Cryptocurrency market watchers are eyeing the long-awaited Ethereum Merge this week as the network changes from a proof-of-work (PoW) blockchain to a more energy-efficient proof-of-stake (PoS) system.

The Merge is predicted to reduce Ethereum’s energy consumption by 99.95% – considered to be a positive for the network's sustainability and security. Based on the latest estimates, the changeover will take place late Wednesday or early Thursday.

There’s a lot of speculation among crypto traders as to how it will all play out. The blockchain analytics platform Nansen and data firm Kaiko have published reports on what to watch.

Here are four things about the Merge that the firms are monitoring.

1. ETH funding rates

Both firms are looking at staked ether (stETH) – a type of digital token from the Lido protocol that allows traders to get liquidity even when their ether is staked on the Ethereum blockchain – essentially making it locked up for a long period of time.

In theory, the stETH tokens should trade at the same price as the ether tokens they’re supposed to substitute for. In the lead-up to the Merge, though, they have been trading at a discount.

Nansen’s research showed that Lido, a staking service, holds the greatest amount of stETH at 31%, followed by Coinbase, Kraken and Binance with a combined around 30%.

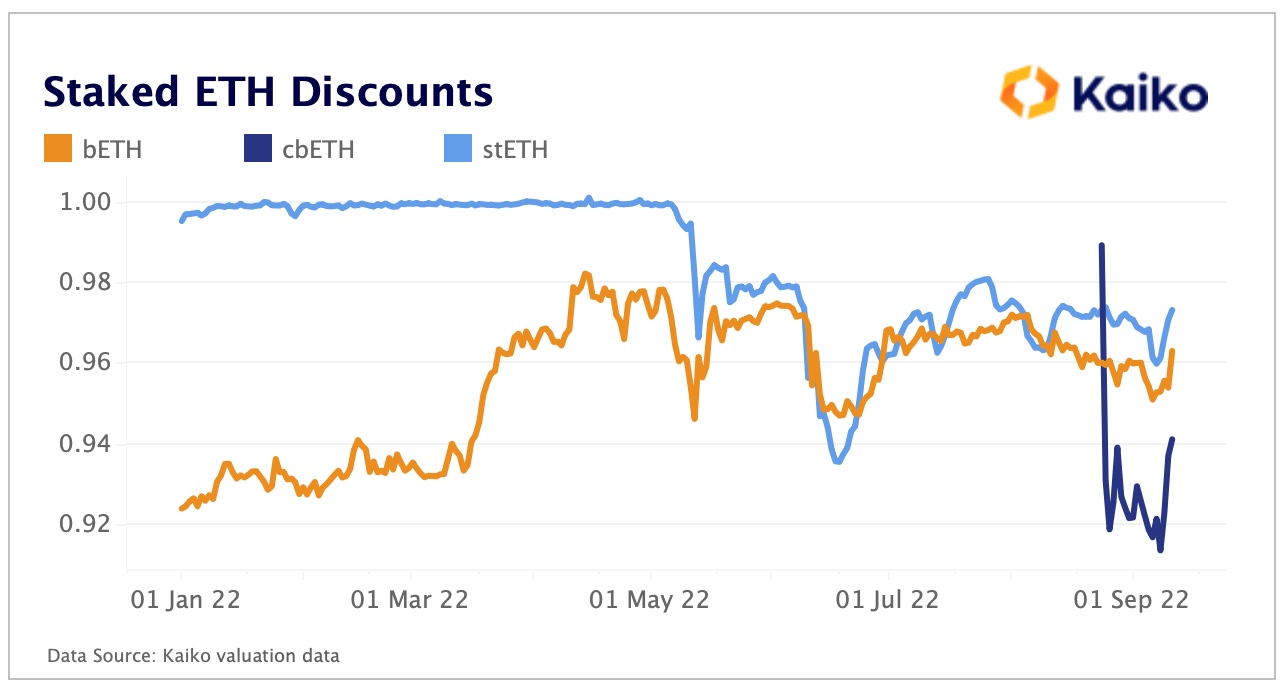

Despite that each token is redeemable sometime post-Merge at a 1:1 ratio, the Kaiko researchers observed a significant discount across the three largest staked ether tokens: stETH from Lido, cbETH from Coinbase and bETH from Binance — reflecting the various risks perceived by investors.

Nansen also highlighted the technology risk of whether The Merge will be properly executed and if the PoS chain will be adopted.

The good news was the improvement in the discounts for stETH and bETH on Sept. 11, according to Kaiko. “Investors might be sufficiently happy with the discount to invest in both tokens, earning both the yield from the staked ETH as well as the price discount once the token is redeemable 1:1.”

3. Ethereum classic derivatives

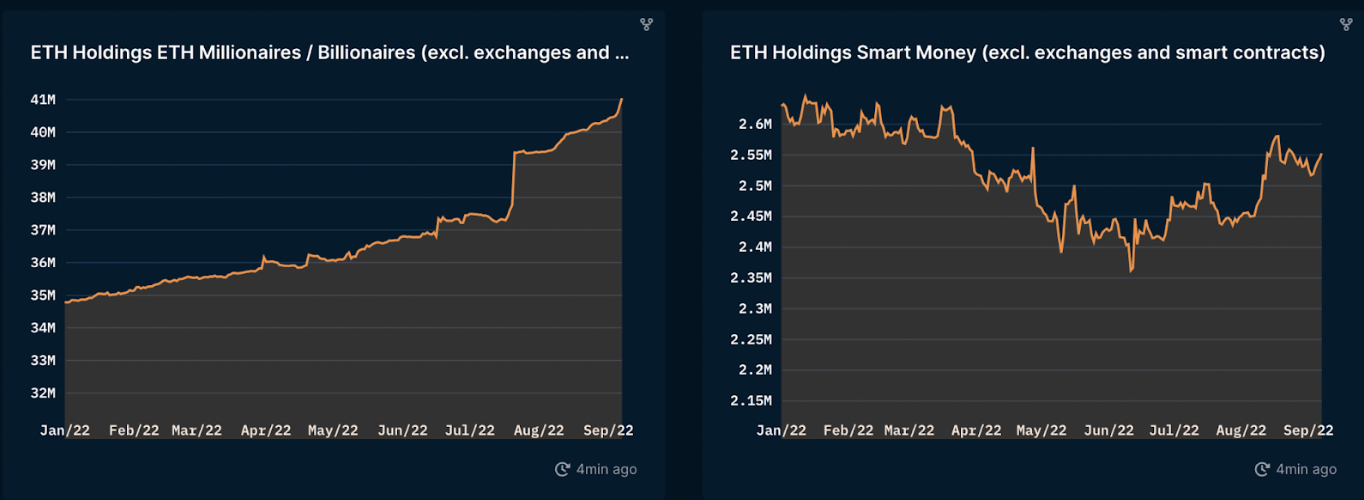

Nansen researchers said that ETH millionaires and billionaires – large holders – have consistently been stacking ether since the beginning of this year, seemingly without being fazed by volatile markets.

Yet the ”smart money,” as Nansen describes it – the capital controlled by institutional investors – has started scaling in after a low in mid-June, researchers pointed out. “They are anticipating some positive price action around the Merge,” according to Nansen.

coindesk.com

coindesk.com