Leveraged Yield Farming is Risky

Yield-farming —the art of staking, lending, or borrowing crypto assets to earn crypto rewards—is one of the chief reasons Decentralized Finance (DeFi) is highly popular in the crypto community. As a result, many crypto users have taken up yield-farming as a source of passive income.

While there are many forms of yield-farming available in DeFi, one of the prominent ones is liquidity mining. In general, liquidity mining supports a protocol's function by lending liquidity to the protocol in the form of a token pair known as liquidity pool (LP) tokens and earning crypto rewards in return. The LP pair must be split in an equal ratio. For instance, to provide BNB/BUSD liquidity with $100 worth of BNB would require pairing it with $100 worth of BUSD.

Liquidity mining is highly vulnerable to a type of risk known as impermanent loss. Apart from LP tokens formed with stablecoins, every other kind of LP pair is prone to impermanent loss due to the volatile nature of cryptocurrencies. The risk of impermanent loss becomes more remarkable when one delves into leveraged yield farming—an advanced type of liquidity mining where users borrow crypto assets to amplify their returns potential.

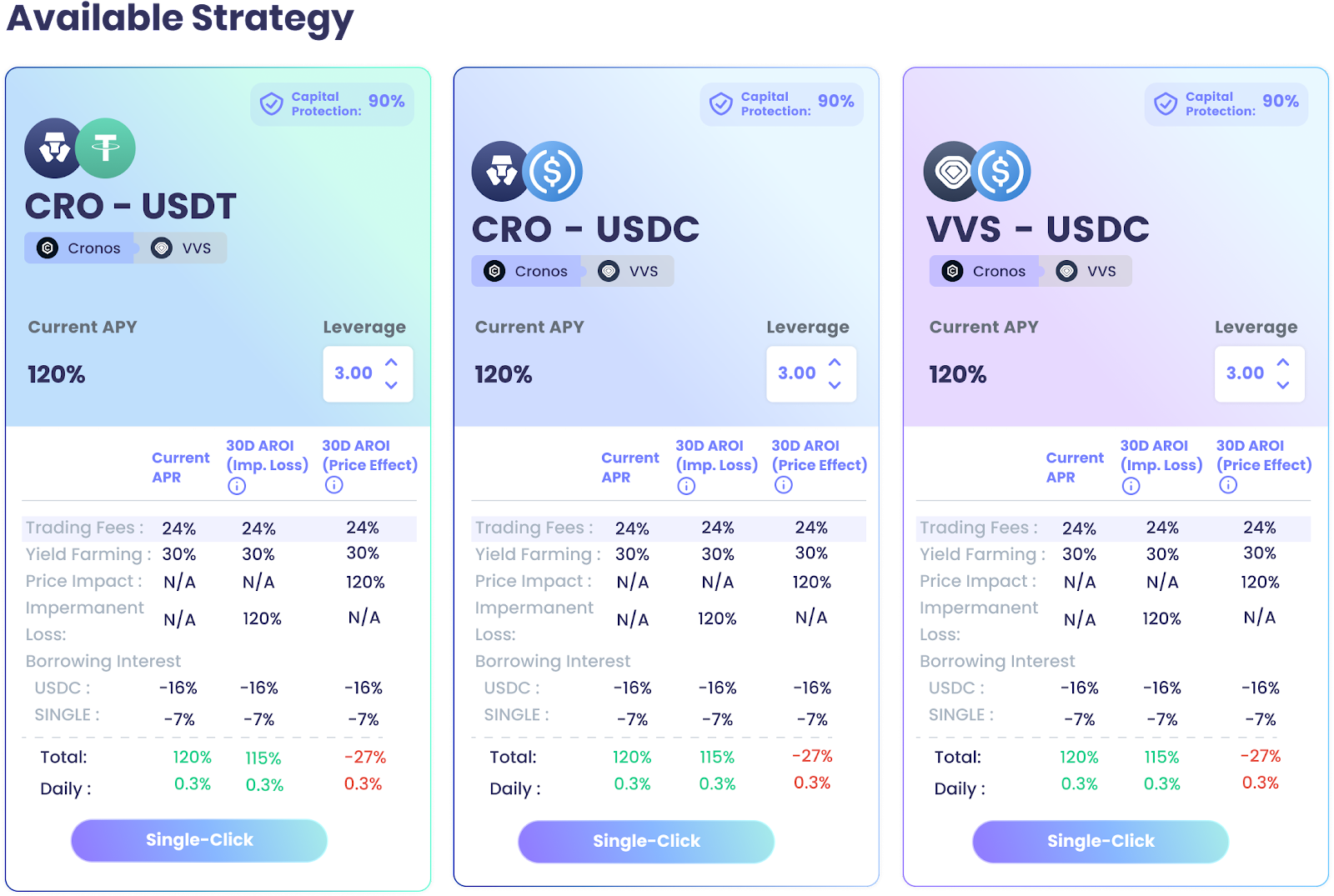

Many people find leveraged yield-farming attractive because it offers the possibility of quickly multiplying profit, but it also comes with a greater risk of impermanent loss and liquidation. Single Finance uses Pseudo Market-Neutral Strategy to minimize users' exposure to impermanent loss and rapid liquidation while still helping leveraged yield farmers to earn high returns.

