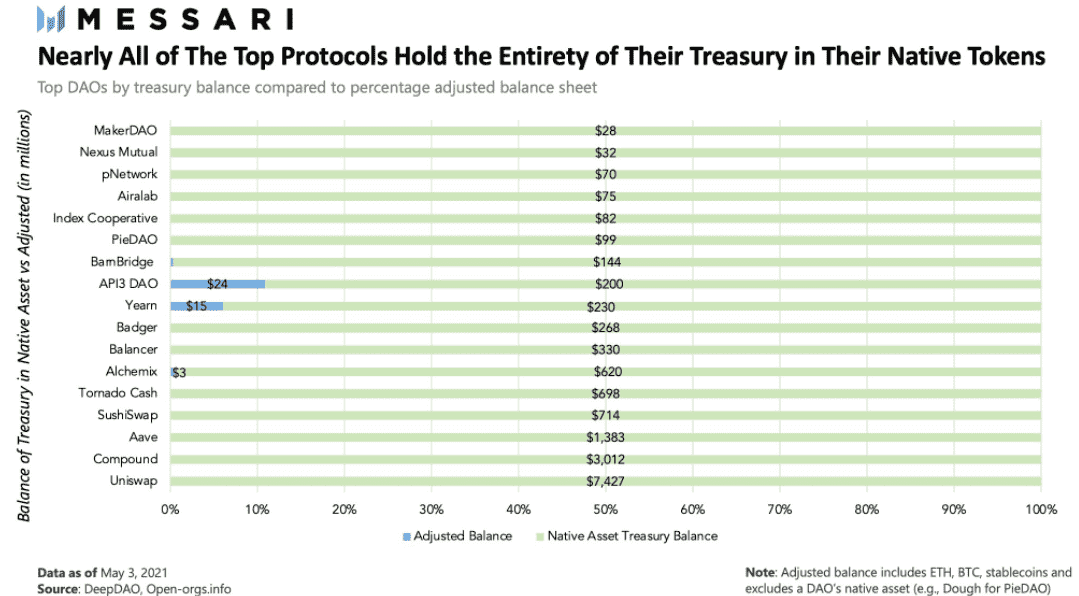

Continuing with its buyback and build theme, Yearn project has purchased an additional 8.15 YFI for $408,000 at an average price of $50,121 per YFI.This purchase also includes two previous smaller buybacks that weren't announced by the team; the last one was bought at $60k.“Tradfi companies do buybacks on the way up. Yearn does buybacks on the way down. Built different,” commented Ceterispar1bus.Falling to $58,655 in the past 24 hours in line with the rest of the cryptocurrency market, the YFI price has already recovered above $68k. The DeFi blue-chip is currently down 25% from ATH of $90,786, five days back, as per CoinGecko.The decentralized finance (DeFi) protocol has earned $20 million in revenue since launch, with its total value locked (TVL) surpassing $4 billion.However, the issue with Yearn’s treasury is the fact that almost all of it is dominated by the native asset YFI, much like other projects like Uniswap, Aave, SushiSwap, MakerDAO, and many others, as noted by Mason Nystrom, a research analyst at MessariCrypto. Over the past year, the bull market has caused DAO treasuries to balloon, with the top ten treasuries processing balance sheets worth hundreds of millions or billions of dollars. However, Nystrom points out that “DAOs in their current form are set up for financial failure.”This is because nearly all of them have all of their assets in their native token, making them subject to the market's turbulence. These treasuries have no proper risk management to cover immediate expenses and weather uncertain tides. Roberto Talamas, another researcher at Messari said,

Over the past year, the bull market has caused DAO treasuries to balloon, with the top ten treasuries processing balance sheets worth hundreds of millions or billions of dollars. However, Nystrom points out that “DAOs in their current form are set up for financial failure.”This is because nearly all of them have all of their assets in their native token, making them subject to the market's turbulence. These treasuries have no proper risk management to cover immediate expenses and weather uncertain tides. Roberto Talamas, another researcher at Messari said,

“As DAO treasuries continue to grow, appropriate fund and risk management frameworks should play a bigger role in the treasury management process to ensure protocols are well-capitalized during different market environments.”

bitcoinexchangeguide.com

bitcoinexchangeguide.com