For years, FinTech has made financing easier and faster. Yet, throughout this time, it remains on the same financial infrastructure—centralized, regulated institutions. In many ways, the blockchain space marks a revolutionary divergence as it only requires the internet. Further pushed by fiat currency devaluation, the DeFi space is beginning to outshine FinTech, at the same time as their services merge.

The Pandemic Boosted FinTech, but it Seems Temporary

Have you noticed an acceleration shift between 2019 and 2021? This can be construed in many ways, bad or good. We have seen an historic money supply increase, rising inflation, social unrest, and global supply chain disruptions that recently blasted off semiconductor stocks by over 100% amid a computer chip shortage.

On the other hand, it is clear that the Great Digitization of all things is under way, as outlined by World Economic Forum. Even prior to the pandemic, many businesses planned to digitize their operations to raise cost-efficiency. After the pandemic, digital transformation became an essential measure rather than one of extra benefit.

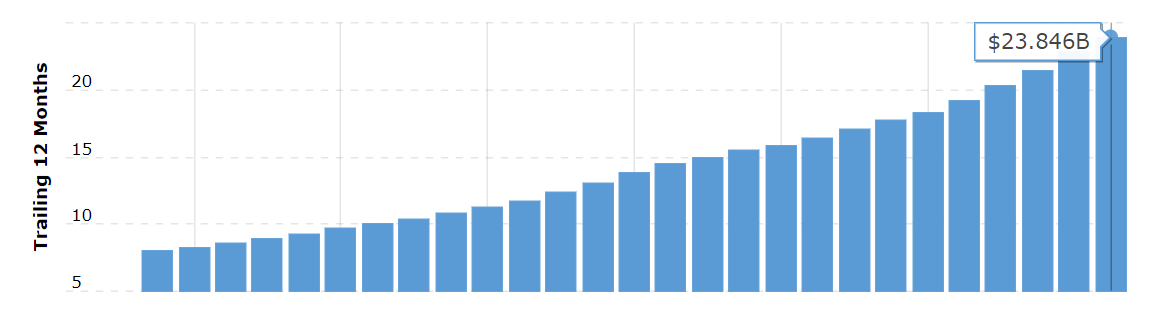

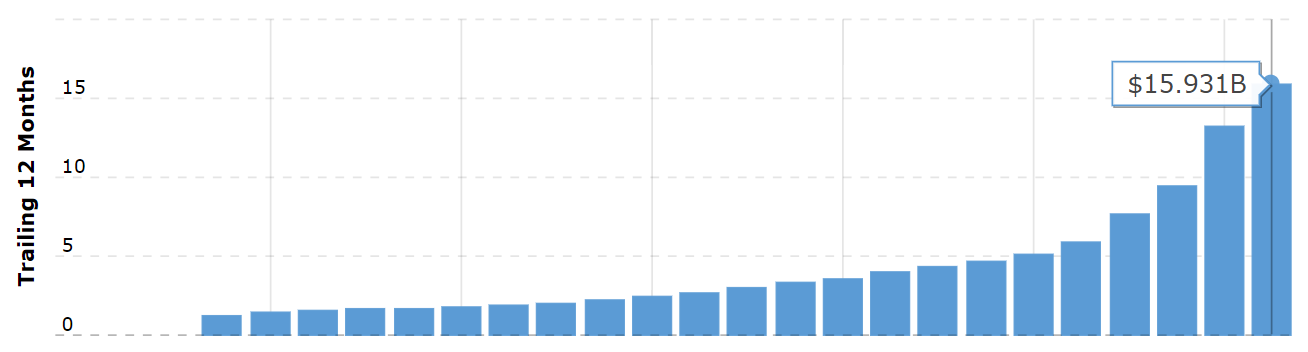

Financial technology saw immediate windfalls. As FinTech frontrunners, Robinhood, PayPal, and Square, each gained greater ground faster than ever before.

While PayPal’s revenue gains were impressive, it had already established itself as a global payments platform. Its closest competitor Square achieved even greater results with its super-simplified and convenient payments solution Cash App.

Of course, as lockdowns and social distancing normalized, Robinhood seemingly became the go-to platform to replace gambling venues and sports bars. As trillions of stimulus packages flooded the economy, Robinhood got a hefty cut, increasing its revenue from 2019 to 2020 by 245%. Yet, there are other entrants into the market that show even more impressive results.

The FinTech to DeFi Pipeline

The Great Digitization, or the Fourth Industrial Revolution, is best understood as a gateway toward blockchain tokenization. PayPal, Robinhood, and Square may have innovated the financial sector on the backbone of banks, but the crypto space has little need for banks. This makes decentralized finance – DeFi – a particularly enticing venture.

Furthermore, both PayPal and Robinhood have shown their vulnerabilities. PayPal’s security and privacy policies have been the subject of public scrutiny, while Robinhood’s payment for order flow (PFOF) business model has illuminated numerous conflicts of interest in the US stock market, as the practice is outright illegal in other Western nations.