Typically, most leveraged yield-farming protocols protect the lending pool by setting a liquidation threshold for the Liquidity Pool. If a borrower's debt ratio exceeds the threshold, the system will liquidate the borrower's assets and recover the lending pool's funds. Then whatever is left after the recovery is returned to the borrower.

Unfortunately, while the liquidation threshold is a standard strategy to protect lenders' funds, very few protocols have any strategy to protect the capital of yield farmers who provide leveraged liquidity. To further safeguard the capital of leveraged yield farmers from quick liquidation, Single Finance created a second layer of protection called Capital Protection.

Overview of Capital Protection

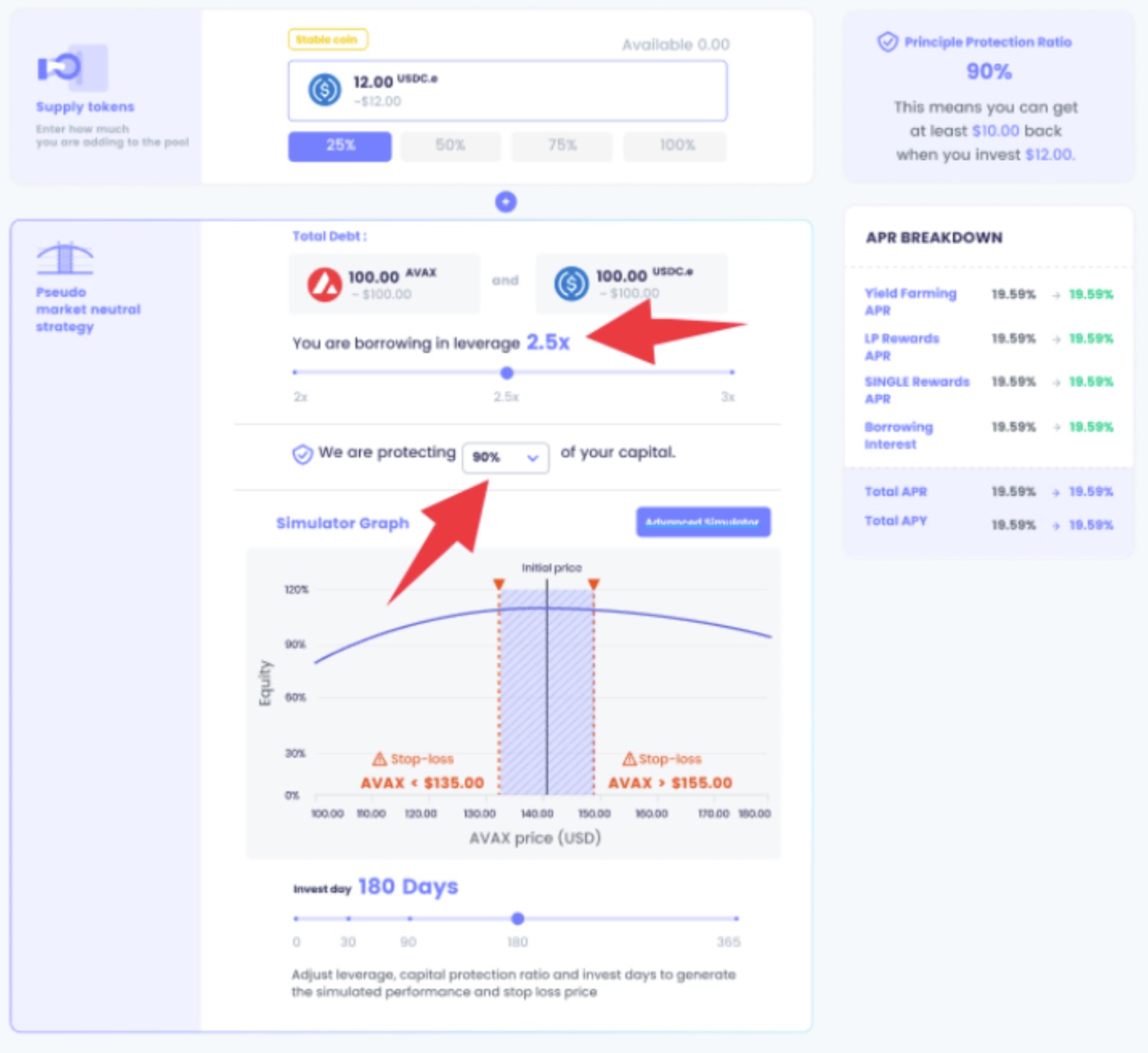

Capital protection is a safety strategy implemented by Single Finance to help users control what percentage of their capital is exposed to impermanent loss and liquidation risks. In terms of its objectives, it is similar to the stop-loss feature in Futures Trading. Capital protection applies a ratio that compares a user's leveraged position against their initial capital in USD.

