Decentralized finance (DeFi) protocols are surging in popularity – just as signs pile up that big centralized crypto exchanges are going in reverse.

According to data analytics platform Nansen, most DeFi protocols have experienced double-digit percentage growth in users and transactions in the past seven days, a sign of vitality following the collapse of FTX.

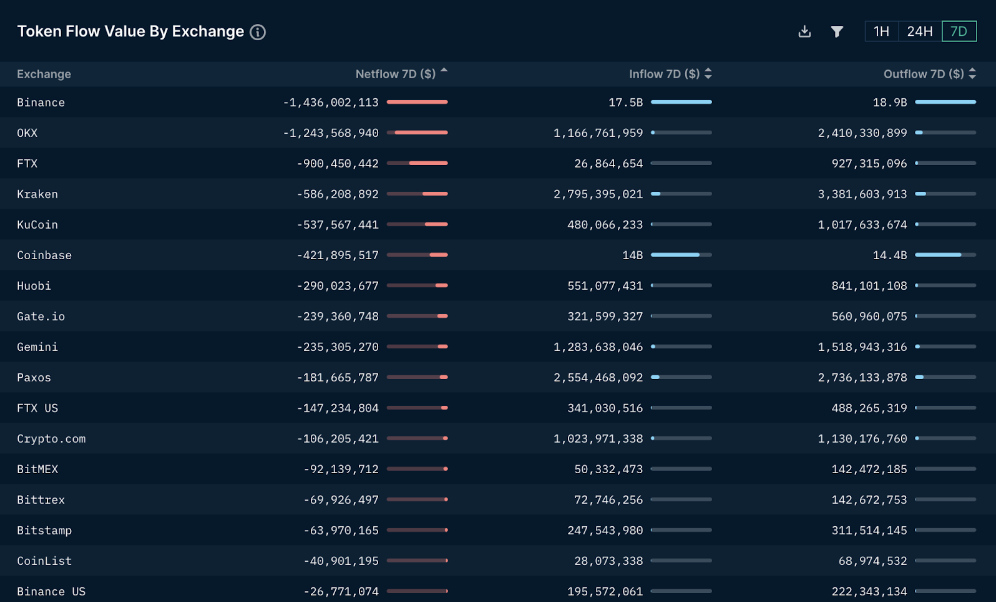

Among the centralized exchanges, Binance experienced the largest net outflow – outflows less inflows –, of roughly $1.44 billion among exchanges in the past 7 days. This means that users on Binance have removed $1.44 billion more than they have deposited. (Nansen’s token flow value by exchange accounts for only ETH and Ethereum-based ERC-20 tokens.)

OKX ranked second with a negative net flow of $1.24 billion. FTX has the third largest net outflow of $900 million, while Kraken suffered a net outflow of $586 million.

According to Nansen, in the past 7 days, Binance, OKX, FTX, Kraken, KuCoin, Coinbase, Huobi, Gate.io, Gemini, Paxos, FTX US and Crypto.com have experienced a combined net outflow of $6.33 billion; Users have deposited $42.03 billion into those exchanges but withdrew $48.35 billion.

The significant outflows likely highlight a lack of user confidence and trust in holding funds on centralized exchanges.

coindesk.com

coindesk.com