StarkNet, an Ethereum zero-knowledge (ZK) rollup product created by StarkWare, made an announcement that its goal is to move to community control in either the third or fourth quarter of 2022.

While StarkNet declined to comment on whether this signaled the release of a token, the decentralized autonomous organization (DAO)/governance model has often relied on a governance token to establish voting rights and align the protocol’s governance with investors in the platform. Many projects in crypto have tokens, and so why would StarkNet’s potential launch be important in the industry? Ethereum’s layer 2 protocols have thus far been conflicted on whether a token is needed or whether ether should be the core token for all rollups, as well.

This article originally appeared in Valid Points, CoinDesk’s weekly newsletter breaking down Ethereum 2.0 and its sweeping impact on crypto markets. Subscribe to Valid Points here.

Rollups like Arbitrum and Optimism use a “wrapped” ether as their base token, which pays for gas and acts as the main DEX (decentralized exchange) pairing on many decentralized finance (DeFi) assets. To post the batched rollup transactions to a mainnet, the protocols must pay on-chain transaction fees that are subsidized by the users of the rollup.

In that sense, it is understandable that Ethereum-scaling tools would use ether as the native asset. Yet rollups have struggled to gain a following comparable to what we’re seeing in alternative layer 1s, like Solana, Avalanche and Binance Smart Chain. In the short term, the tokenless layer 2s are facing an uphill battle against layer 1s with billion-dollar war chests that provide the ability to incentivize builders and users to contribute to the network.

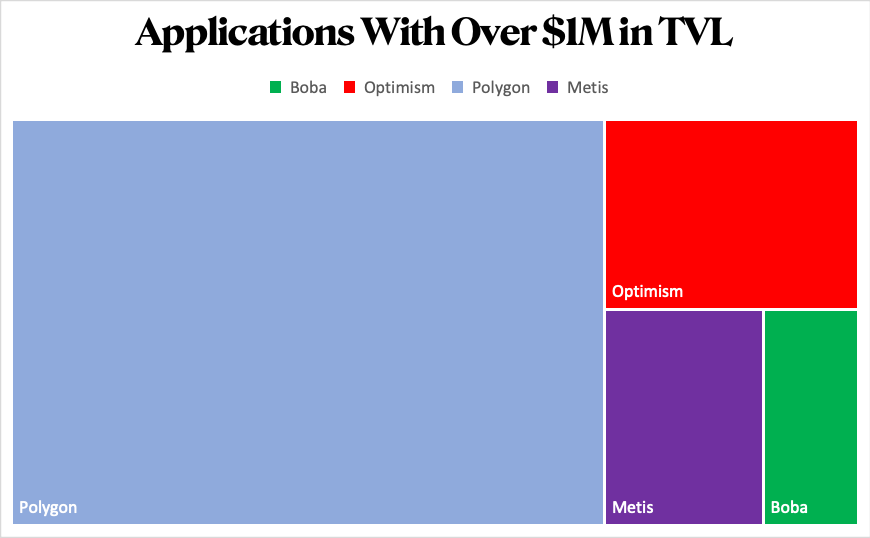

Ethereum’s Scaling Solutions Compete for Total Value Locked

By looking at the performance of tokenized Ethereum scaling tools (Polygon, Metis, Boba) vs. tokenless layer 2s (Arbitrum, Optimism, all ZK rollups), it's clear that the launch of a token economy allows networks to generate hype, build community and establish grants used for innovation and security. The total value locked (TVL) may not be permanent, but the launch of a token or an incentive program generates attention and financially encourages builders and users alike to bridge to the network.

Metis is looking to get even more creative with its tokenomics, using the Metis token for transaction fees and returning 30% of the gas paid to protocols that build on the network. The program better aligns Metis and the projects building on the network, as they now both benefit financially from stealing market share from other chains and creating a stronger ecosystem.

Outside of DeFi, Metis also uses its native token to encourage decentralization and security. Metis’ Andromeda is an Optimistic rollup, which uses sequencers to verify transactions much like Abitrum and Optimism do. However, instead of relying on a single sequencer run by the team behind the protocol, Metis intends to allow third parties to also run sequencers by staking Metis to financially prove their honesty.

The token is just one of several differences between Optimism and these other tokenized layer 2s, and so multiple factors like user experience, decentralization and transaction fees are also at play in driving adoption. Yet, it seems likely that layer 2 ecosystems would thrive like alternative layer 1s if they could also make use of the speculative valuations that are seen throughout the crypto industry.

