In approximately 7 hours from now, at around 8 pm (UTC) Ethereum will undergo not one, but two upgrades; on significantly more important than the other, but both equally integral to the future of the Ethereum network. So what can we expect from the Ethereum hardfork?

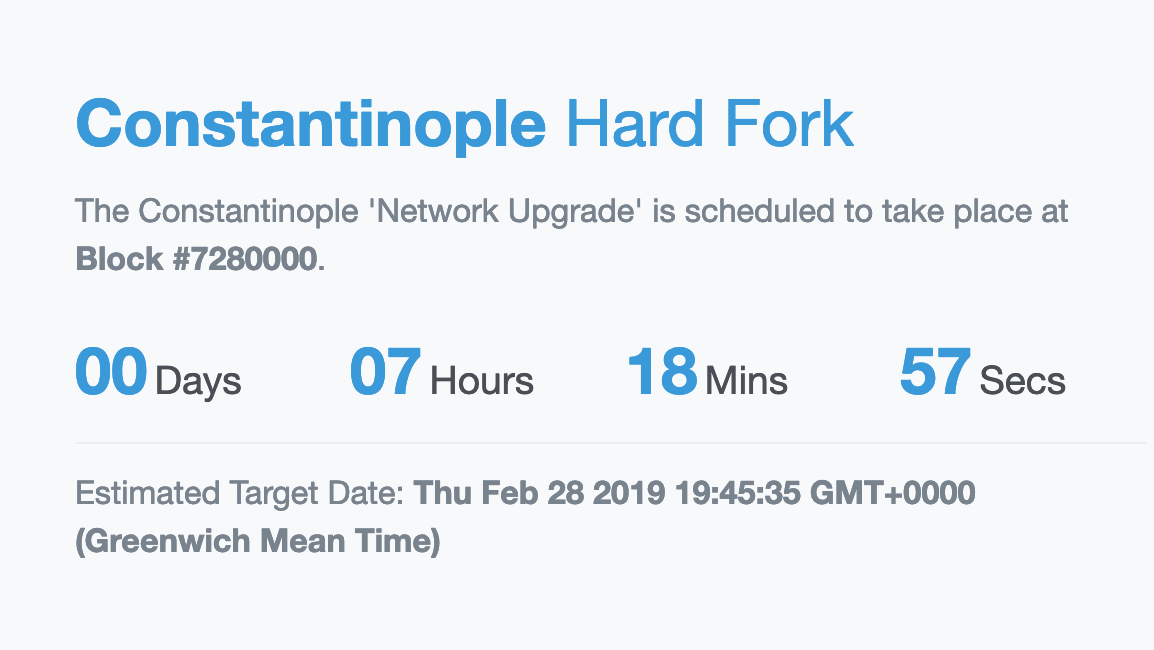

The fork is set to occur at block height 7,280,000 and is sitting at a tantalizingly close block number 7278394. Ether scan currently has a countdown timer, estimating 8 hours until the highly anticipated event.

This hardfork is unusual in that it’s actually two upgrades in one. Today will usher in, improvements from both the long-awaited (and twice delayed), Constantinople upgrade and the St.Petersberg upgrade.

Why was it delayed?

Ethereum aficionados have been waiting for the Constantinople upgrade since August 2018 when it was delayed due to multiple bugs found on its testnet, Ropsten.

Read more: Ethereum's Constantinople hard fork has been delayed over discovered vulnerability

The re-established hardfork date was then set for January 2019, however further delays were caused by the unearthing of an exploit that would have allowed an attack vector enabling would-be hackers to withdraw user funds at a whim.

What will the upgrades achieve?

Ethereum's Constantinople and St. Petersburg network upgrades are less than a week away! Click this post for more info and what you need to do to prepare #Constantinople #StPetersburg

>#Ethereum

— Ethereum (@ethereum) February 23, 2019

St. Petersburg

Interestingly St Petersburg will act as more as an eraser, deleting the previous and failed Constantinople upgrade from the Ropsten testnet, and therefore won't have too much of an impact besides ensuring the smooth running of Constantinople

There are two notable upgrades within Constantinople (both with extremely catchy titles): EIP 1052, and EIP 1234

EIP 1052 (new opcodes)

This update will affect Ethereum's contracts, making them far more efficient and reducing the cost (gas) it takes to implement certain on-chain actions.

