Popular lending platform Aave revealed its institutional product Aave Arc, previously Aave Pro, at a closed-door DeFi for Institutions event. Held by the Dei Alliance, KPMG, and The Block, the event hosted several DeFi projects, with Aave announcing that it is ready to bring institutions into the fold. Chris Blec, a DeFi analyst, shared the slides on Twitter presented by the project at the event, showing that the Arc is a permissioned liquidity pool for institutions.  Built on battle-tested Aave v2 software, suppliers will provide liquidity by depositing virtual assets, and borrowers can borrow pooled funds by supplying collateral. The system relies on asset pools where suppliers receive liquid yield from borrowers in the form of tokens accrued in real-time, and borrowing yield increases as more assets are borrowed from a pool. Before catering to the institutions, its smart contracts have been rigorously audited by several firms CegiN, ConsenSys, Diligence, PeckShield, and Sigma Prime, with formal verification from Certora. “Safety Module was built to allow stakers to cover the risk of deficit for other participants,” reads one slide on security, audits, and stress testing. This product isn’t for degen retailers who prefer anonymity and decentralization; this product follows KYC and AML compliance. Users will go through compliance onboarding procedures by one or more regulated intermediaries called whitelisters, who are given veto powers to support continued regulatory compliance and provide appropriate terms and disclosures to users. Also, “simplified liquidity BTC, ETH, USDC, and AAVE liquidity to align with institutional demand.”

