Ether's (ETH) price has broken out for the first time in 23 days in its Bitcoin (BTC) pair. It follows a high-profile announcement from Visa to use USDC, a stablecoin based on the Ethereum blockchain.

Although ETH/BTC saw a strong technical breakout, the uptrend has been fueled by firm fundamental catalysts, buoying the short-term bull case for ETH.

Traders think Ethereum will outperform Bitcoin in April

According to the pseudonymous trader known as "Rekt Capital," Ethereum was close to breaking out of its triangle market structure multiple times since January 2021.

However, every time it attempted to break out of it, ETH saw a fairly large rejection from the resistance area.

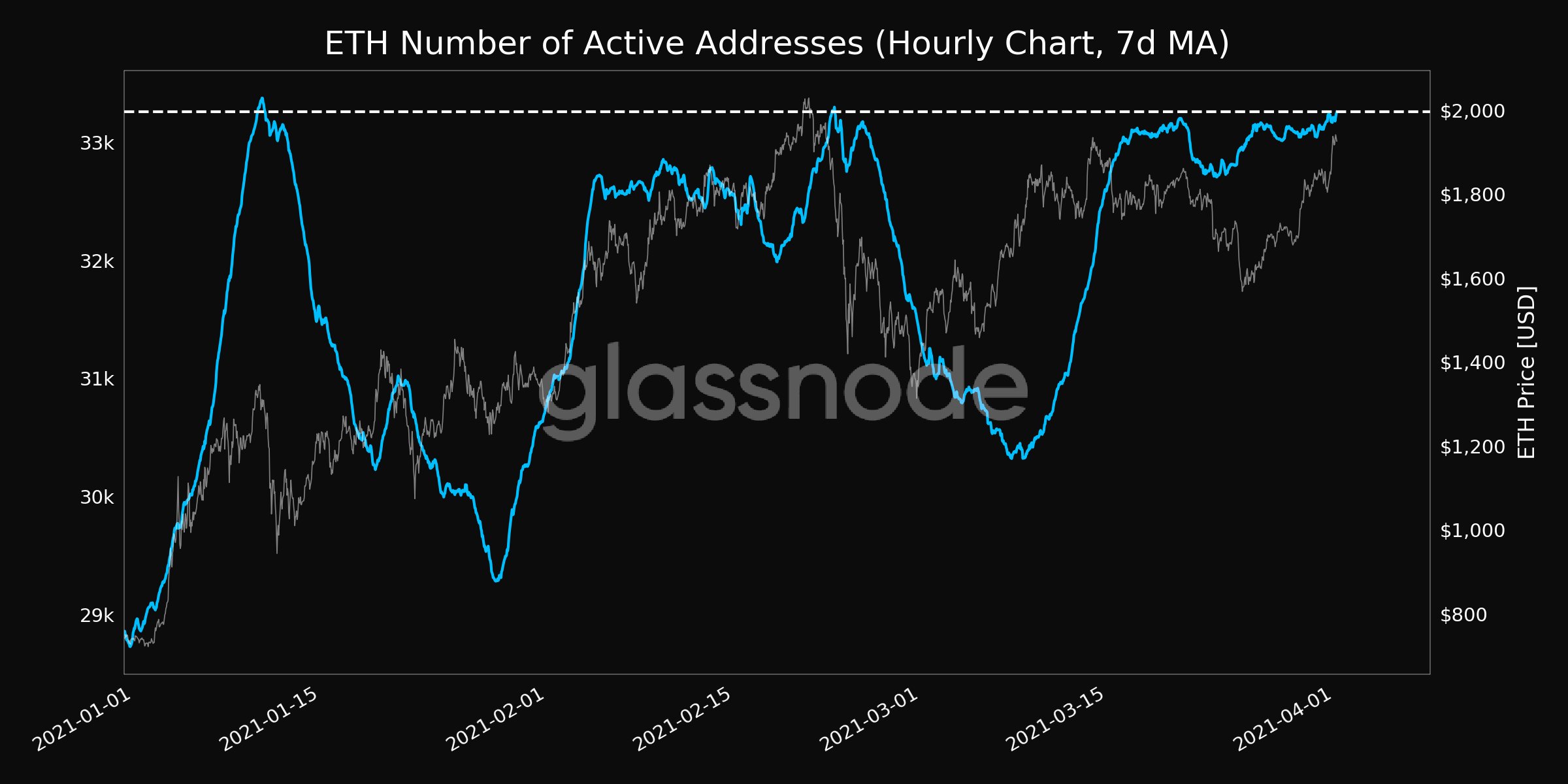

The increasing number of active addresses indicates that the user activity on the Ethereum blockchain is rising in tandem with the price.

For any blockchain protocol, the rally of its underlying token's price being supplemented with an increase in user activity is an optimistic trend because a blockchain at its core is a value transfer network.

On top of this, the total value locked in DeFi lending on Ethereum has been consistently surging since 2020. A pseudonymous Ethereum investor and researcher known as DCinvestor said:

"Believe it or not, this was a common refrain a few years ago when DAI went live people didn't get it, and they eschewed collateralized lending but numbers don't lie now, it's becoming the bedrock of a new, hyper-capital efficient world being built out on #Ethereum via #DeFi."

As long as the user activity on the Ethereum blockchain continues to increase alongside important metrics pertaining to DeFi on Ethereum, the price of ETH would likely reflect the rising demand for its blockchain network.

Since the primary demand for ETH is coming from DeFi as a means to pay for "gas" or transaction fees, the popularity of DeFi would catalyze the value of Ethereum.

EIP1559 is not priced in

— Ξ DavidHoffman.eth (@TrustlessState) March 29, 2021

Commentators also say that the EIP1559 proposal, which is expected to go live in July, is not priced into the price of Ether, which would overhaul Ethereum's fee market structure and indirectly lead ETH to become more scarce.

cointelegraph.com

cointelegraph.com