Canadian-based crypto miner, Bitfarms Ltd., closed its intraday position at $1.39. This change represents a 4.51% increase amidst tightening conditions for the mining firms. Earlier this week, the company had announced selling its long-held Bitcoin stash valued at ~$62 million.

On Tuesday, they stated that they had sold 3,000 bitcoin over the past week. Out of its previous 6,349 BTC holdings, this amounts to over 47% that was traded.

The Crypto Winter Takes a Toll on Crypto Miners

The company said it needed to service outstanding debts by shedding some of its BTC-backed credit facility with Galaxy digital. Bitfarms added another 1,500 BTC from its earnings to repay its debts. This reduced its initial $100 million deficit to $66 million, which finally dropped to $38 million at the time of writing.

Bitfarms’ Chief Financial Officer (CFO), Jeff Lucas, revealed that the firm is adjusting its strategy, given the crypto market rout. He said they would not be “hodling” any of its daily proceeds, averaging about 14 BTC. The CFO added that the company is resorting to these measures to service running costs and strengthen its balance sheet.

“Since January 2021, we have been funding operations and growth through various financing measures. We believe that selling a portion of our BTC holdings and daily production as a source of liquidity is the best and least expensive method in the current market environment,” said Lucas.

Bitfarms also revealed a closed deal with NYDIG, which will fund mining equipment, bringing its total available liquidity to $100 million.

Join our Telegram group and never miss a breaking digital asset story.

