As the cryptocurrency market started to crash, many projects became very risky. Those blockchain companies tend to over-capitalize cryptocurrencies. In bear markets, cryptocurrencies become valued less, hence those companies become less worthy as well. To fight for survival, they start slashing services and benefits to reduce their risk and exposure. Bancor is one of those crypto projects that is removing today the very same feature they showed off to attract thousands of investors. Is Bancor risky or safe? Why are Bancor investors wary and considering liquidating their positions? Let’s investigate.

What is Bancor Crypto?

Bancor is a decentralized protocol that was launched in 2016. It allows users to convert digital tokens without the necessity of a centralized exchange. The protocol compensates users who stake their tokens in its platform after utilizing their assets to facilitate trades for other users. Users who deposit assets in the pool are rewarded with fees paid by those who trade them.

Bancor functions as an Automated Market Maker (AMM) in the crypto market, providing liquidity. Bancor, on the other hand, goes a step further by rewarding users for building and managing these asset pools. The main benefit of staking on Bancor is that it protects users from Impermanent Loss. The primary and utility token of the network is Bancor Network Token (BNT), an ERC-20 token. It also serves as the network’s reserve currency for all smart tokens.

How does Bancor Work?

Bancor works similarly to a Decentralized Exchange (DEX), allowing users to exchange numerous tokens in a pool. Each pool has a pair of tokens as well as a BNT coin reserve. Unlike other DEXs, however, Bancor’s AMM services are powered by their users. As a result, depositors rule the protocol, as their money enables Bancor’s worldwide trading. Depositors profit from their holdings on the platform because of this. Traders who trade tokens on the exchange, on the other hand, pay fees to the network in order to earn money. Depositors are paid these fees under the protocol.

Why is Bancor under Fire from its community?

In a sudden move, Bancor announced that they paused their “Impermanent Loss” protection. This feature was one of the main reasons why investors flocked to this protocol. The reason for this announcement was that the cryptocurrency market was highly volatile recently.

However, the crypto market has always been volatile and this is no news. Most investors became angry and said that they would directly liquidate whenever they have the opportunity to do so. This event would most likely drag BNT prices lower.

So the one thing you sold everyone on gets taken away by the team…nice🤦♂️ I’ll be dumping ever asap into link what a joke. So price plummets, not making shot on bnt pool, and no IL protection. You do know people are using to make money not lose it exponentially?

— TheFetztizzle (@thefetztizzle) June 20, 2022

Bancor Price Prediction – Where will BNT prices crash towards?

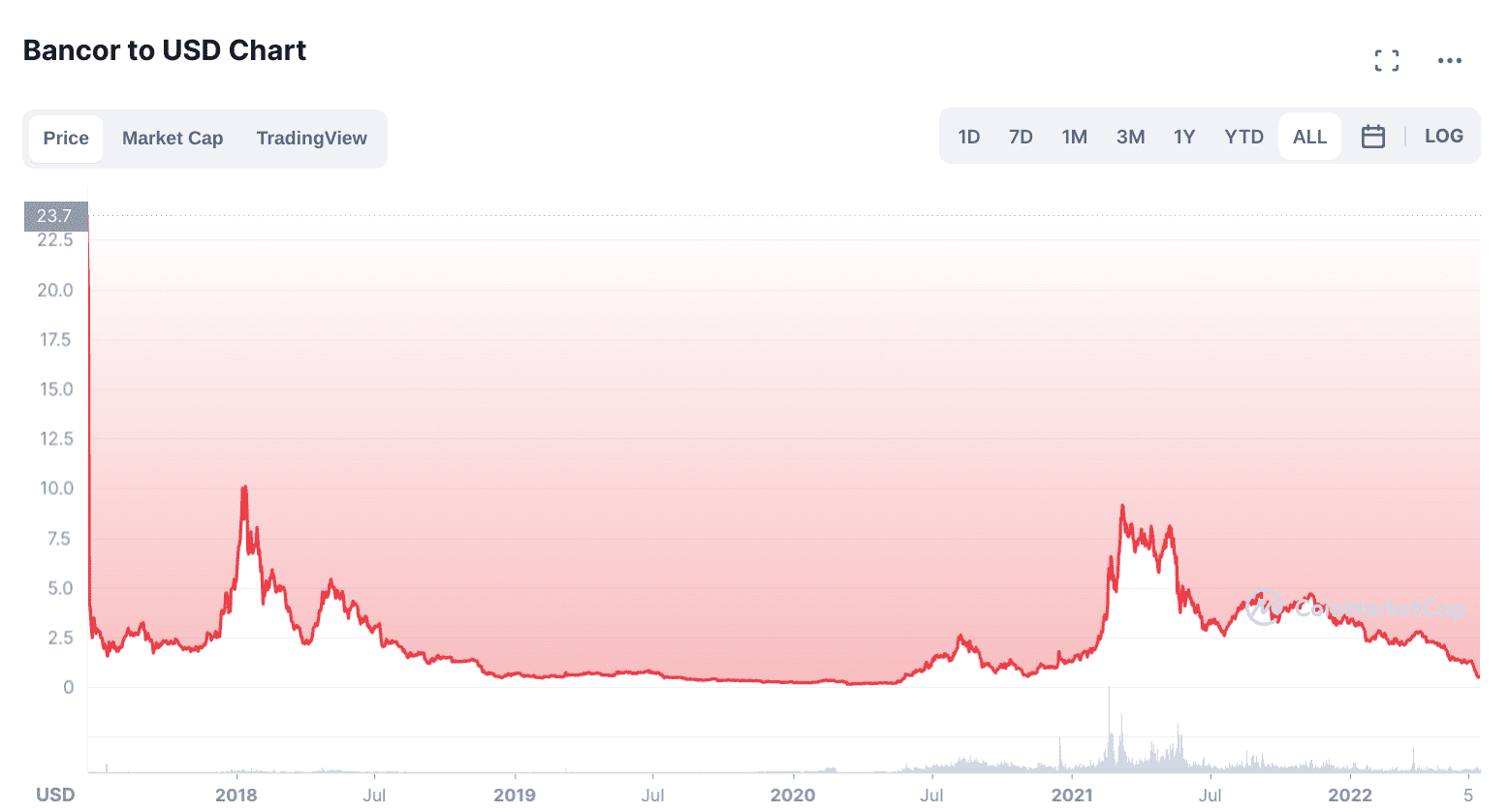

BNT prices have already taken a heavy toll since November 2021. In fact, prices fell by more than 89% when most cryptocurrencies in the crypto market reached their ATH prices. If the crypto market continues on its bearish trend, we might see BNT prices fall towards the strong support price of $0.20. This is where Bancor price consolidated the most between 2018 and 2020.

cryptoticker.io

cryptoticker.io