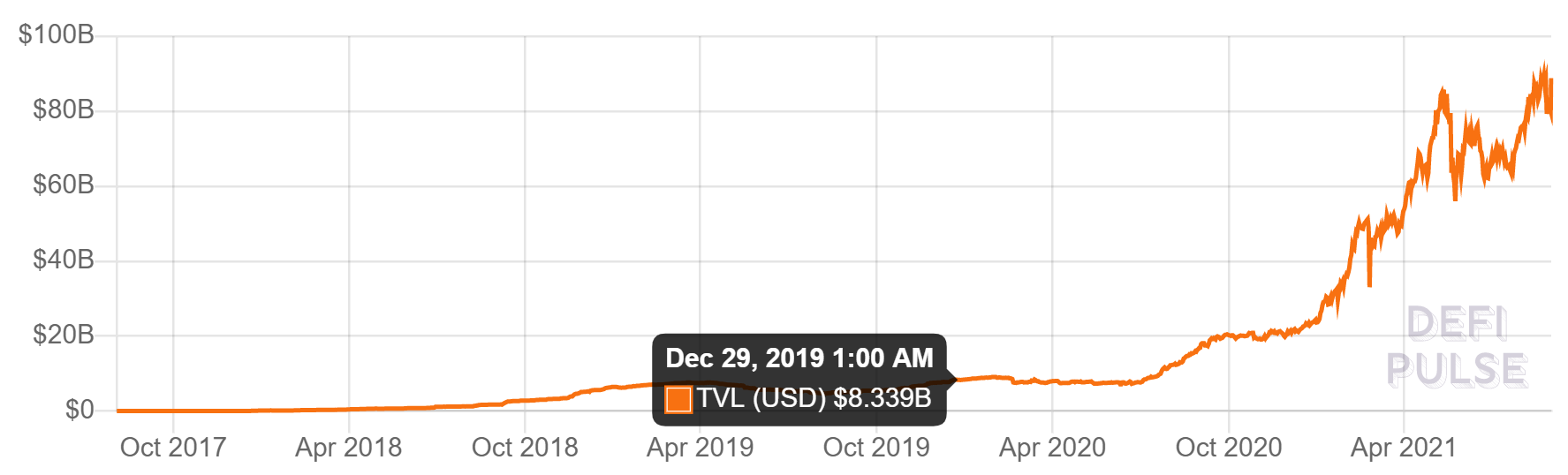

As a result, the value locked within the DeFi sector is overshadowing FinTech, at a rapid rate.

In the same period, the FinTech frontrunners – PayPal, Robinhood, Square – each began to integrate cryptocurrencies within their payment and trading platforms. Square alone reported $2.72 billion in Bitcoin revenue for Q2 2021. Interestingly, for Q2 2021, Robinhood reported $232 million in revenue from crypto-based transactions.

Yet, Robinhood’s gains from venturing into the crypto space are still less than Axie Infinity. This one blockchain game created by a small team of Vietnam-based developers generated $330 million revenue in the last month, overall increasing its growth by 6500% since last year. If that is not enough of an indication to illustrate a FinTech to DeFi pipeline, another example is even more telling – 1inch DeFi protocol.

1inch is Setting a New Record for Valuation Growth

In the first half of 2021 alone, 2,600 new cryptocurrencies and tokens were created. Each one represents a speculative investment opportunity. This also means that token pairs will have to be exchanged rapidly. And this can only be achieved with Automated Market Makers (AMMs) that provide liquidity protocols.

With easy to use tools such as the popular MetaMask wallet in hand, it only takes a couple of minutes to become a liquidity provider (LP) for token swaps. In exchange for being an LP, holders receive rewards any time a trader taps into their liquidity pool for a token exchange. Hence, holders become yield farmers.

While DeFi has no shortage of these decentralized exchanges (DEXes), 1inch collects the best token swap prices across them and conveniently places the best deals in front of the trader. It’s not an exchange, but rather an aggregator. Accordingly, 1inch has drawn investors across the FinTech space.

Founded by Sergej Kunz and Anton Bukov, 1inch DEX aggregator launched in August 2020, having received funding from Galaxy Digital, Binance Labs, Dragonfly Capitalists, and half a dozen other venture capitalist firms. Following 1inch’s launch on Optimistic Ethereum, it is gaining further attention. According to The Block, the rising DeFi star is seeking to raise $70 million in a Series B round token sale at a $2.2 billion valuation.

This is on top of the most recently announced integration with BitPay app.

2/

— 1inch Network (@1inch) August 31, 2021

🧐 From now on, #BitPay Wallet app users can take advantage of 💸 lucrative rates for #crypto swaps offered by #1inch without leaving the 📱 application, making the user experience seamless and adding to the many ways BitPay Wallet holders can live life on crypto.

As you can see, the well-oiled Fintech to DeFi pipeline accelerates what previously took years to accomplish. For instance, take a look at how long it took FinTech frontrunners to breach the $1 billion valuation milestone.

- Robinhood launched in 2013. In 2017, it reached a valuation at $1.3 billion.

- Square launched in 2009. In 2011, it reached a $1 billion evaluation with a Series C funding worth $100 million.

- PayPal launched in 1998. In 2002, it was sold to eBay for $1.5 billion.

In a year’s time, 1inch’s valuation is posed to be almost double that of these iconic FinTech firms. It is safe to say that this not only shows the demand for DeFi, but that investors too see that blockchain’s decentralized governance is poised to be far more cost-effective than FinTech platforms. One only has to remember that another DEX – Uniswap – generated 77% of Coinbase’s trading volume with 33x fewer employees.

tokenist.com

tokenist.com