If the user's loss position exceeds the ratio, it will trigger liquidation and save a substantial part of the user's capital and prevent it from being eaten up. Single Finance offers minimum capital protection of 85%, meaning users will not lose more than 15% of their capital before their positions get liquidated.

How To Use The Capital Protection Feature:

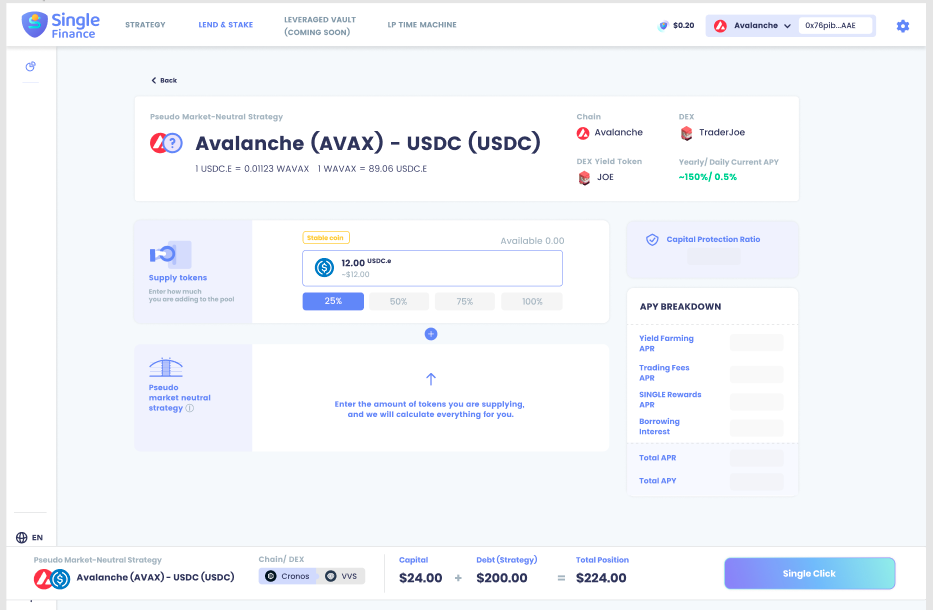

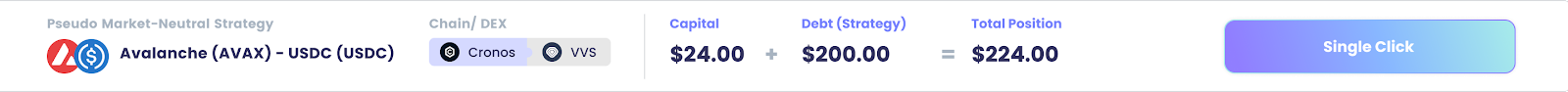

- Input the amount of capital you want to contribute.

- Your debt position will be generated under the Pseudo Market-Neutral Strategy using the default 3x leverage.

- Adjust the Capital protection ratio and leverage to your preferred levels.

- Review the details of your final position, and click 'Single-click' to complete the process.

For more details about Single Finance's implementation of the Pseudo Market-Neutral Strategy and Capital Protection, take a look at this documentation.

Closing Thoughts

Capital Protection is a very thoughtful user-focused utility. It demonstrates a genuine desire for a decentralized finance protocol to help users avoid burning their fingers in the risk-laden world of leveraged yield farming.

Newbies in leveraged yield-farming who are careful about exposing their capital to lethal risk would find Single Finance's capital protection very helpful. Users can set up their positions for once without the familiar volatility-induced crypto anxiety, knowing that a significant portion of their capital is safe even if the market goes against them.

What is Single Finance:

Single Finance is actively working to help keep users’ leveraged yield farming positions safe and stable by protecting their principal with specific strategies. Single Finance tracks users' performance based on their principal marked to USD, ensuring that both parties know their profits. Single Finance also states they are the first to introduce a historical performance tracking database to help you pick your favorite liquidity pairs with quantitative metrics.

They claim they embrace DeFi and are grateful to be able to play a part in the whole DeFi ecosystem. Single Finance serves as a DeFi 2.0 protocol by introducing automated strategies to everybody, amplifying the liquidity provided to the entire ecosystem. As a proud owner of SINGLE tokens, you can shape the future of Single Finance and the future of DeFi.