Contracts initiated on the Ethereum blockchain a required to validate and check other contracts via a piece of code known as a bytecode.

EIP 1052 will introduce a new opcode that simply checks the hash of a contract, rather than checking the entire bytecode - something which is extremely costly and inefficient, especially in large contracts.

This not only reduces cost but significantly increases the viability for the use of Ethereum’s blockchain within enterprise.

EIP 1234 (delay of the difficulty bomb and block reward adjustment)

This is the big kahuna of updates within the Constantinople fork; an update that will affect everyone, from miners to speculators and everything in-between.

The term difficulty bomb has been used to denote the increasing levels of difficulty when mining Ether, which will eventually lead to an ‘ice age’ in which miners jump ship to fund a less difficult and more profitable cryptocurrency to mine hence the term ‘bomb’; If left untreated this system will likely see the Ethereum network implode.

Luckily it is being treated, by a switch from the current proof of work (PoW) consensus algorithm to Proof of stake (PoS).

Conversely, the difficulty bomb was specifically designed to detonate, this is because even after a switch to PoS miners may still be able to mine via PoW. Due to this The difficulty bomb was put in place to de-incentivize miners from PoW and incentivize a transition to PoS.

However, Casper – the upgrade responsible for implementing PoS – isn’t ready and thus the difficulty bomb has to be delayed for 12 months via EIP 1234 in order to avoid a premature ice age for Ethereum. The update will also include a block reward adjustment, reducing the block reward from 3 ETH to 2 ETH in order to supplement the delay of the difficulty bomb.

What does this mean for price?

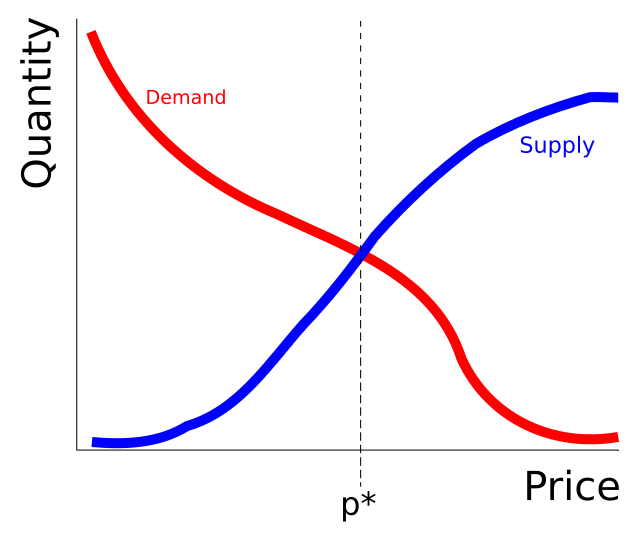

One theory from Chepicap’s own technical analysis expert, David Borman, is that the reduction of the block reward will results in a bear stretch for ETH in the short term. This is due to miners selling ETH in order to cover the increased cost of mining.

However, the economic logic behind the decreasing of the block reward is that in the long term, ETH will see exhibit a lower demand, and if supply and demand principles hold true this should yield a higher demand for the #2 cryptocurrency.

This could also be catalyzed in conjunction with an overall bull market, (providing we have one). Looking to the retrospective trend last year in which ETH followed the market, a rise in the gross market cap of all cryptocurrencies could provide ETH with a nice long term outlook, especially when combined with the idea of a lowered supply and a higher demand.

For all updates regarding the Ethereum upgrade, and everything else in the crypto space, keep tunes to Chepicap!

Read more: 7 Ethereum long-term price predictions by crypto experts: $1 million?!; Most important things that will occur with the Ethereum upgrade