Ethereum (ETH) is showcasing a major uptick in several aspects of its network, pushing a revival in its price action. Ethereum is changing hands for $2,825.07, up by 0.88% in 24 hours and by more than 14% in the past week. The Ethereum story is closely related to the Bitcoin resurgence, as both coins are seeing their best price levels since at least early 2022.

Combating visible resistance

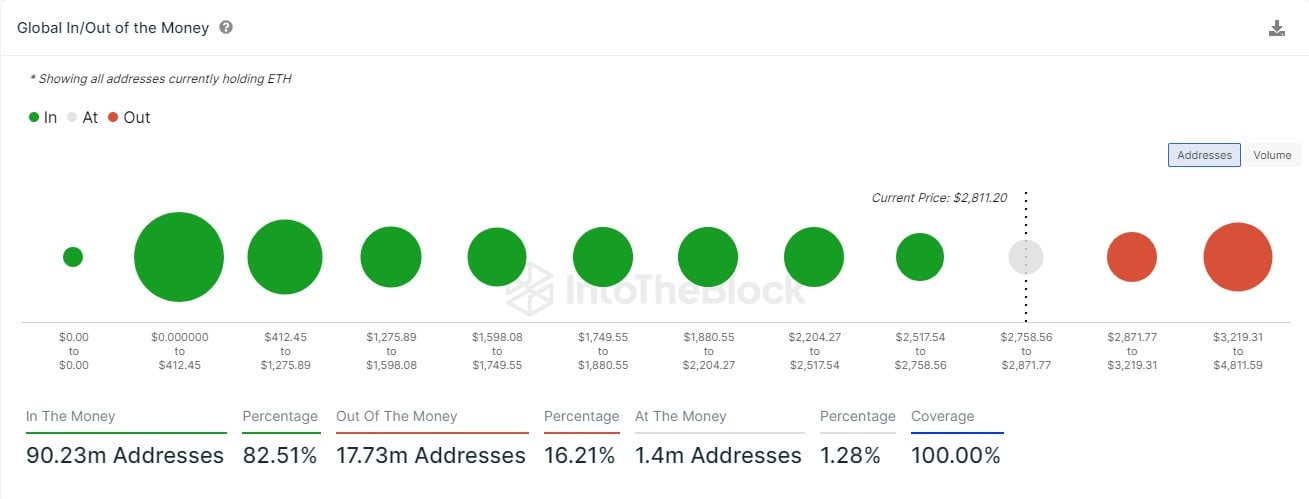

With the resurgence, there is now a general assumption that the price of Ethereum may be on its way toward the $3,500 price mark. One problem lies in this massive projection, and that is the major barrier at the $3,219.31 to $4,811.59 price levels, where a total of 4.74 million ETH were acquired by more than 12.83 million addresses.

Per the In and Out of the Money data from IntoTheBlock, this level is the most significant barrier that needs to be broken for Ethereum to gain the much-coveted liberation.

It is worth noting that this data indicates a significant number of Ethereum wallets bought the coin at the top and might be more receptive to selling off the coin if the price soars toward the point at which they made their purchases.

This resistance is crucial, and it remains to be seen whether or not the current Ethereum fundamentals have what it takes to create the momentum to drive this surge.

Ethereum Dencun Upgrade and ETF hype

Besides the general market momentum that is stirring the ongoing altcoin rally, the forthcoming release of the Dencun Upgrade on the Ethereum mainnet marks one of the most ambitious events that might shift the overall outlook of the protocol. With scalability, low cost and enhanced performance at the heart of the Proto-Danksharding update, Ethereum is set for better days ahead.

Additionally, there is growing speculation that Ethereum might also get its spot ETF product in the United States by May, a move that would usher in more institutional capital and drive the price of the coin, as it is doing for Bitcoin.

u.today

u.today