All of this is not to say that tokenization solves everything. In fact, the tokenization of layer 2s may cause some issues within the broader Ethereum ecosystem. Crypto is so strongly narrative-driven that liquidity can become fragmented while users chase incentives. This dispersal can render applications and chains inefficient as users and liquidity are split across hundreds of applications and multiple chains.

Furthermore, tokenization can lead to short-term thinking among both developers and ecosystem participants, slowing true innovation and creating a negative feedback loop. (This same dynamic is often seen with executives and stock options.)

So while tokenization is no one-size-fits-all solution, it will certainly give select layer 2s a tool for encouraging growth and innovation. A large rollup provider like Arbitrum, Optimism or StarkWare could easily create a domino effect by launching a token, forcing other networks to follow suit to stay relevant. Surely a big player in the Ethereum rollup game will give way to the demands of ecosystem participants and venture capital firms in the near future.

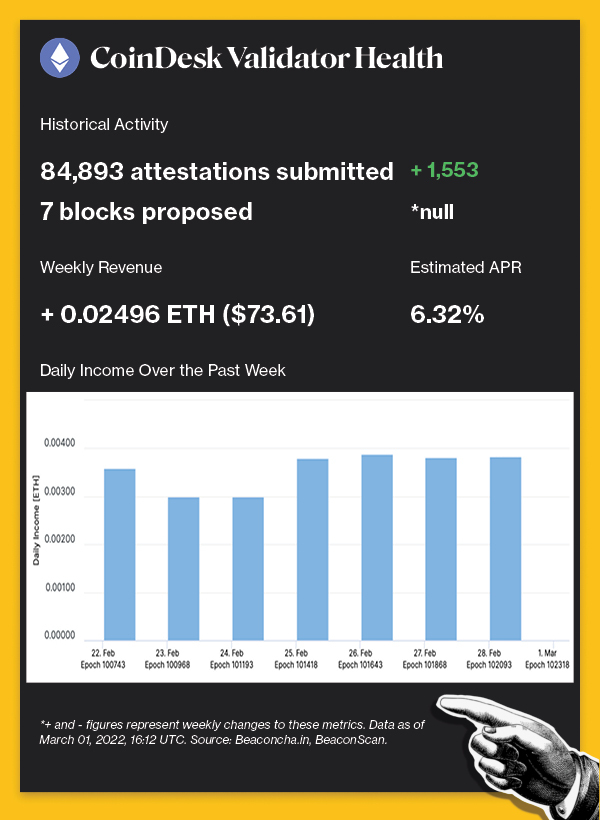

Pulse Check

The following is an overview of network activity on the Ethereum Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

-

The Aave community unanimously approved a proposal to launch the Aave ecosystem on StarkWare in February. BACKGROUND: The bootstrapping will be executed over an estimated three months, in a move to offer Aave V3 on Ethereum rollups. Deliverables for this project include “smart contracts (Ethereum/Starknet) for wrapping and bridging of aTokens,” as Aave V3 focuses on a multi-chain borrowing and lending experience for users.

-

The arrival of zkEVM signals the first EVM (Ethereum virtual machine)-compatible ZK rollup on Ethereum’s testnet. BACKGROUND: zkSYNC 2.0 is intended to be a key component in Ethereum’s scalability endgame. The newly deployed tool for Ethereum’s scaling issues is the first implementation of a ZK rollup that would allow developers to build and deploy decentralized applications in a low-fee, highly scalable layer 2 environment using Ethereum’s native programming language, Solidity.

-

An Ethereum address has received over $5 million worth of ETH to help Ukraine repel the Russian invasion. BACKGROUND: The official Twitter accounts of the Ukrainian government and Minister of Digital Transformation Mykhailo Fedorov – @Ukraine and @FedorovMykhailo – provided this wallet address in an effort to streamline global support for Ukraine against Russia. Cryptocurrency has again proven to be an effective measure for crowdsourcing and funding.

-

KPMG in Canada bought a World of Women non-fungible token just weeks after its first BTC purchase. BACKGROUND: Global accounting firm KPMG’s Canada branch recently marked its entry into digital collectibles by purchasing an NFT from the World of Women collection for 25 ETH. KPMG’s entrance into digital collectables is a step toward the firm building a corporate NFT strategy for its clients.

Factoid of the week

coindesk.com

coindesk.com