More Miners Liquidate their BTC Holdings

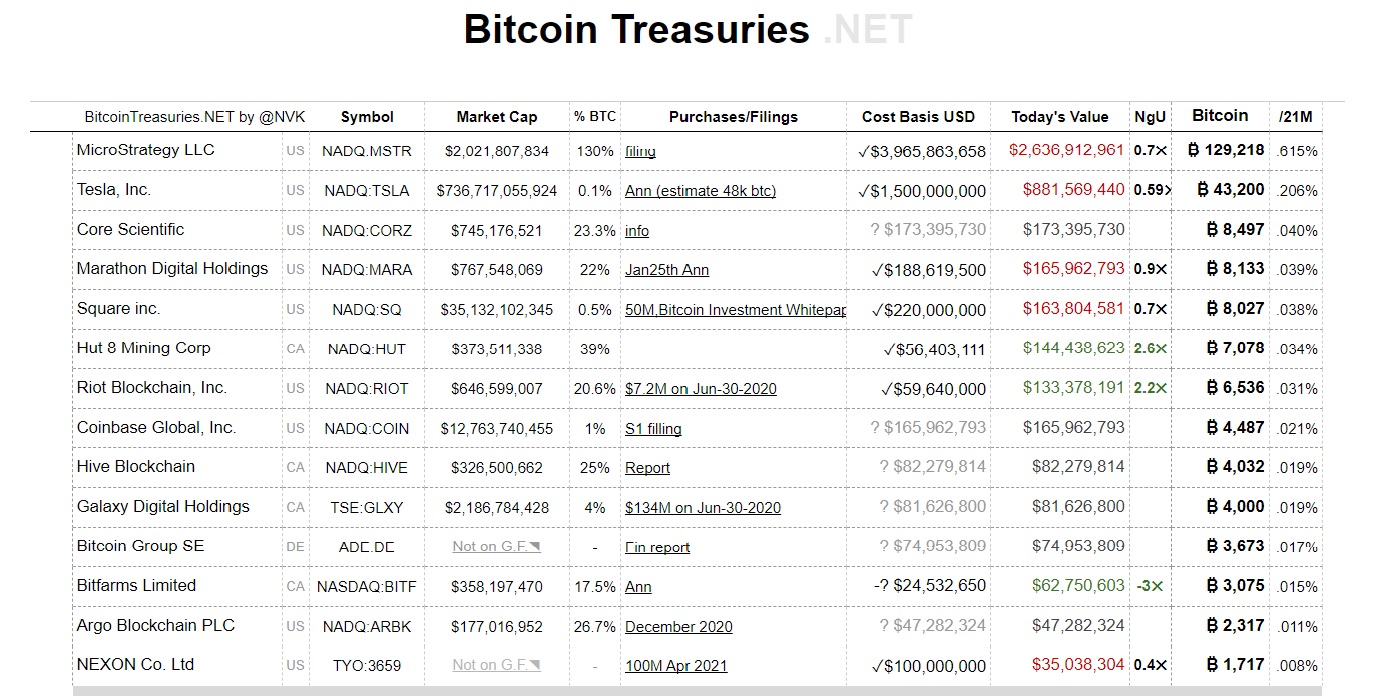

BitcoinTreasuries show that the current 3,075 BTC balance has pulled Bitfarms’s ranking down to 8th among publicly traded companies. Other mining companies have also suffered a similar fate. They seem to be in desperate positions, causing them to touch their minted reserve to stay afloat.

Argo Blockchain Plc, Riot, and Core Scientific Inc. sold 427, 250, and 2,598 coins, respectively. The first currently holds 2,317 BTC, while the second and third have 6,536 and 8,497 BTC in their reserve. These three companies have also dropped from their previous positions on the list of publicly traded companies.

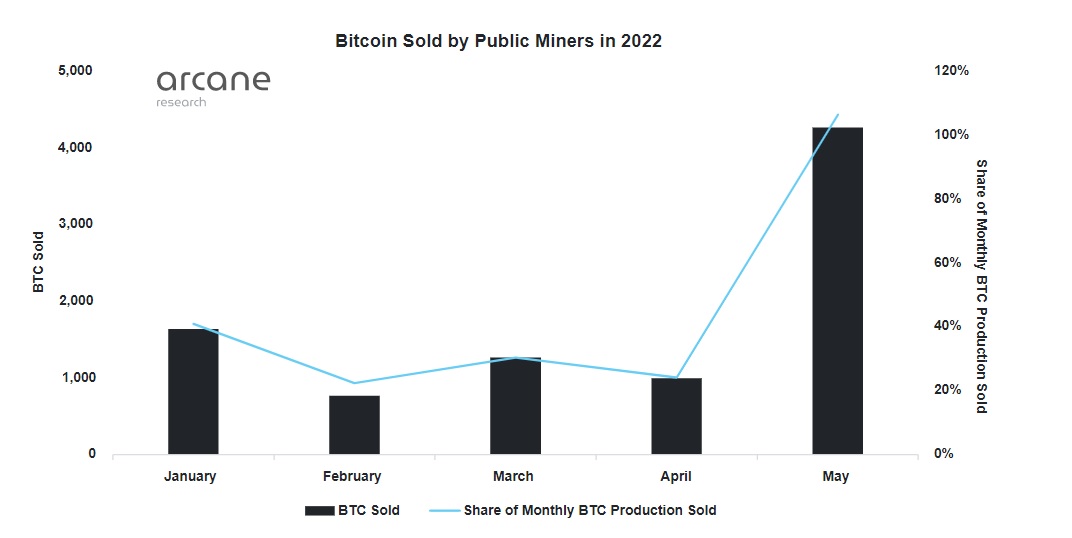

Bitcoin holdings have sharply declined as the crypto market volatility intensifies. A report from Arcane research shows that more miners are liquidating their hoard. The plummeting profitability of minting BTC has compelled this sell-off among miners. More than 100% of May proceeds were sold, amounting to about 4000 coins. This condition appears to have deteriorated in June as more firms are joining the selling spree.

Furthermore, there may be more pain for BTC as private miners could be emulating the behavior of their counterparts in the sector. Also, miners often constitute a decent portion of Bitcoin whales; according to CoinMetrics, they control about 800,000 bitcoin.

Bitcoin’s price has hovered around the $20,000 price level for the past week. This has thrown the market into much uncertainty as it signifies a critical support level for many investors. The pioneering cryptocurrency has lost over 70% from its all-time high of $69,000 in November and may bleed further if the current market sentiment lingers.

Do you think Bitcoin will still hold the $20k support level if more miners liquidate? Let us know your thoughts in the comments below.

tokenist.com

tokenist.com