The increase in the price of Ethereum (ETH) in the last few days, has set record numbers for the addresses holding this crypto. This has not been recorded since July of last year and even beats the price at the time, which reached 334 dollars.

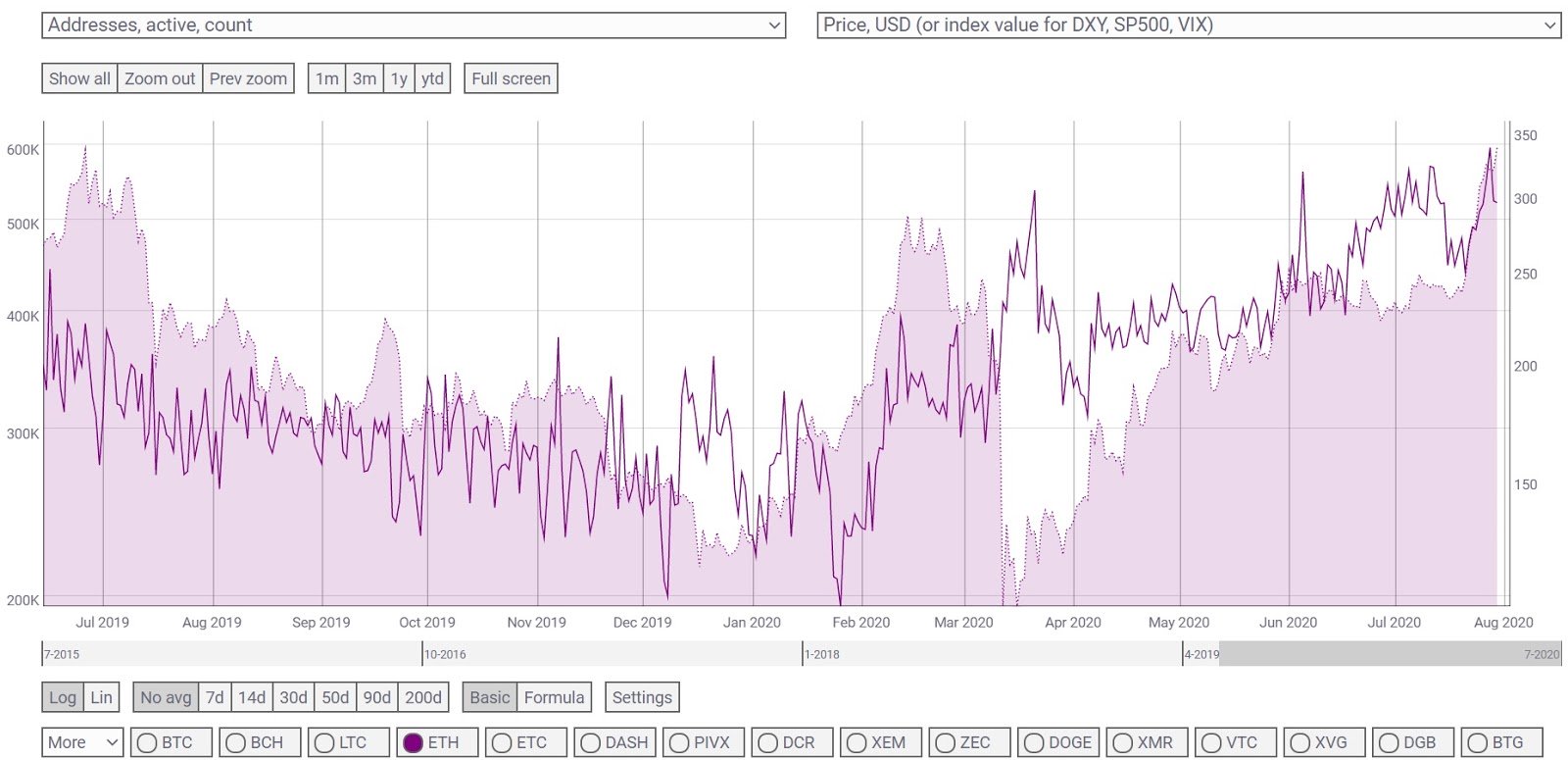

Looking at the data that Coinmetrics provides, it is possible to make comparisons over the last year and see how both the price of the asset and the number of active addresses that hold ETH have evolved.

In particular, these are the data that emerge:

- July 30th, 2019, 331,000 active addresses and a price of $210;

- July 30th, 2020, 521,000 active addresses and a price of $335.

When calculating everything in percentage then, there has been an increase of 57% for active addresses compared to the previous year, while when taking the price as a reference, the price has increased by 59%.

Ethereum addresses, profits skyrocketing for those who bought in March

These are 2-digit figures and this means that even all those who had bought during the July peak are still in profit, a profit that increases staggeringly for all those who had bought during the crypto crash in mid-March when ETH reached a minimum price of $102. So if we take the latter as a starting point then the profit percentage rises to 228%.

In addition, these days the price of ETH continues to rise and is not hinting at falling, a sign that there is still some room to gain more from this asset.

It has to be said, however, that many people are taking advantage of this positive market situation to sell some or all of the assets and take profits, given that it has been 1 year since the last time the price of ETH reached these levels.

It is worth noting that the most convenient times to buy a crypto are precisely after periods of crisis due to external and internal factors, as can be seen from the chart provided.

And indeed the rise in the number of active addresses has been recorded near these price drops, which many people have skillfully used to buy ETH. And, judging from the data, it seems that now they are liquidating their positions, while other addresses are still buying today because in a year, what seems like a lot today, could increase even more, resulting in further profits.

en.cryptonomist.ch

en.cryptonomist.ch