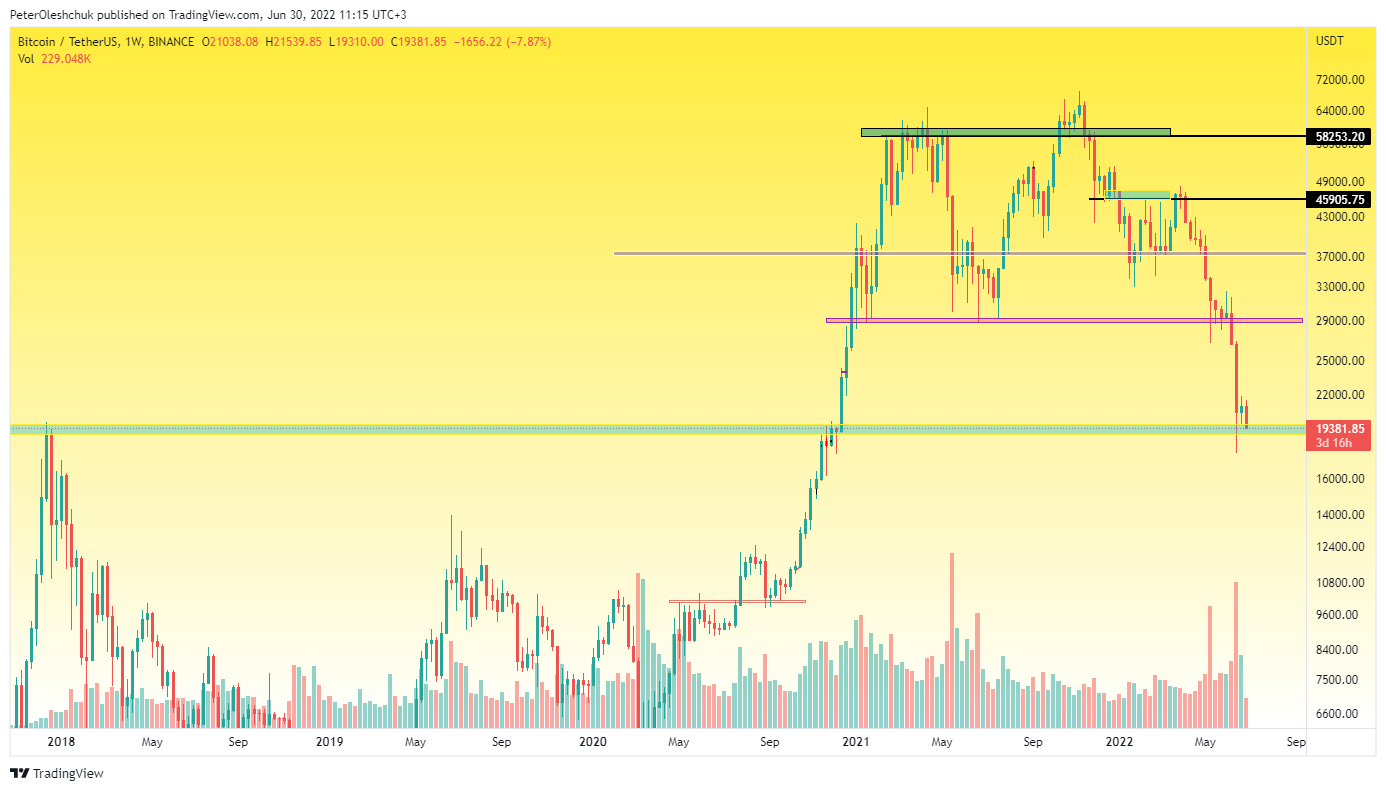

If investors did not want to stop this terrible Bitcoin and the cryptocurrency market fall, there are no positive signals globally. A powerful weekly candle from 13 June sent BTC down 33% for the week. Buyers managed to keep the range of $19,000-$20,000 under their control. However, this fact did not give buyers any inspiration. This is perfectly visible on the next weekly candle from 20 June. During this period, the price moved in a narrow 10% consolidation. Trading volumes during the trading week from 20 June were high enough and even this did not allow buyers to carry out a bright counterattack.  Source: https://www.tradingview.com/x/GXyHVSzI/ The trading week from 27 June saw a continued Bitcoin fall. Sellers were able to update the local lows of the previous week and re-extend the range of previous historical highs. If buyers give the range of $19,000 without problems, the BTC price will hit $13,000 in July. In addition, on 30 June, the monthly candle closes, as at the moment it is terrible for investors and hints at only one thing - the fall is not complete.

Source: https://www.tradingview.com/x/GXyHVSzI/ The trading week from 27 June saw a continued Bitcoin fall. Sellers were able to update the local lows of the previous week and re-extend the range of previous historical highs. If buyers give the range of $19,000 without problems, the BTC price will hit $13,000 in July. In addition, on 30 June, the monthly candle closes, as at the moment it is terrible for investors and hints at only one thing - the fall is not complete.

