ecosystem replaces these middlemen and replaces them by code.

Conclusion

You just saw 14 reasons why Ethereum still is and will remain a hot asset. All the signs are long-term bullish. As a result, @PastryEth and others working within the ETH ecosystem think that you can never have enough ETH. It seems he may have a case.

altcoinbuzz.io

altcoinbuzz.io