Earlier this week, Ethereum developer Tim Beiko and the Ethereum Foundation announced the deployment of the Kintsugi Merge test network.

Kintsugi is a “longer-lived, public testnet” that will allow application developers and users to become familiar with a post-merge Ethereum environment. Heavy usage of the test network will allow clients and Ethereum developers to find any potential issues and further mitigate issues during mainnet’s impending Merge.

This development is another huge step toward Ethereum’s transition to proof-of-stake, showing the significant progress core developers have made since announcing the Amorpha developer network just weeks ago.

Read more about Kintsugi here.

To all the readers of Valid Points, merry Christmas and happy holidays! We will be back next week with the full version of the newsletter.

Welcome to another issue of Valid Points.

Pulse check

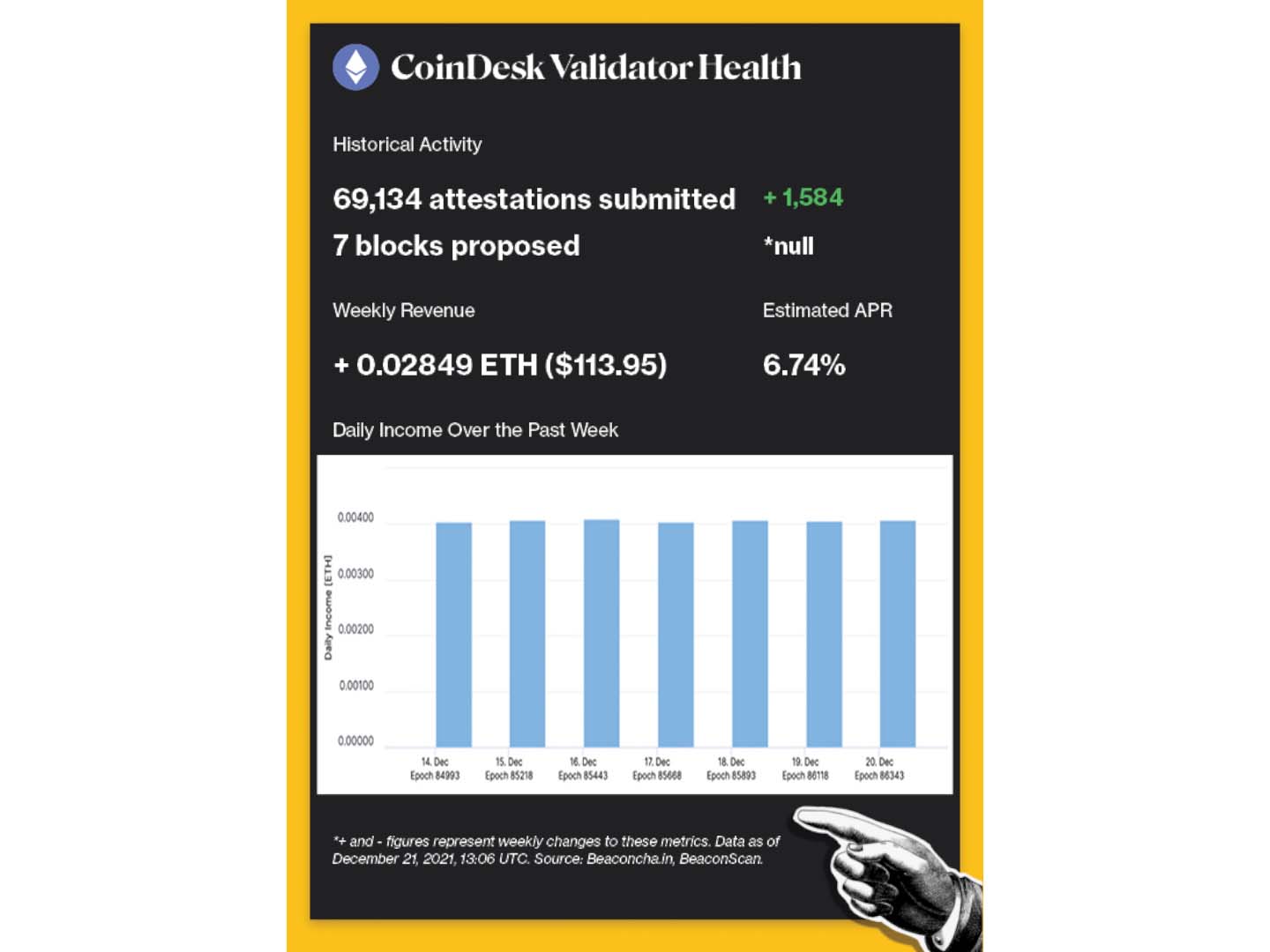

The following is an overview of network activity on the Ethereum 2.0 Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

-

The supply of stablecoins grew 388% during 2021, fueled by decentralized finance (DeFi) and derivative products. BACKGROUND: After starting 2021 with a supply of $29 billion, the stablecoin market capitalization looks to end 2021 around $140 billion. New market participants utilized stablecoins to generate outsized yield in DeFi, purchase crypto assets and collateralize derivatives positions. While USDC and USDT remained in the top spots, MIM, FRAX and UST showed their potential as on-chain alternatives for their centralized counterparts.

-

Financial services giant Goldman Sachs released a research report highlighting blockchain technology’s potential in metaverse and Web 3 applications. BACKGROUND: The report noted blockchain’s ability to independently verify unique digital assets, without the need for a central authority. Goldman analysts believed that a partial elimination of centralized control could disrupt companies currently dependent on user identity.

-

Stablecoin supplier Fei Protocol and Rari Capital approved a protocol merger after weeks of governance discussion. BACKGROUND: The merger between Fei and Rari faced scrutiny from the Rari community, due to terms allegedly more favorable to Tribe holders. While the merger’s success was a big win for DeFi governance, certain aspects of the process highlighted issues with the decentralized autonomous organization (DAO) model, as governance can be shortsighted and slow to implement changes.

Open comms

Valid Points incorporates information and data about CoinDesk’s own Eth 2.0 validator in weekly analysis. All profits made from this staking venture will be donated to a charity of our choosing once transfers are enabled on the network. For a full overview of the project, check out our announcement post.

You can verify the activity of the CoinDesk Eth 2.0 validator in real time through our public validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it on any Eth 2.0 block explorer site.

coindesk.com

coindesk.com