Decentralized exchanges, or DEXes, are cornerstones of the crypto industry. They eliminate intermediaries that are commonplace at centralized exchanges like Coinbase and Binance.

Today, several governance tokens behind the top DEXes are enjoying massive price increases.

Uniswap’s native token UNI is up 10.4% at press time and is currently trading hands at $29.22.

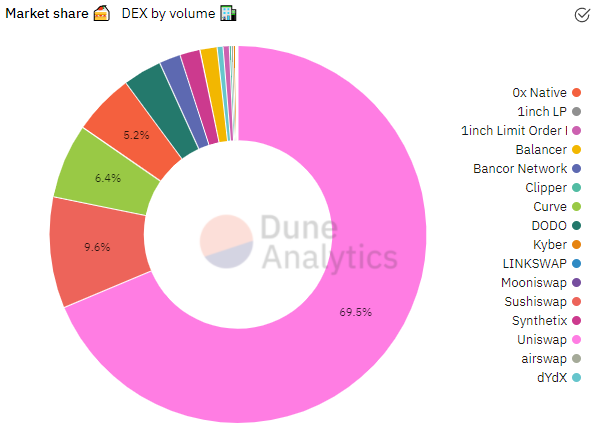

Built in 2017, Uniswap lets users trade any ERC-20 token for a small fee. It also allows users to earn passive interest on their idle assets by adding them to the protocol and improving a trading pair’s liquidity. At press time, it is the most dominant DEX on the market, commanding nearly 70% market share.

What’s more, the platform is processing trading volumes on par with centralized counterparts in FTX Exchange and Kraken over the last 24 hours, according to CoinGecko.

SushiSwap’s native token, SUSHI, is currently up 10.4% and is trading at $10.33.

A near-identical fork of Uniswap, SushiSwap has recently rolled out several new features to the platform.

The four new products, which have been bundled under the brand “Trident,” continue pulling ideas from other decentralized finance (DeFi) protocols, too.

Its ConstantProductPool resembles Uniswap’s 50/50 token pool, which asks liquidity providers to stake both sides of a trading pair. The HybridPool mimic’s Curve Finance’s optimization for trading assets that reflect similar values, like stablecoins. The ConcentratedLiquidityPool draws inspiration from Uniswap’s v3 launch that lets liquidity providers specify which trading range they want to concentrate their liquidity. And, finally, the WeightedPool lets users manually adjust the balance of pooled tokens, similar to Balancer.

The SushiSwap team has also been hard at work building out its non-fungible token (NFT) platform, called Shoyu.

🍣 Here's a sneak peek of Shoyu: @SushiSwap's NFT Platform

- Immersive Gallery & 3D Metaverse

- Social Token

- On-chain & off-chain exchange

- Bidding strategies

- Royalties distribution

- Fractional ownership

- Multi-chain supporthttps://t.co/decVPlEKRz— LΞVX (@LevxApp) July 8, 2021

Finally, 1inch Exchange’s native token, 1INCH, is also enjoying a bullish lift. The token is up a whopping 12.5%, at press time.

Though 1inch is technically a DEX aggregator, meaning it sources prices from a variety of different DEXes, including SushiSwap and Uniswap, it has become a helpful resource to mitigate gas fees when trading.

This is because 1inch previously used a gas token called CHI which reduced the cost of trades by up to 40%. This token, and others like it, have become obsolete since Ethereum upgraded.

Instead, the 1inch Foundation has voted to distribute refunds in the form of the 1INCH token to compensate users for the cost of gas. A user that stakes 100 1INCH tokens on the platform will, for example, see a 25% gas refund in the native token.

1/

🚨 #Attention! The London hard fork activated EIP-1159, which dramatically changed the #Ethereum gas fee model.

As a result, the #1inch Foundation decided to adjust gas refund requirements.#ETH #DeFi #crypto https://t.co/ZIfDk7oFKC

— 1inch Network (@1inch) August 7, 2021

The reasons behind each token’s latest rise are varied. Still, a common denominator among all three is the underlying protocol on which they are built: Ethereum.

Following the Ethereum hard fork last week, it would now appear that DeFi tokens are enjoying the benefits of the protocol’s latest upgrade.

decrypt.co

decrypt.co