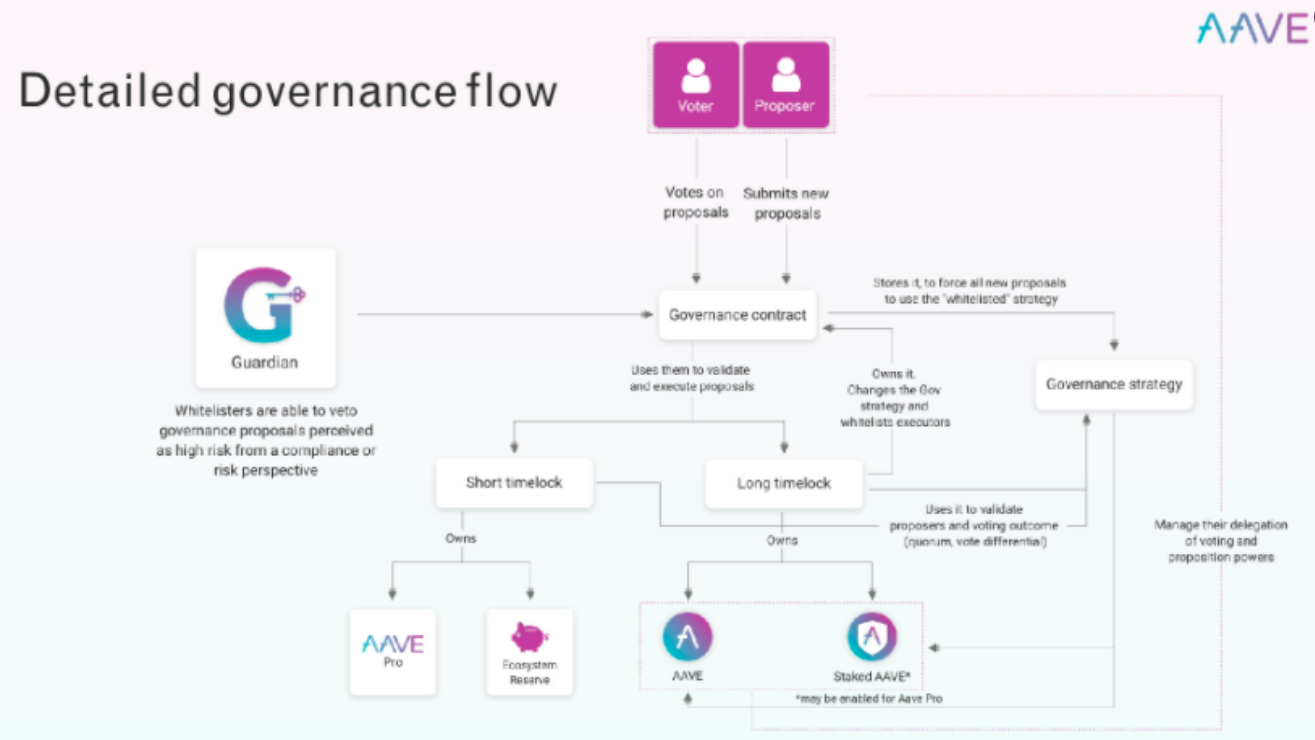

Built on battle-tested Aave v2 software, suppliers will provide liquidity by depositing virtual assets, and borrowers can borrow pooled funds by supplying collateral. The system relies on asset pools where suppliers receive liquid yield from borrowers in the form of tokens accrued in real-time, and borrowing yield increases as more assets are borrowed from a pool. Before catering to the institutions, its smart contracts have been rigorously audited by several firms CegiN, ConsenSys, Diligence, PeckShield, and Sigma Prime, with formal verification from Certora. “Safety Module was built to allow stakers to cover the risk of deficit for other participants,” reads one slide on security, audits, and stress testing. This product isn’t for degen retailers who prefer anonymity and decentralization; this product follows KYC and AML compliance. Users will go through compliance onboarding procedures by one or more regulated intermediaries called whitelisters, who are given veto powers to support continued regulatory compliance and provide appropriate terms and disclosures to users. Also, “simplified liquidity BTC, ETH, USDC, and AAVE liquidity to align with institutional demand.”  Whitelisters are the gateway for Aave Arc users who grant users “permission” to interact with the protocol. They are regulated entities that will conduct ongoing KYB/Transaction monitoring. A whitelister has also been given the power to remove users' permissions temporarily or permanently by not allowing them to make deposits or withdrawals. They can also offboard a user by closing their position using the collateral to cover the user's borrow position debt and transferring the excess to an appropriate wallet. Still, Aave Arc will follow Aave’s decentralized governance model, with more than 70k token holders controlling it. But of course, as stated, whitelisters have the unique guardian role with veto privileges designed to support their oversight over the regulatory risk and compliance obligations.

Whitelisters are the gateway for Aave Arc users who grant users “permission” to interact with the protocol. They are regulated entities that will conduct ongoing KYB/Transaction monitoring. A whitelister has also been given the power to remove users' permissions temporarily or permanently by not allowing them to make deposits or withdrawals. They can also offboard a user by closing their position using the collateral to cover the user's borrow position debt and transferring the excess to an appropriate wallet. Still, Aave Arc will follow Aave’s decentralized governance model, with more than 70k token holders controlling it. But of course, as stated, whitelisters have the unique guardian role with veto privileges designed to support their oversight over the regulatory risk and compliance obligations.

“Aave Arc is owned and governed by the Aave governance.”

In separate news from a different event, the Ethereum Community Conference (EthCC), Aave revealed its latest innovation cross-chain governance that one can fork and use in their own project if building cross-chain composability. Amidst all this development, Aave founder Stani Kulechov is also focused on building a decentralized Twitter. In an interview with Modern Finance, he shared that it is no joke and they will be bringing Twitter on Ethereum, which they say makes more sense, while Twitter CEO Jack Dorsey works on getting Aave on Bitcoin.

“We don’t mess around, If you need to build something, we definitely will. And we have a good ability to do it now as more people are onboarding into the Web 3.0 economy and with the NFTs, we see more creators coming into the space. We see more wider adoption questions raised about the blockchain. This is very important for the larger audience… This just showcases that more people are coming into the space and we’re in a state where actually building something like this could make a lot of sense for the whole economy.”

bitcoinexchangeguide.com

bitcoinexchangeguide.com