BTC Technical Analysis On The Daily Timeframe

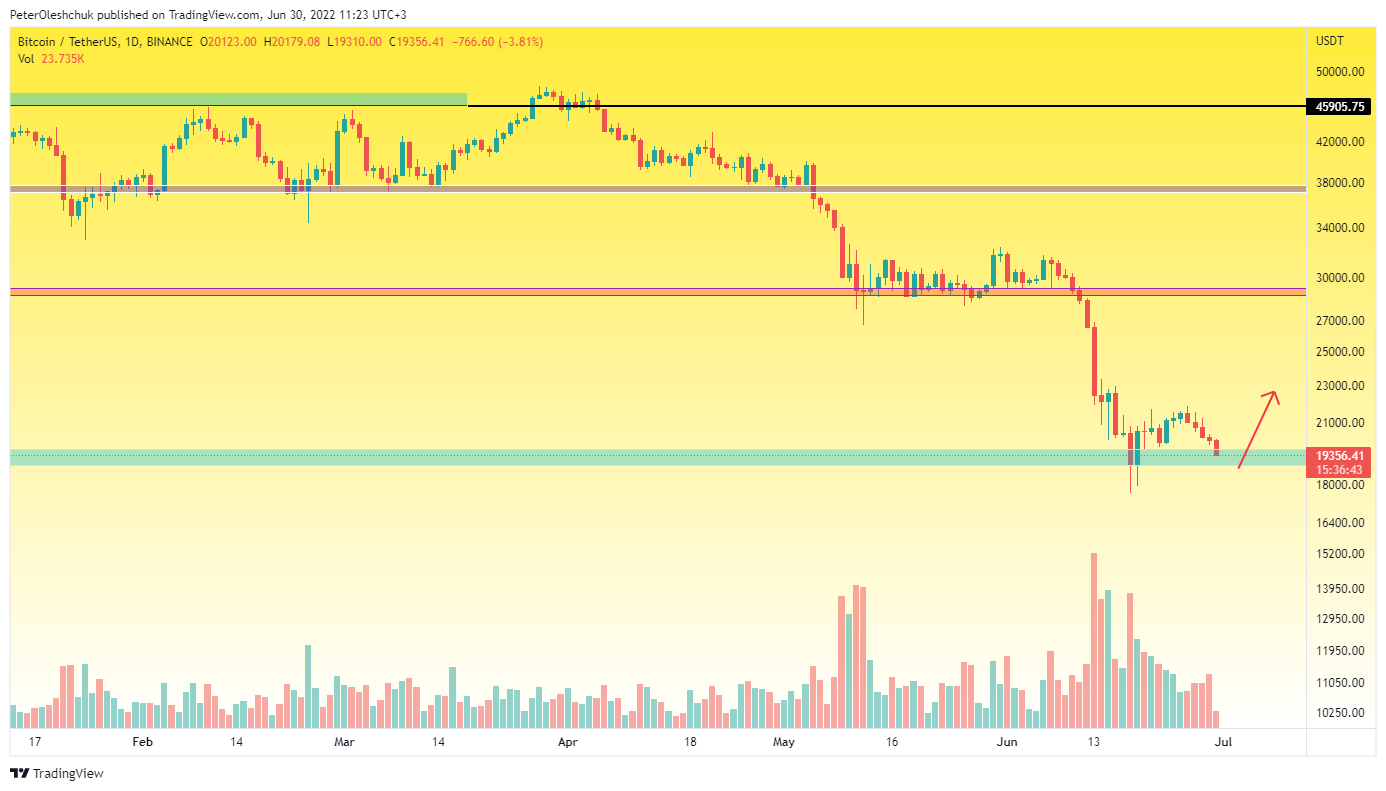

Source: https://www.tradingview.com/x/4VD2kmyE/ Analyzing the movement of the BTC price on the daily timeframe, it can be noted that the duration of the consolidation in the range of $28,000 is much longer than the current consolidation in the range of $19,000-$20,000. This indicates a high probability of continued price movement in a narrow range and a local rebound to $22,000. Trading volumes from 25 June are much lower than the week before. Yes, the daily candles have become less aggressive compared to the candles from 12 June. All this indicates that none of the market parties are ready for a new vector price movement. Based on these facts, within the next few days, a sharp growth impulse should occur in the Bitcoin market, which will change the local mood of market participants. If BTC continues its lazy fall without much volume, it means that there will be no positives in the Bitcoin market in the near future.

Source: https://www.tradingview.com/x/4VD2kmyE/ Analyzing the movement of the BTC price on the daily timeframe, it can be noted that the duration of the consolidation in the range of $28,000 is much longer than the current consolidation in the range of $19,000-$20,000. This indicates a high probability of continued price movement in a narrow range and a local rebound to $22,000. Trading volumes from 25 June are much lower than the week before. Yes, the daily candles have become less aggressive compared to the candles from 12 June. All this indicates that none of the market parties are ready for a new vector price movement. Based on these facts, within the next few days, a sharp growth impulse should occur in the Bitcoin market, which will change the local mood of market participants. If BTC continues its lazy fall without much volume, it means that there will be no positives in the Bitcoin market in the near future.

Bitcoin Dominance Has Ample Prospect Of The Fall Continuation

Source: https://www.tradingview.com/x/ppDIXyp7/ The weekly BTC dominance chart shows us that the main cryptocurrency has stopped being interesting. Bitcoin influence is steadily declining. In a falling market, this is great news for altcoin investors. The fact is that the fall of Bitcoin dominance means capital flows from BTC not only to stablecoins, but to other altcoins. And this significantly slows down the fall of cryptocurrencies and allows to maintain a relatively stable price until better times. The fall of Bitcoin dominance has a perspective of at least 10%. Therefore, while this is happening, you can calmly keep the altcoins and calmly react to small investment drawdowns.

Source: https://www.tradingview.com/x/ppDIXyp7/ The weekly BTC dominance chart shows us that the main cryptocurrency has stopped being interesting. Bitcoin influence is steadily declining. In a falling market, this is great news for altcoin investors. The fact is that the fall of Bitcoin dominance means capital flows from BTC not only to stablecoins, but to other altcoins. And this significantly slows down the fall of cryptocurrencies and allows to maintain a relatively stable price until better times. The fall of Bitcoin dominance has a perspective of at least 10%. Therefore, while this is happening, you can calmly keep the altcoins and calmly react to small investment drawdowns.

cryptoknowmics.com

cryptoknowmics.com